- United States

- /

- Construction

- /

- NYSE:AGX

Argan (NYSE:AGX) Removed From Russell 3000E And Microcap Indexes

Reviewed by Simply Wall St

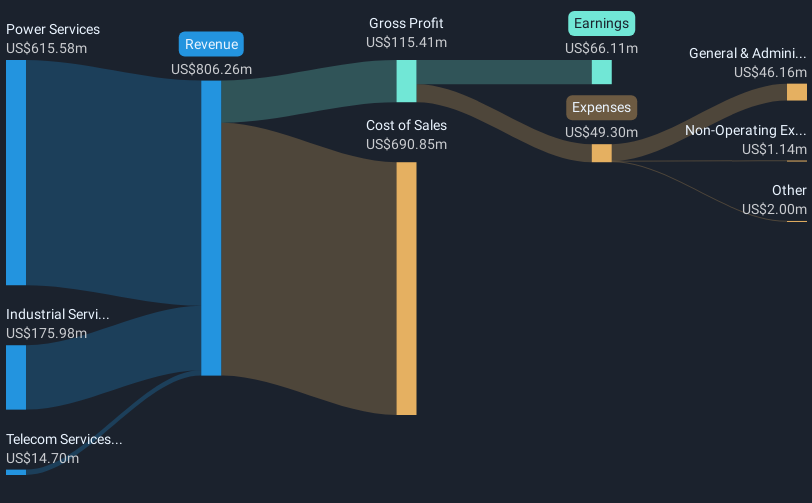

Argan (NYSE:AGX) experienced significant changes last quarter, with its removal from key indices like the Russell 3000E and Russell Microcap, likely impacting market visibility. Despite this, the company reported a strong earnings performance for Q1 2026, with sales rising to $194 million and net income increasing to $23 million. This positive financial performance contrasts with the index exclusion and may have reinforced investor confidence, contributing to a notable 68% price rise. The company's continuous dividend affirmations and buyback activities further supported its stock performance amid broader market gains, as the S&P 500 and Nasdaq reached new highs.

Argan has 1 warning sign we think you should know about.

The recent exclusion of Argan from key indices like the Russell 3000E and Microcap could affect its market visibility, yet the company's robust first-quarter earnings demonstrate resilience. With US$525 million in cash and no debt, Argan's financial stability allows for ongoing investments and operational improvements. On-market total returns over a three-year period reached a very large value, highlighting investor confidence and consistent performance. Over the past year, Argan outperformed both the US Market, which returned 13.7%, and the US Construction industry, which posted a 44.7% return, supporting investor optimism in its growth prospects.

The updated earnings and revenue forecasts could be positively impacted by the strong project backlog, including significant projects like the 405 megawatt solar project in Illinois. Analysts expect revenues to grow to US$1.2 billion and earnings to US$130.2 million by 2028. However, the execution risks associated with large-scale projects, regulatory shifts, and possible cost overruns remain critical concerns. Currently, Argan's share price is close to the analyst price target of US$150.0, suggesting that the stock is fairly priced based on these earnings projections. Investors may want to assess whether the forecasted potential of Argan justifies the company's current valuation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGX

Argan

Through its subsidiaries, provides engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market in the United States, Republic of Ireland, and the United Kingdom.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)