- United States

- /

- Construction

- /

- NYSE:AGX

Three Undiscovered Gems in the US Stock Market

Reviewed by Simply Wall St

Over the last 7 days, the United States stock market has remained flat, yet it boasts a remarkable 22% increase over the past year with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying stocks that have not yet captured widespread attention but possess strong growth potential can be key to uncovering hidden opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Morris State Bancshares | 9.72% | 4.93% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

IRADIMED (NasdaqGM:IRMD)

Simply Wall St Value Rating: ★★★★★★

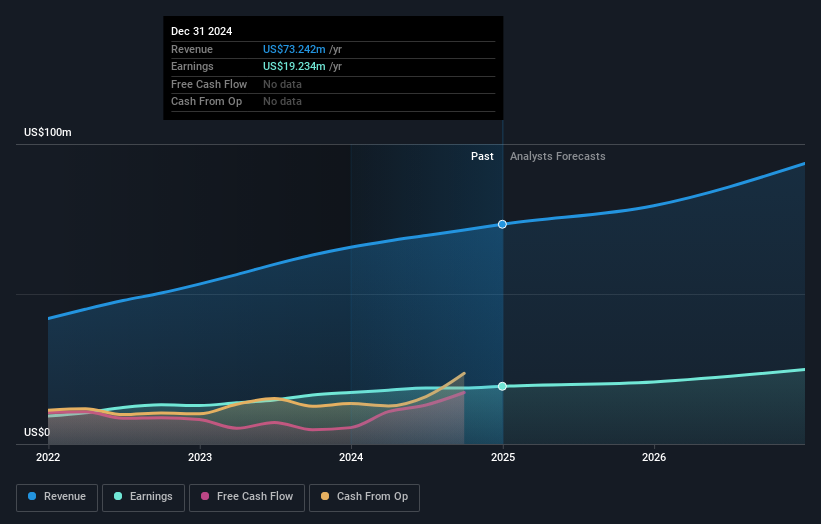

Overview: IRADIMED CORPORATION develops, manufactures, markets, and distributes MRI-compatible medical devices and related accessories, disposables, and services in the United States and internationally with a market cap of $775.99 million.

Operations: IRADIMED generates revenue primarily from its patient monitoring equipment, amounting to $71.31 million. The company's financial performance includes a focus on optimizing profit margins, with net profit margin trends being a key area of interest for stakeholders.

IRADIMED, a nimble player in the medical equipment space, is making strategic moves to bolster its market position. With no debt on its books for five years and high-quality earnings, it stands out for its financial health. The company has grown earnings at 27.7% annually over the past five years but faces challenges with insider selling recently noted. Trading at 36.6% below estimated fair value, IRADIMED offers potential upside if future projections hold true. Plans are underway to launch a new MRI-compatible pump by late 2025, which could enhance revenue streams significantly if FDA approval proceeds as expected.

AudioCodes (NasdaqGS:AUDC)

