- United States

- /

- Trade Distributors

- /

- NYSE:AER

Did AER’s US$1 Billion Buyback and 777-300ERSF Bet Just Shift AerCap Holdings' Investment Narrative?

Reviewed by Sasha Jovanovic

- AerCap Holdings N.V. has authorized a share repurchase program of up to US$1,000 million, to be funded from cash on hand and operating cash flow, running through June 30, 2026, and has also recently delivered the first of three Boeing 777-300ERSF converted freighters to Fly Meta Leasing Co. Ltd.

- This combination of a large, internally funded buyback and AerCap’s early involvement in the 777-300ERSF freighter platform highlights how the company is using both capital returns and fleet innovation to support its leasing franchise.

- We’ll now examine how AerCap’s US$1,000 million buyback authorization may shape its existing investment narrative on capital deployment.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

AerCap Holdings Investment Narrative Recap

To own AerCap, you generally need to believe that tight aircraft supply, high utilization and disciplined capital allocation can offset cyclical swings in aviation and credit. The new US$1,000 million buyback modestly reinforces the near term capital return story, but it does not materially change the key catalyst of healthy lease demand or the biggest risk around deploying large capital into aircraft and repurchases while leverage and interest coverage remain important watchpoints.

The new buyback sits alongside AerCap’s ongoing capital returns, including its quarterly dividend of US$0.27 per share throughout 2025, which together frame how management is balancing cash distributions with fleet investment. For investors focused on catalysts, this pairing of internal buybacks and regular dividends is most relevant when set against the risk that higher leverage or a downturn could make debt servicing more demanding in a less favorable market.

But against that backdrop of strong recent returns, investors should also be aware of how quickly conditions could change if aircraft supply loosens and...

Read the full narrative on AerCap Holdings (it's free!)

AerCap Holdings' narrative projects $8.4 billion revenue and $1.4 billion earnings by 2028. This implies 1.7% yearly revenue growth and an earnings decrease of $1.5 billion from $2.9 billion today.

Uncover how AerCap Holdings' forecasts yield a $148.00 fair value, a 7% upside to its current price.

Exploring Other Perspectives

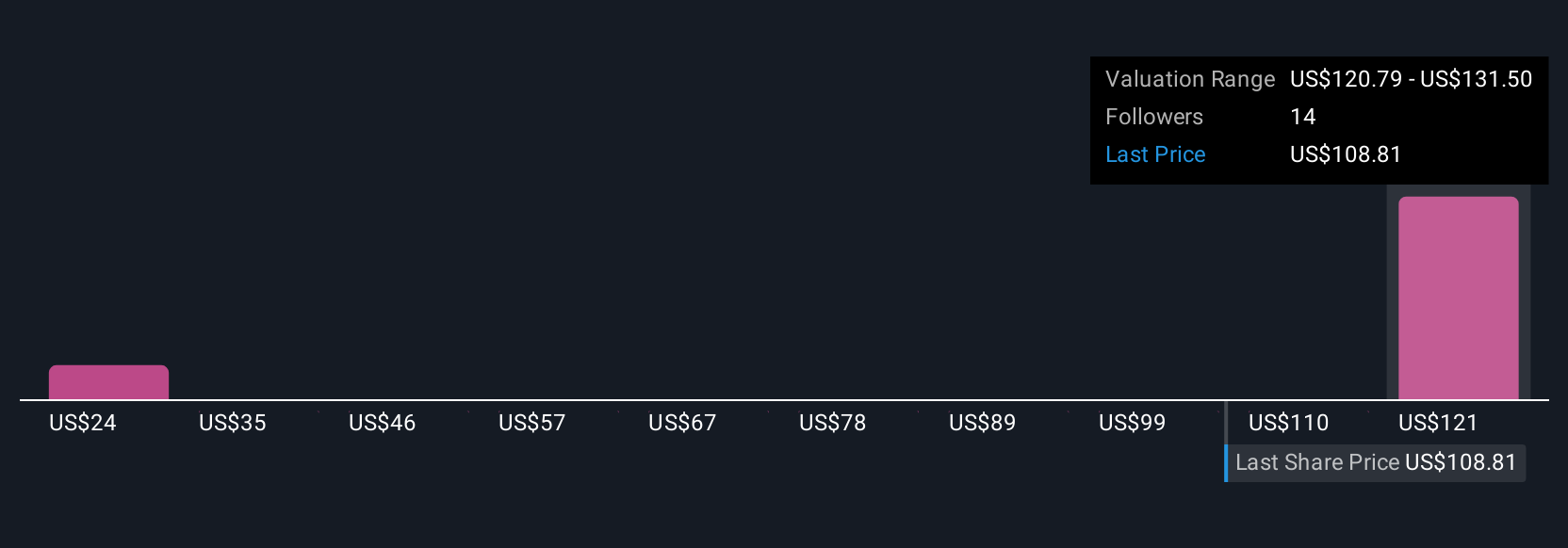

Simply Wall St Community members see fair value between US$148 and about US$530 across 2 individual models, underscoring how far opinions can diverge. Against that spread, the risk that heavier capital deployment into aircraft and buybacks could amplify the impact of any future downturn on AerCap’s earnings and balance sheet is something readers may want to weigh alongside these different views.

Explore 2 other fair value estimates on AerCap Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own AerCap Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AerCap Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AerCap Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AerCap Holdings' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AER

AerCap Holdings

Engages in the lease, financing, sale, and management of commercial flight equipment in the United States, China, and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026