- United States

- /

- Machinery

- /

- NYSE:ALH

Alliance Laundry Holdings (ALH): Assessing Valuation as Investor Interest Builds

Reviewed by Kshitija Bhandaru

Alliance Laundry Holdings (ALH) traded higher in the latest session, closing at $24.99. The modest single-day move comes as investors continue to monitor sector trends and seek value relative to the company’s fundamentals.

See our latest analysis for Alliance Laundry Holdings.

Alliance Laundry Holdings’ share price return of 13.6% year-to-date suggests that investors are warming up to its growth potential, especially as the company stays in focus amid shifting sector dynamics. While the recent gains have been steady rather than meteoric, momentum appears to be building as the story evolves.

If you’re interested in discovering what else savvy investors are watching this season, now is the perfect time to explore fast growing stocks with high insider ownership.

But with shares moving steadily higher, the big question is whether Alliance Laundry Holdings remains undervalued compared to its fundamentals, or if the market has already accounted for all of its future growth potential.

Price-to-Earnings of 62.4x: Is it justified?

Alliance Laundry Holdings trades at a price-to-earnings (P/E) ratio of 62.4x, substantially higher than both its direct peers and the broader US Machinery industry. With a last close price of $24.99, this positions the stock as expensive relative to typical sector benchmarks.

The P/E ratio indicates how much investors are willing to pay today for a dollar of current earnings. In the machinery industry, this multiple often reflects growth expectations, capital efficiency, and overall market sentiment.

However, Alliance Laundry Holdings stands out for having a P/E more than double the peer average (33.2x) and almost three times the industry norm (23.8x). This high multiple suggests the market may be pricing in ambitious future growth or overlooking underlying risks, especially given recent earnings declines.

At such a premium valuation, investors should pay close attention to whether current profitability and future potential truly warrant this price. Otherwise, the market could see this multiple move closer to industry averages over time.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 62.4x (OVERVALUED)

However, weaker profit margins or slowing revenue growth could quickly shift sentiment. This may challenge the case for Alliance Laundry Holdings’ valuation premium.

Find out about the key risks to this Alliance Laundry Holdings narrative.

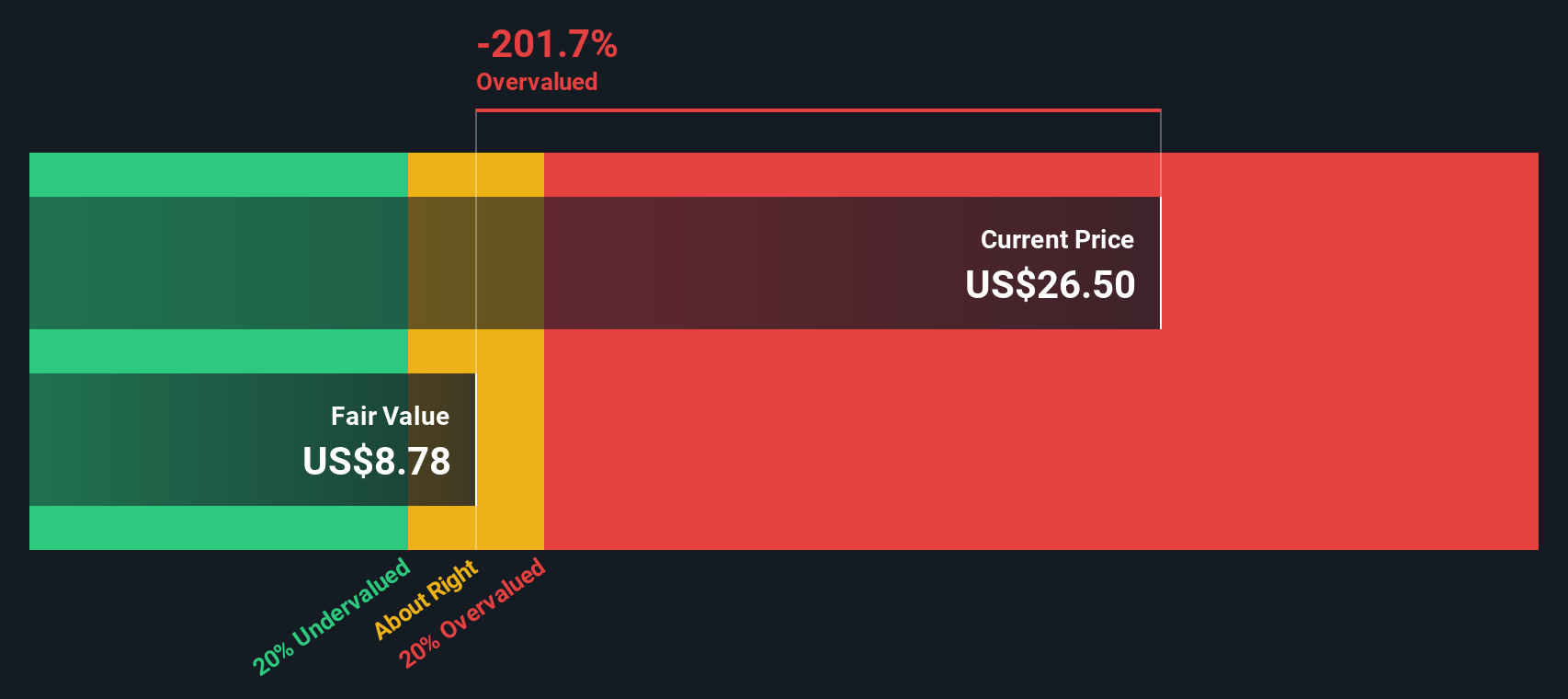

Another View: DCF Model Challenges the Premium

While Alliance Laundry Holdings’ high price-to-earnings ratio suggests an expensive stock compared to peers, our DCF model provides an even more cautious perspective. The SWS DCF model estimates fair value at $8.77, which is significantly below the current share price of $24.99. This indicates the stock may be overvalued according to this method.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alliance Laundry Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alliance Laundry Holdings Narrative

If you want a different perspective or enjoy digging into the numbers on your own, it's easy to craft your own story in just a few minutes. Do it your way.

A great starting point for your Alliance Laundry Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Opportunities abound for those willing to think ahead. Don’t settle for the obvious when you can easily unlock unique plays and emerging winners in today’s market.

- Tap into high potential by scanning these 898 undervalued stocks based on cash flows, where strong fundamentals point to overlooked stocks ready for a breakout.

- Stay ahead of digital disruption by scanning these 79 cryptocurrency and blockchain stocks, featuring innovators at the forefront of blockchain and crypto technologies.

- Accelerate your search for reliable returns with these 19 dividend stocks with yields > 3%, which highlights companies delivering income and resilience with yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALH

Alliance Laundry Holdings

Designs, manufactures, and sells commercial laundry systems and service parts under the Speed Queen, UniMac, Huebsch, Primus, and IPSO brands in North America and internationally.

Very low risk with poor track record.

Market Insights

Community Narratives