Simply Wall St Value Rating: ★★★★★★

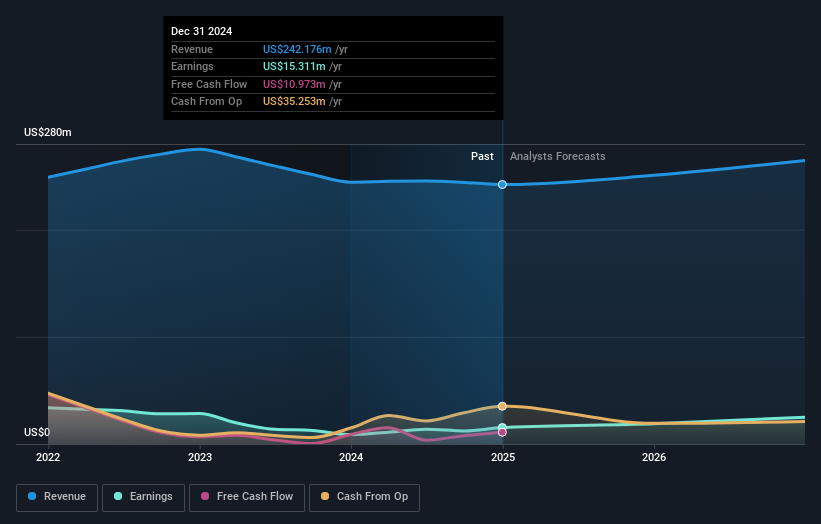

Overview: AudioCodes Ltd. offers advanced communications software, products, and productivity solutions for the digital workplace globally, with a market cap of $323.15 million.

Operations: AudioCodes Ltd. generates revenue primarily from its communications equipment segment, amounting to $242.18 million. The company's market cap stands at $323.15 million.

AudioCodes seems to be an intriguing prospect, particularly given its recent financial performance and strategic initiatives. The company reported a net income of US$15.31 million for 2024, up from US$8.78 million the previous year, reflecting strong earnings growth of 74.4% over the past year compared to the industry average of 1.6%. With no debt on its books now versus a debt-to-equity ratio of 4% five years ago, AudioCodes is well-positioned financially. Additionally, it has initiated a share repurchase program worth up to US$20 million and announced an innovative AI-driven meeting room solution that could enhance its market standing further.

- Click here and access our complete health analysis report to understand the dynamics of AudioCodes.

Assess AudioCodes' past performance with our detailed historical performance reports.

Argan (NYSE:AGX)

Simply Wall St Value Rating: ★★★★★★

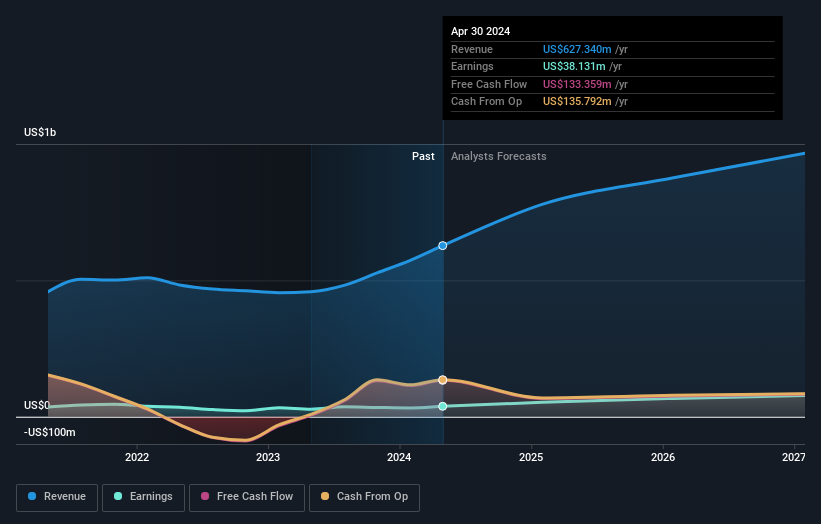

Overview: Argan, Inc. is a company that, through its subsidiaries, offers engineering and construction services primarily to the power generation market, with a market cap of $1.78 billion.

Operations: Argan generates revenue primarily from power services, contributing $615.58 million, followed by industrial services at $175.98 million and telecom services at $14.70 million. The net profit margin trend offers a key insight into the company's financial health over time.

Argan, a nimble player in the construction sector, has been making waves with its impressive earnings growth of 94.6% over the past year, outpacing the industry's 20.8%. The company reported third-quarter sales of US$257 million compared to US$164 million a year ago, and net income soared to US$28 million from US$5.46 million previously. With no debt on its books and trading at 48.5% below estimated fair value, Argan seems well-positioned for continued success despite significant insider selling recently noted. A recent buyback tranche saw 5,700 shares repurchased for $0.39 million, reflecting strategic financial management by Argan's leadership team.

Make It Happen

- Investigate our full lineup of 281 US Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGX

Argan

Through its subsidiaries, provides engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives