- United States

- /

- Machinery

- /

- NYSE:AGCO

How Investors Are Reacting To AGCO (AGCO) Unveiling €54 Million Finnish Remanufacturing Expansion

Reviewed by Sasha Jovanovic

- AGCO announced in September 2025 that its AGCO Power division has opened new production facilities in Linnavuori, Finland, with a €54 million investment to expand manufacturing of CVT components and CORE engine cylinder heads while boosting remanufacturing capacity.

- This expansion highlights AGCO's commitment to sustainable manufacturing and the circular economy, enabling greater production capacity and reduced environmental impact through remanufactured engines.

- We’ll look at how AGCO’s expanded remanufacturing commitment could influence its long-term investment narrative and operational resilience.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

AGCO Investment Narrative Recap

For shareholders in AGCO, the long-term thesis rests on demand for modern, sustainable agricultural equipment and the ability to maintain margins despite cyclical and political headwinds. The expansion of AGCO Power’s remanufacturing and CVT production facilities in Finland demonstrates operational resilience and commitment to efficiency, but the biggest short-term catalyst, rebound in core market demand, remains largely unaffected, while ongoing risks tied to dealer inventories and cautious farmer sentiment persist.

AGCO’s appointment of Brian Sorbe as President of PTx underscores the company’s ongoing push into precision agriculture and digital solutions, aligning with efforts to increase higher-margin, tech-driven aftermarket revenues. This fits strategically alongside the latest facility investment, which aims to support efficiency and margins through expanded reman capabilities.

However, investors should be aware that despite AGCO’s progress, the risk of prolonged weak demand in North America and Western Europe remains...

Read the full narrative on AGCO (it's free!)

AGCO's narrative projects $12.1 billion revenue and $800.1 million earnings by 2028. This requires 5.9% yearly revenue growth and a $700.5 million earnings increase from $99.6 million today.

Uncover how AGCO's forecasts yield a $123.77 fair value, a 13% upside to its current price.

Exploring Other Perspectives

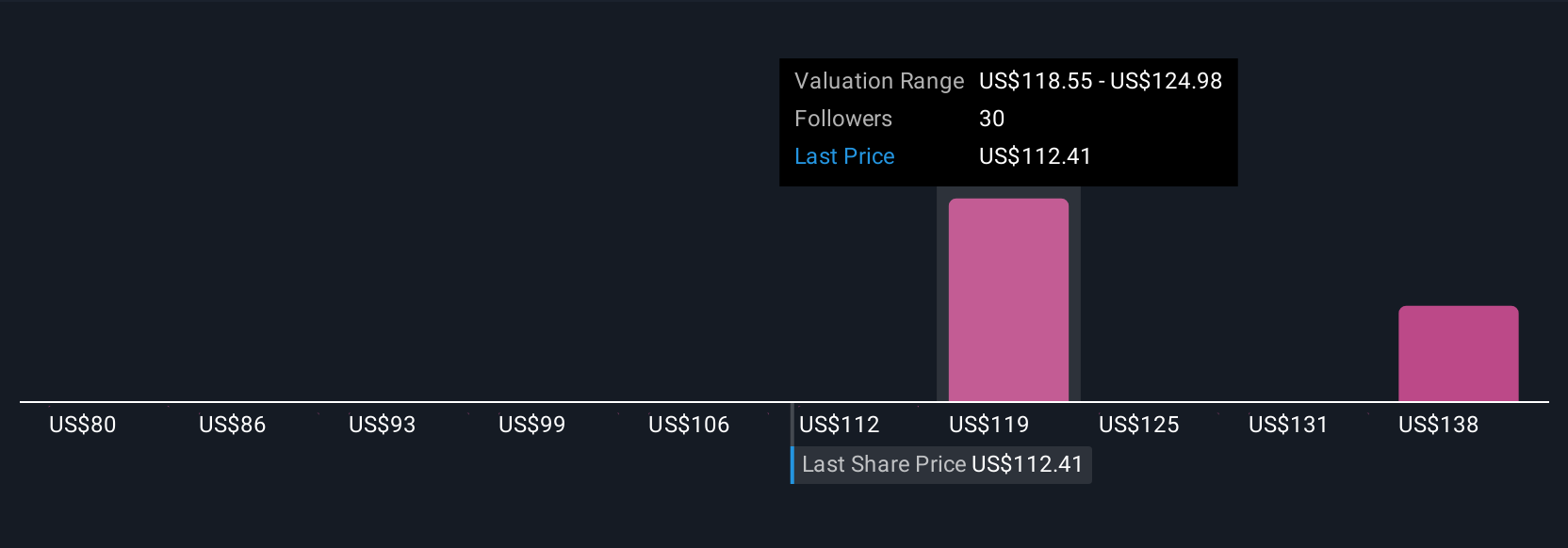

Four Simply Wall St Community fair value estimates for AGCO range from US$80 to US$141.65, showing broad diversity in investor assessments. Amid these varied views, persistent risks from dealer inventory overhang and farmer sentiment can sharply influence revenue and margin recovery, so you should explore multiple forecasts and opinions before forming your own outlook.

Explore 4 other fair value estimates on AGCO - why the stock might be worth 27% less than the current price!

Build Your Own AGCO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AGCO research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free AGCO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AGCO's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGCO

AGCO

Manufactures and distributes agricultural equipment and replacement parts worldwide.

Moderate risk with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives