- United States

- /

- Electrical

- /

- NYSE:AMPX

Could Amprius Technologies' (AMPX) Drone Battery Win Reveal a New Edge in Defense Markets?

Reviewed by Simply Wall St

- On September 2, 2025, Amprius Technologies announced that Nordic Wing has selected its high-energy-density SiCore® cells for the ASTERO ISR unmanned aerial vehicle after successful qualification, producing a 90% increase in flight endurance without adding weight.

- This highlights Amprius' ability to deliver commercial battery solutions that materially enhance mission capabilities in defense and aviation sectors where reliability and endurance are crucial.

- We'll examine how Nordic Wing's adoption of Amprius' SiCore cells for longer-endurance drones could influence the company's growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Amprius Technologies Investment Narrative Recap

For investors considering Amprius Technologies, the core thesis revolves around capturing growth in advanced battery adoption within commercial drones and aviation, where Amprius’ high energy-density cells create significant operational advantages. The recent Nordic Wing selection highlights product differentiation and serves as a proof point for commercial traction, but the biggest near-term catalyst remains scaling to high-volume production, while the main risk continues to be Amprius’ heavy revenue concentration in these niche markets; this news, while positive, does not materially diversify its customer base.

Among recent updates, the July 22 delivery of SiCore battery cells to Airbus’ AALTO stands out as highly relevant. This order, similar to Nordic Wing’s adoption, signals that key drone manufacturers are moving into active deployments with Amprius batteries, validating product readiness but keeping revenue streams concentrated in a few end markets.

But even with these promising customer wins, investors should also be aware that revenue volatility risk remains elevated due to...

Read the full narrative on Amprius Technologies (it's free!)

Amprius Technologies' narrative projects $306.6 million revenue and $13.4 million earnings by 2028. This requires 89.8% yearly revenue growth and a $52.1 million increase in earnings from the current -$38.7 million.

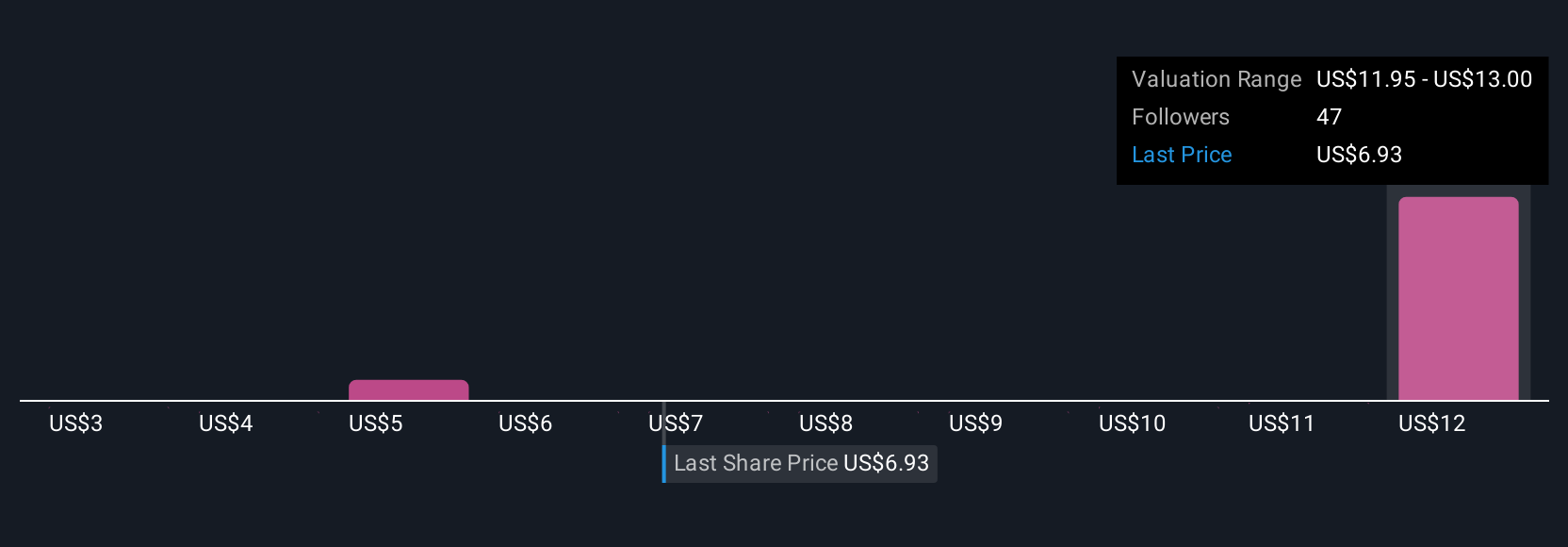

Uncover how Amprius Technologies' forecasts yield a $13.00 fair value, a 78% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community provided fair value estimates between US$2.52 and US$13 for Amprius Technologies. While revenue growth expectations are high, your view should also account for ongoing risks from concentrated end-market exposure before reaching your own conclusion.

Explore 7 other fair value estimates on Amprius Technologies - why the stock might be worth as much as 78% more than the current price!

Build Your Own Amprius Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amprius Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Amprius Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amprius Technologies' overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMPX

Amprius Technologies

Develops, manufactures, and markets lithium-ion batteries for mobility applications.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives