- United States

- /

- Electrical

- /

- NYSE:AME

A Fresh Look at AMETEK (AME) Valuation as Analysts Highlight Earnings Consistency and Investor Optimism

Reviewed by Kshitija Bhandaru

AMETEK (AME) continues to draw attention from investors as recent analyst coverage points to the company’s ongoing streak of topping earnings estimates. This consistent performance has helped shape positive expectations for its next quarterly results.

See our latest analysis for AMETEK.

Even with the broader market facing some turbulence, AMETEK’s latest share price of $183.31 keeps it firmly on investors’ radar. Momentum has cooled slightly in recent weeks, but the real story is its 9.25% total return over the last year and a stellar 61% total return over three years. This underscores solid long-term compounding. Short-term pullbacks have not derailed the bigger growth narrative, and recent upbeat earnings are only fueling interest in what comes next.

If you’re curious to discover more companies with similar growth focus and strong insider belief, now is a great time to broaden your search and explore fast growing stocks with high insider ownership

With shares trading just below analyst price targets but after a strong run, the key question is whether AMETEK’s growth prospects are truly underappreciated or if markets have already factored in all the good news. Is there still a real buying opportunity here?

Most Popular Narrative: 11% Undervalued

With the most widely followed narrative assigning a fair value of $205.94 to AMETEK, the current price of $183.31 shows meaningful upside in the eyes of analyst consensus. This places extra weight on growth dynamics and margin expectations in the road ahead.

Adoption of digital reality, automation, and advanced metrology solutions is accelerating across key end markets such as aerospace, defense, and architecture. This trend was recently reinforced by the FARO Technologies acquisition, which expands AMETEK's addressable market and supports both revenue and margin growth through higher value, software-enabled recurring revenue streams.

Curious about the math that powers this narrative’s price target? Everything hinges on a bold projection: rising profits, fatter margins, and hefty revenue growth over the next three years. Want to see which specific levers analysts are pulling to justify such optimism? Dive into the narrative’s full story to decode exactly what’s driving these numbers.

Result: Fair Value of $205.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in key segments and increased competition from digital solutions could quickly challenge these optimistic growth projections.

Find out about the key risks to this AMETEK narrative.

Another View: Multiples Offer a Different Perspective

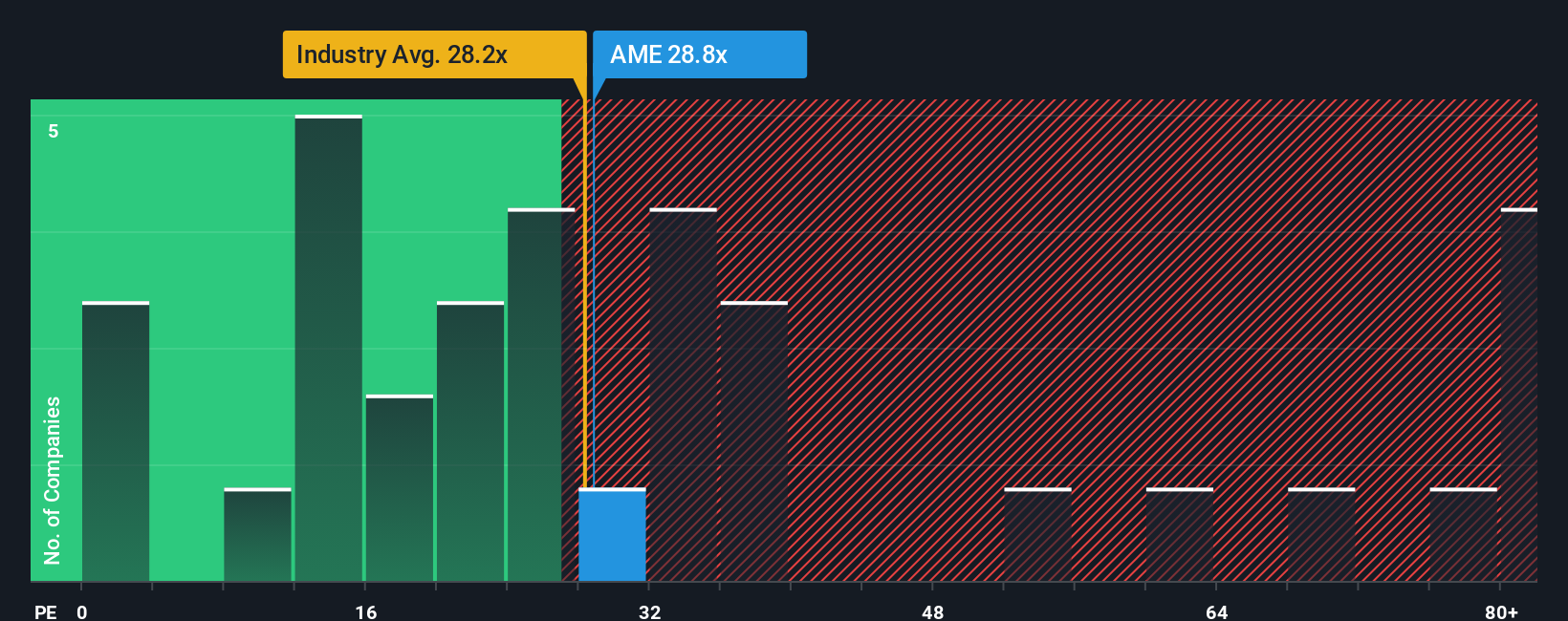

While analyst fair value targets point to AMETEK being undervalued, a closer look at its price-to-earnings ratio tells a more cautious story. At 29.4x, it stands above both the industry average of 28.7x and a fair ratio of 24.2x. This suggests some premium is built into the share price. Are expectations running ahead of fundamentals, or is AMETEK’s quality worth paying for?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AMETEK Narrative

If you want to dig deeper or challenge the consensus, you can use the same data to craft your own view in under three minutes. Do it your way

A great starting point for your AMETEK research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Staying ahead means seeking out opportunities that others might overlook. Use the Simply Wall Street Screener to target profitable themes and promising niches before they go mainstream.

- Boost your portfolio's income potential by checking out these 18 dividend stocks with yields > 3% offering strong yields above 3% and a track record of rewarding loyal shareholders.

- Ride the momentum of groundbreaking innovation with these 25 AI penny stocks that are transforming industries and driving the next wave of digital change.

- Take advantage of potential bargains by uncovering these 890 undervalued stocks based on cash flows that stand out for solid fundamentals and attractive valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AME

AMETEK

Manufactures and sells electronic instruments (EIG) and electromechanical (EMG) devices in the United States and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives