- United States

- /

- Electrical

- /

- NYSE:AMPX

Assessing Amprius Technologies’s Valuation Following Key UAV Battery Win with Empirical Systems Aerospace

Reviewed by Kshitija Bhandaru

Amprius Technologies’ high-power silicon battery cells have been selected by Empirical Systems Aerospace for use in batteries powering unmanned aerial vehicles across defense, security, logistics, and public safety applications. This highlights the company’s expanding commercial traction.

See our latest analysis for Amprius Technologies.

Amprius Technologies is building momentum on the back of this new client win, with recent leadership changes and conference appearances keeping the spotlight on innovation. The stock’s 30-day share price return of 58.7% and one-year total shareholder return of 841.6% highlight surging investor confidence. This reflects both short-term excitement and a remarkable long-term track record.

If Amprius’s upward trajectory has caught your attention, this could be the perfect moment to discover See the full list for free.

With shares on a dramatic run and high expectations for rapid growth, the question now is whether Amprius Technologies is still undervalued or if the market has already priced in its future success. Could this be a genuine buying opportunity, or is optimism running ahead of fundamentals?

Most Popular Narrative: 12% Undervalued

At a recent close of $12.90, the most widely followed narrative sees Amprius Technologies’ fair value at $14.67 per share, suggesting there may still be room for upside despite significant recent gains. The narrative sets an ambitious bar, pointing to an inflection point driven by strategic manufacturing deals and record customer wins.

Ongoing investment in automation and manufacturing capacity, supported by government contracts like the $10.5M Defense Innovation Unit award, positions Amprius to capture a larger share of future high-margin opportunities in defense and critical infrastructure. This enhances both revenue visibility and earnings stability.

Want to know why analysts see more to this stock’s story? There is a bold projection hiding behind that fair value, with a forward leap in profit margins, recurring revenue, and a premium reserved for market leaders. Discover the exact forecasts pushing this target higher and find out what could send the stock soaring or stalling.

Result: Fair Value of $14.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges remain. These include hurdles in scaling new technology and potential supply chain disruptions, both of which could impact growth expectations.

Find out about the key risks to this Amprius Technologies narrative.

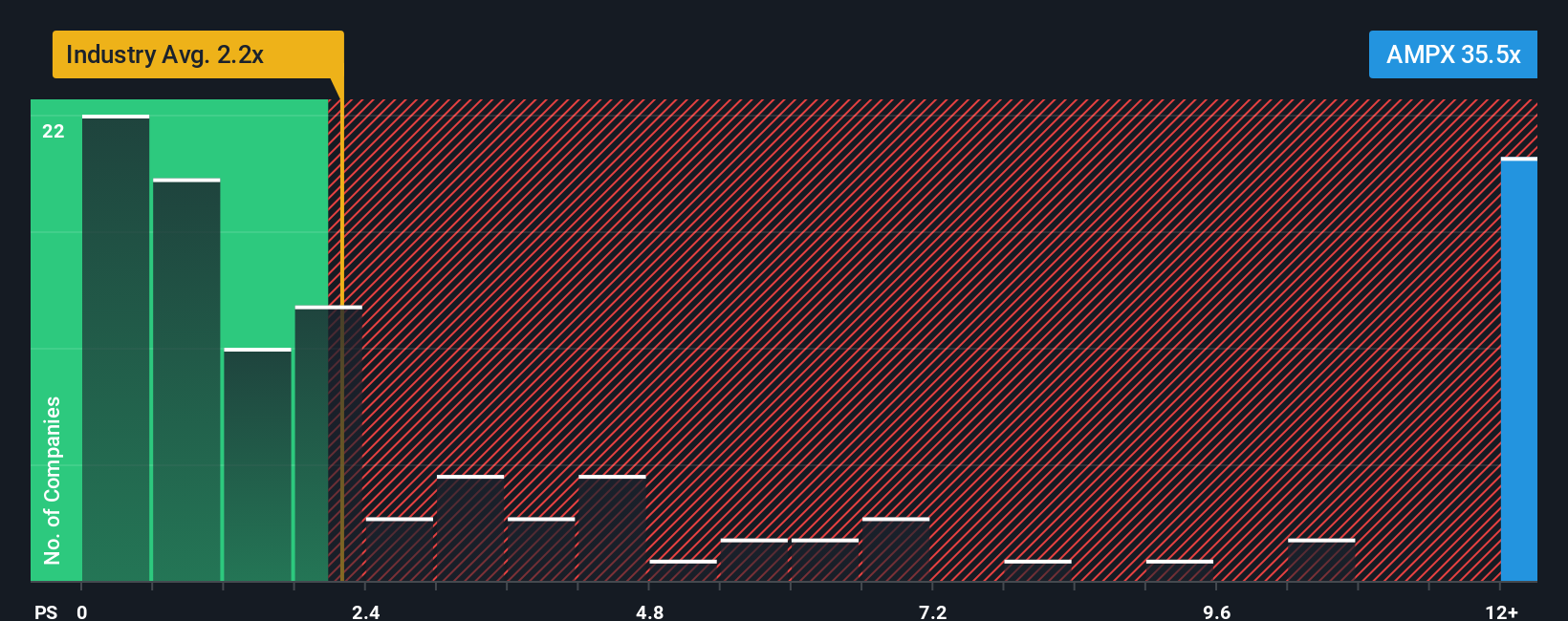

Another View: High Sales Ratio Signals Market Optimism

While some see upside, another angle raises eyebrows. Amprius Technologies trades at a price-to-sales ratio of 36x, much higher than both the US Electrical industry average of 2.4x and its peer group at 6.7x. This sizable gap could mean valuation risk if expectations reset. Will momentum last, or are shares running ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amprius Technologies Narrative

If you want to dig into the numbers or uncover an angle that others might have missed, you can easily craft your own perspective in just minutes. Do it your way

A great starting point for your Amprius Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye out for fresh opportunities. Expand your search beyond Amprius Technologies and don't let tomorrow's winners slip by unnoticed.

- Uncover hidden gems making waves in the tech space with these 25 AI penny stocks and discover companies reshaping the AI landscape with powerful innovation.

- Stay ahead of market trends by exploring these 891 undervalued stocks based on cash flows, where you'll find stocks trading below their intrinsic value based on future cash flows.

- Earn more with less stress by browsing these 18 dividend stocks with yields > 3%, which highlights stocks offering attractive yields for investors seeking steady income.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMPX

Amprius Technologies

Develops, manufactures, and markets lithium-ion batteries for mobility applications.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives