- United States

- /

- Machinery

- /

- NYSE:AGCO

How Might AGCO's (AGCO) New Leadership Shape Its Path in Precision Agriculture Innovation?

Reviewed by Simply Wall St

- AGCO recently appointed Brian Sorbe as President of PTx, effective August 25, 2025, adding nearly thirty years of precision agriculture and technology leadership to its growing business.

- Sorbe's deep expertise, particularly in mixed fleet technology and AI-driven agricultural automation, highlights AGCO's commitment to advancing digital and precision solutions amid shifting industry demands.

- We'll assess how Sorbe’s leadership in precision agriculture could further support AGCO’s growth objectives and evolving investment case.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

AGCO Investment Narrative Recap

To be confident as an AGCO shareholder, you need to believe in the long-term potential of precision agriculture and the company's capacity to capitalize on technological shifts in farming. The appointment of Brian Sorbe as President of PTx underscores this focus, but it is not likely to materially influence the most immediate catalyst, demand recovery in North America and Western Europe, or the biggest risk, which remains prolonged weak market demand in those regions.

Among AGCO's recent announcements, the joint venture with Trimble stands out, as it advances the company's technology transformation and pushes deeper into precision ag solutions. This collaboration is highly relevant to Sorbe's new role and could play into the anticipated shift towards higher-margin, software-driven revenue, which has been cited as a near-term catalyst for margin improvement and future growth.

On the other hand, investors should pay close attention to... ongoing inventory risks in North America that could weigh on company margins.

Read the full narrative on AGCO (it's free!)

AGCO's narrative projects $12.1 billion in revenue and $800.1 million in earnings by 2028. This requires 5.9% yearly revenue growth and a $700.5 million increase in earnings from $99.6 million today.

Uncover how AGCO's forecasts yield a $123.92 fair value, a 6% upside to its current price.

Exploring Other Perspectives

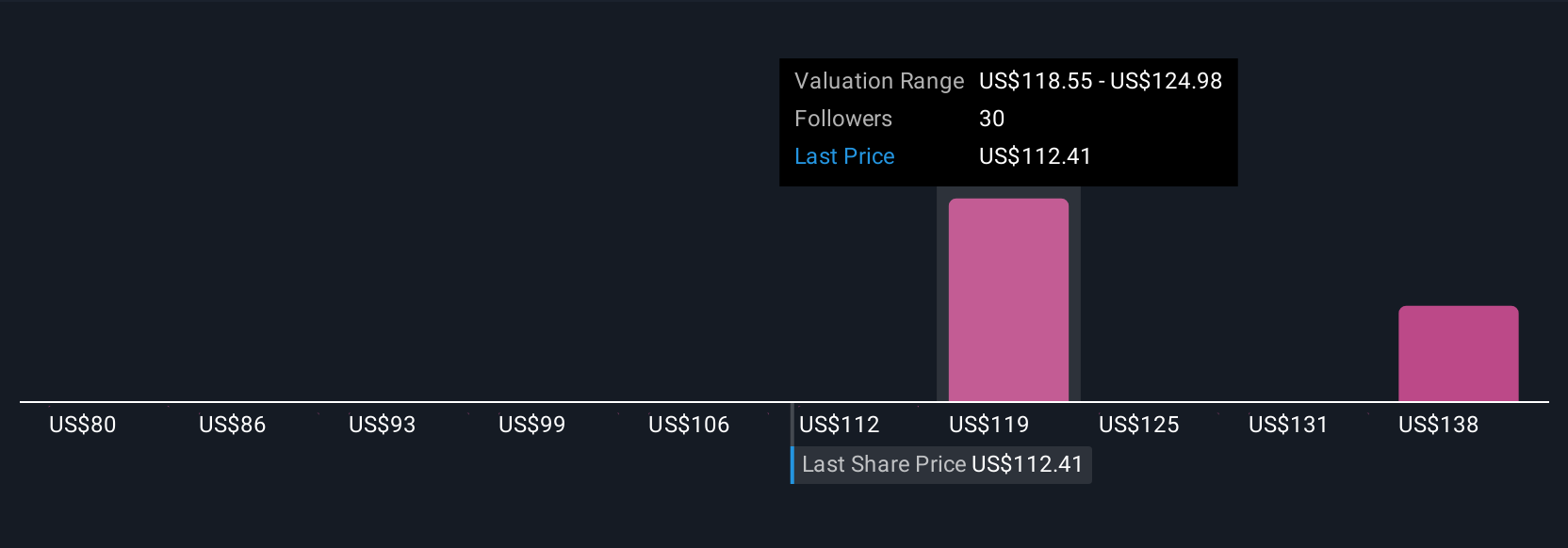

Private fair value estimates from the Simply Wall St Community range from US$80 to US$144.50, sourced from 4 analyses. While most see upside in digital and retrofit precision technologies, you may want to consider how persistent weak demand in key markets could affect AGCO’s outlook.

Explore 4 other fair value estimates on AGCO - why the stock might be worth as much as 24% more than the current price!

Build Your Own AGCO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AGCO research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free AGCO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AGCO's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGCO

AGCO

Manufactures and distributes agricultural equipment and replacement parts worldwide.

Moderate risk with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives