- United States

- /

- Electrical

- /

- NYSE:AMPX

Will Amprius Technologies' (AMPX) CFO Transition Signal a Strategic Shift in Global Expansion Plans?

Reviewed by Sasha Jovanovic

- Amprius Technologies recently appointed Ricardo C. Rodriguez as Chief Financial Officer, effective October 6, 2025, following the retirement of Sandra Wallach, with Rodriguez bringing more than two decades of finance, strategy, and operations experience across the automotive, mobility, and technology sectors.

- Rodriguez’s track record in scaling growth-phase companies and securing capital in the electrification materials space could influence Amprius’s trajectory as it seeks to expand global manufacturing and address demand for advanced battery technologies.

- We’ll assess how the appointment of an experienced CFO with electrification expertise may impact analyst expectations for Amprius Technologies.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Amprius Technologies Investment Narrative Recap

For investors considering Amprius Technologies, the core belief centers around the company's ability to scale its advanced battery technology to meet rising demand from aviation and mobility applications. The appointment of Ricardo C. Rodriguez as CFO could help reinforce Amprius's efforts to manage manufacturing scale-up and capital requirements, yet the biggest immediate catalyst remains the company's success in mass production, while ongoing execution risks remain high, this leadership change does not materially reduce exposure to potential production or supply chain delays in the short-term.

Among Amprius's recent activities, the $35 million purchase order for SiCore cells from a major UAS manufacturer stands out as the most relevant development, highlighting customer demand and production commitments. This large order may intensify near-term pressure to deliver at scale and could further test Amprius’s manufacturing readiness, closely tied to both upside momentum and operational risk. However, investors should remember that while large orders may spur optimism, true progress hinges on...

Read the full narrative on Amprius Technologies (it's free!)

Amprius Technologies' outlook anticipates $306.6 million in revenue and $13.4 million in earnings by 2028. This scenario requires 89.8% annual revenue growth and a $52.1 million increase in earnings from the current level of -$38.7 million.

Uncover how Amprius Technologies' forecasts yield a $14.67 fair value, a 23% upside to its current price.

Exploring Other Perspectives

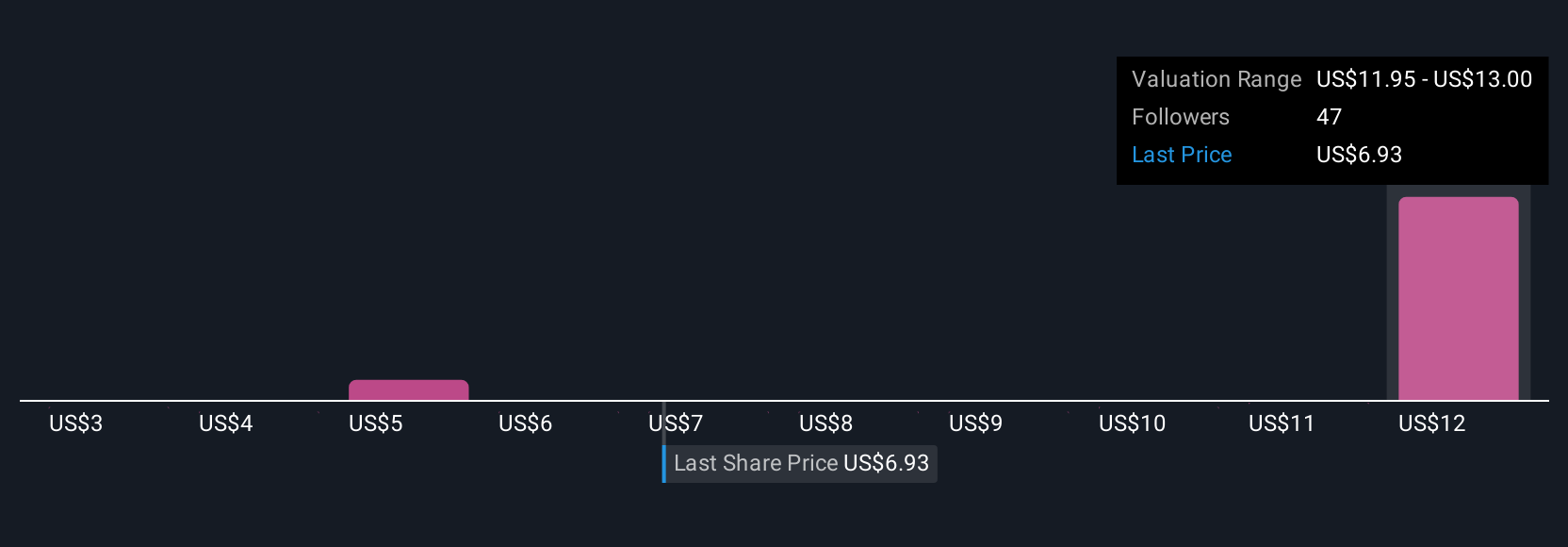

Simply Wall St Community members currently provide eight fair value estimates for Amprius, ranging widely from US$2.52 to US$28.91 per share. As the company addresses manufacturing scale-up amid rapid market growth expectations, consider that opinions and risk tolerance can differ greatly, explore other viewpoints for a fuller picture.

Explore 8 other fair value estimates on Amprius Technologies - why the stock might be worth over 2x more than the current price!

Build Your Own Amprius Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amprius Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Amprius Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amprius Technologies' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMPX

Amprius Technologies

Develops, manufactures, and markets lithium-ion batteries for mobility applications.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives