- United States

- /

- Trade Distributors

- /

- NYSE:AL

Assessing Air Lease’s (AL) Valuation After a 34% Year-to-Date Share Price Climb

Reviewed by Simply Wall St

Air Lease (AL) has quietly pushed higher this year, and with the stock up roughly 34% year to date, investors are starting to revisit the leasing giant’s mix of growth, risk, and valuation.

See our latest analysis for Air Lease.

That climb in the share price to about $64.06 reflects a year of steadily improving sentiment, with a strong year to date share price return contrasting with gentler three and five year total shareholder returns. This suggests momentum has been building rather than peaking.

If Air Lease’s run has you thinking more broadly about transport and capital goods, it could be worth exploring auto manufacturers as another way to spot where capital is being put to work efficiently.

With the shares now hovering just shy of analyst targets and long term returns already strong, investors face a key question: is Air Lease still undervalued, or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 3.9% Undervalued

With Air Lease closing at $64.06 against a narrative fair value of about $66.67, the storyline leans toward modest upside rather than a stretched valuation.

The trend towards stricter environmental regulations and airline fleet renewal is supporting higher demand for next-generation, fuel-efficient aircraft. Air Lease's young fleet positions it to capitalize on this shift, enabling premium pricing on leases and improved net margins as airlines seek to reduce emissions and replace older jets.

Curious how a shrinking margin profile can still support a richer future earnings multiple, even as headline profits drift lower? See how growth, yield assumptions, and discounting work together in this narrative to justify a higher long term valuation story.

Result: Fair Value of $66.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that narrative could easily crack if rising interest costs or stubborn OEM delivery delays begin to erode margins faster than expected.

Find out about the key risks to this Air Lease narrative.

Another View, Using Earnings

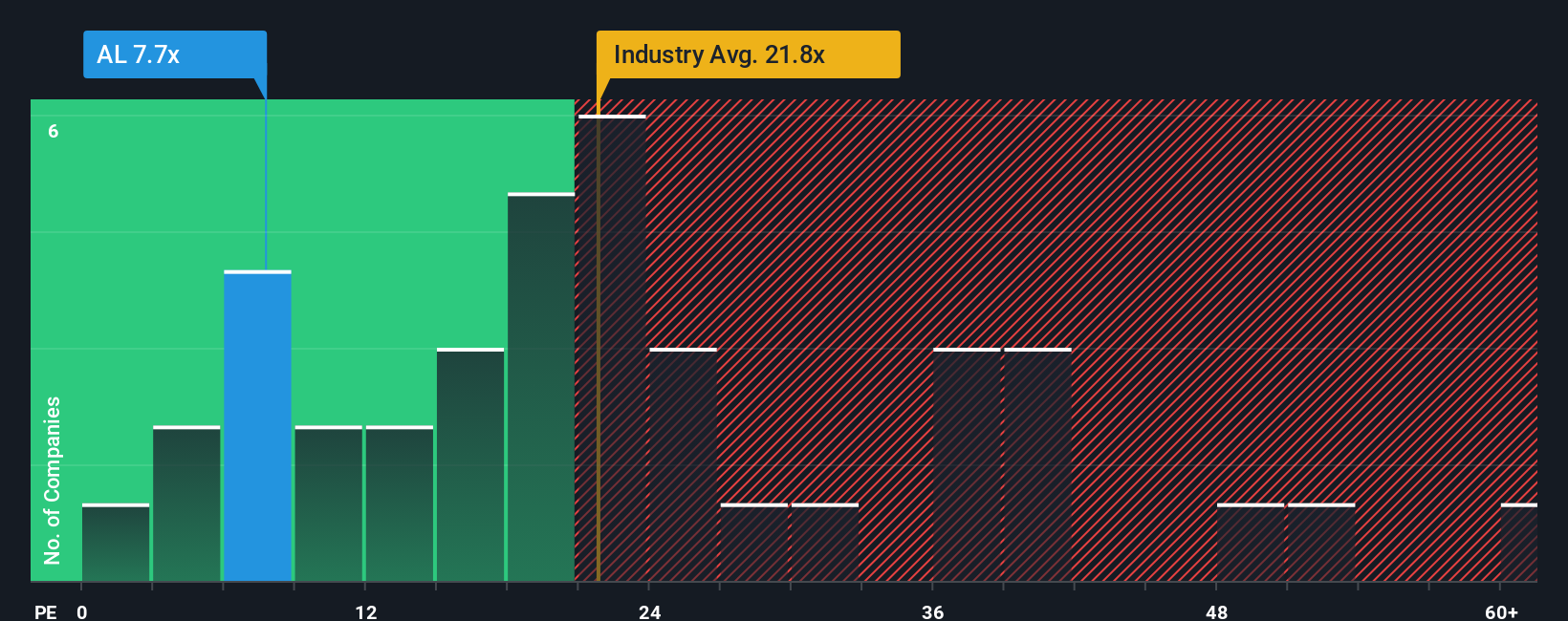

Looking at Air Lease through its earnings instead of narrative fair value tells a stronger value story. The shares trade on a P/E of 7.4x, well below the US Trade Distributors industry at 19.4x, a peer average of 27.1x, and a fair ratio of 11.5x that the market could drift toward over time.

That discount might reflect worries about one off gains, rising interest costs, and forecast earnings declines, or it could be an opportunity if cash flows prove more resilient than expected. Which side of that gap do you believe?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Air Lease for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Air Lease Narrative

If you are unconvinced by this view or prefer to dig into the numbers yourself, you can craft a personal thesis in minutes, Do it your way.

A great starting point for your Air Lease research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your momentum by scanning fresh opportunities with the Simply Wall St Screener, so promising ideas do not slip past you.

- Capture potential mispricings by reviewing these 920 undervalued stocks based on cash flows that combine solid fundamentals with attractive discounts to intrinsic value.

- Capitalize on market innovation by targeting these 25 AI penny stocks that may benefit from adoption of artificial intelligence across industries.

- Strengthen your income strategy by focusing on these 14 dividend stocks with yields > 3% that can help support long term total returns through consistent cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AL

Air Lease

An aircraft leasing company, engages in the purchase and leasing of commercial jet aircraft to airlines in the Asia Pacific, Europe, the Middle East, Africa, Mexico, Central America, South America, the United States, and Canada.

Proven track record with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026