- United States

- /

- Trade Distributors

- /

- NYSE:AIT

Applied Industrial Technologies (AIT): A Fresh Look at Valuation Following Notable Trading Activity

Reviewed by Kshitija Bhandaru

Applied Industrial Technologies (AIT) stock has caught the attention of investors following its recent trading performance. While there has not been a major corporate event, the company’s share price movement invites a closer look at its fundamentals and market positioning.

See our latest analysis for Applied Industrial Technologies.

Applied Industrial Technologies’ share price has shown some recent volatility, but the bigger story is its consistently strong long-term performance. While short-term price returns have softened in the past month, investors who held on over the last year saw a 12.1% total return, and those in for five years have enjoyed a remarkable 324.5% total shareholder return. This persistence suggests underlying growth catalysts and solid operational momentum developing in the background.

If you’re wondering where the next growth story might emerge, it’s a great moment to broaden your horizon and discover fast growing stocks with high insider ownership

With shares trading nearly 20% below analyst price targets, the question is whether Applied Industrial Technologies remains undervalued or if recent gains suggest the market has already accounted for its future growth potential.

Most Popular Narrative: 16.6% Undervalued

The current share price of Applied Industrial Technologies sits notably below what the most widely followed narrative suggests is its fair value, creating a gap that draws investor attention. This sets the stage for a deeper look at the drivers supporting that higher valuation outlook.

The accelerating build-out of data center, semiconductor, and advanced manufacturing infrastructure is increasing demand for industrial automation, robotics, and flow control solutions. This positions Applied Industrial Technologies to capture higher-margin sales and expand its addressable market, supporting long-term revenue and margin growth. Growing reshoring and supply chain diversification in U.S. manufacturing is expected to spur increased capital investment and production infrastructure upgrades. This benefits Applied's technical service offerings as customers seek domestic partners for maintenance and expansion, which should drive higher order volumes and bolster future revenue growth.

Curious about what financial assumptions make this narrative so bold? The real story in these numbers is not just growth, but how changing industry forces are set to reshape future profitability. Want to know which projections are pushing the valuation skyward? Dive in to uncover the hidden dynamics fueling this forecast.

Result: Fair Value of $303.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak demand in key end markets and overreliance on acquisitions could put Applied’s long-term growth trajectory at risk.

Find out about the key risks to this Applied Industrial Technologies narrative.

Another View: Comparing Valuation Ratios

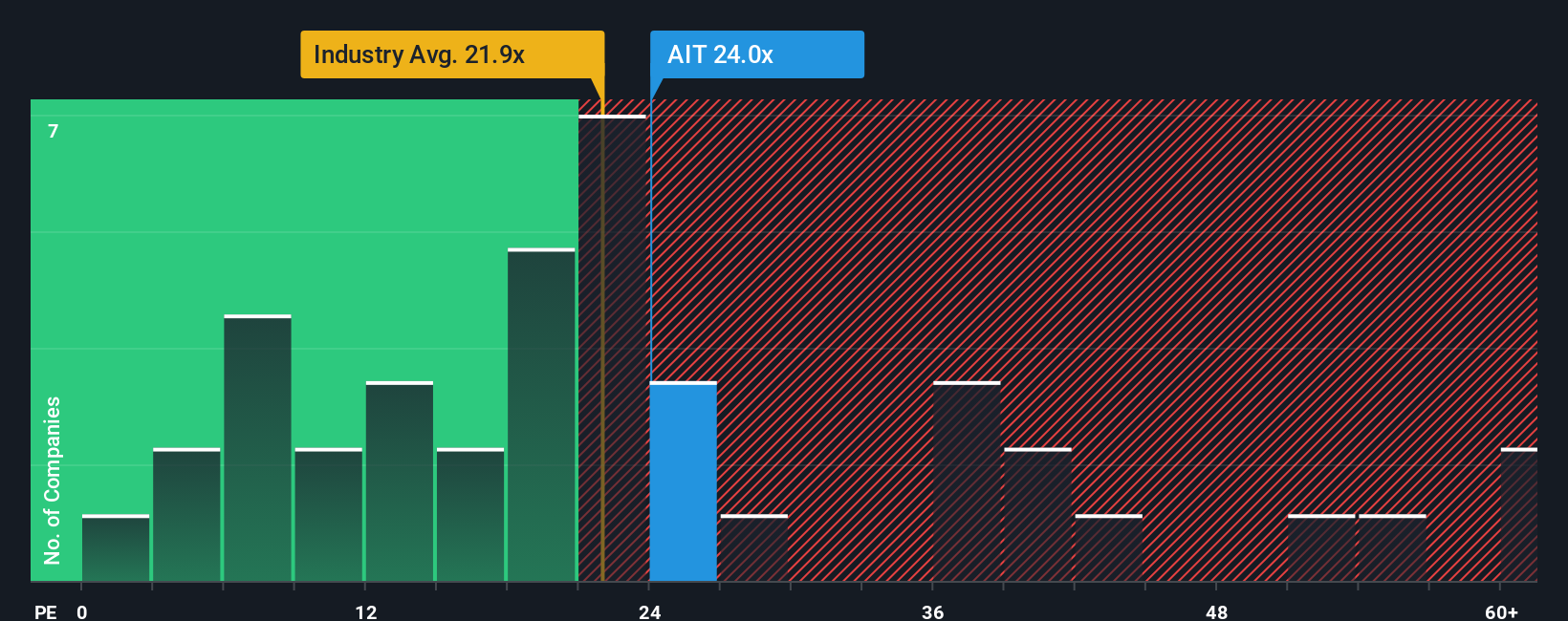

Looking from a different angle, Applied Industrial Technologies appears expensive based on its price-to-earnings ratio of 24.3x. This is noticeably higher than both its peers at 18.9x and the broader US Trade Distributors industry at 21.8x. A fair ratio estimate sits at 22.3x, suggesting the market could move closer to this over time. This higher multiple hints at valuation risk if expectations are not met, raising the question: are investors paying too much for future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Applied Industrial Technologies Narrative

If you want to see the numbers for yourself or develop a unique perspective, you can easily build your own take on Applied Industrial Technologies in just a few minutes, so why not Do it your way.

A great starting point for your Applied Industrial Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let market opportunities pass you by. Make your next smart investing move and see what’s possible when you scan the market with confidence.

- Spot companies rewarding shareholders and ramp up your income potential with these 18 dividend stocks with yields > 3%.

- Uncover unique potential in businesses transforming healthcare applications through artificial intelligence by checking out these 33 healthcare AI stocks.

- Catch the next undervalued opportunity others might be missing and power up your strategy with these 881 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIT

Applied Industrial Technologies

Distributes industrial motion, power, control, and automation technology solutions in the United States, Canada, Mexico, Australia, New Zealand, Singapore, and Costa Rica.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives