- United States

- /

- Machinery

- /

- NYSE:ALG

Alamo Group Inc.'s (NYSE:ALG) Business Is Trailing The Market But Its Shares Aren't

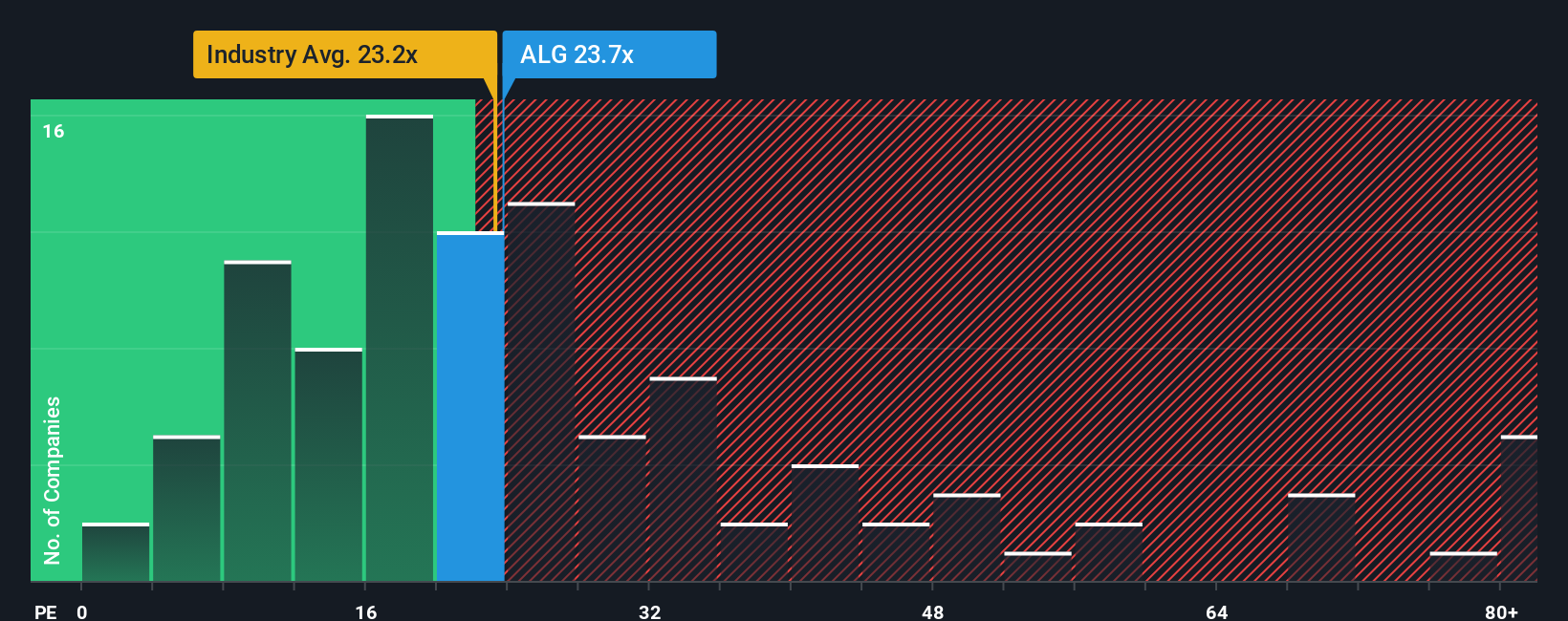

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 18x, you may consider Alamo Group Inc. (NYSE:ALG) as a stock to potentially avoid with its 23.7x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Alamo Group's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Alamo Group

Is There Enough Growth For Alamo Group?

There's an inherent assumption that a company should outperform the market for P/E ratios like Alamo Group's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 15%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 39% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 16% over the next year. Meanwhile, the rest of the market is forecast to expand by 14%, which is not materially different.

With this information, we find it interesting that Alamo Group is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Bottom Line On Alamo Group's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Alamo Group's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about this 1 warning sign we've spotted with Alamo Group.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ALG

Alamo Group

Designs, manufactures, and services vegetation management and infrastructure maintenance equipment for governmental, industrial, and agricultural uses worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives