- United States

- /

- Construction

- /

- NYSE:ACM

This Is Why AECOM's (NYSE:ACM) CEO Compensation Looks Appropriate

Key Insights

- AECOM to hold its Annual General Meeting on 19th of March

- Total pay for CEO W. Rudd includes US$1.25m salary

- The overall pay is comparable to the industry average

- Over the past three years, AECOM's EPS fell by 14% and over the past three years, the total shareholder return was 53%

The share price of AECOM (NYSE:ACM) has increased significantly over the past few years. However, the earnings growth has not kept up with the share price momentum, suggesting that some other factors may be driving the price direction. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 19th of March. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

See our latest analysis for AECOM

Comparing AECOM's CEO Compensation With The Industry

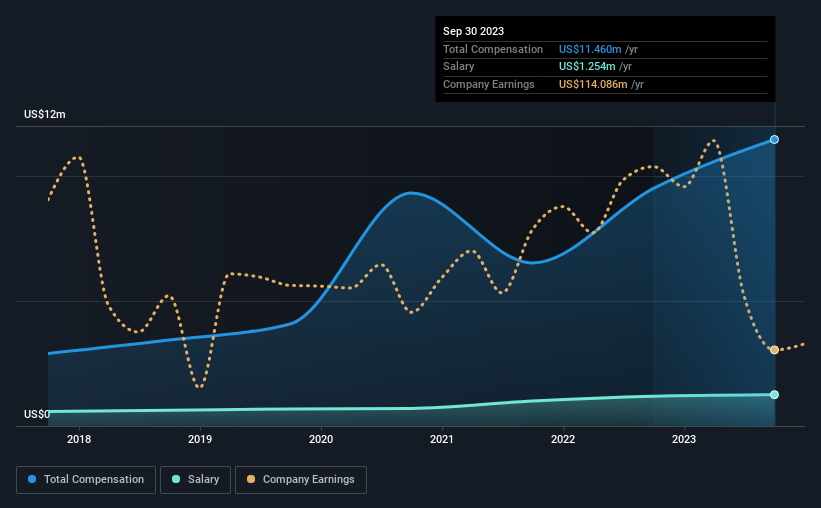

At the time of writing, our data shows that AECOM has a market capitalization of US$12b, and reported total annual CEO compensation of US$11m for the year to September 2023. That's a notable increase of 21% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$1.3m.

On comparing similar companies in the American Construction industry with market capitalizations above US$8.0b, we found that the median total CEO compensation was US$10m. So it looks like AECOM compensates W. Rudd in line with the median for the industry. What's more, W. Rudd holds US$20m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$1.3m | US$1.2m | 11% |

| Other | US$10m | US$8.3m | 89% |

| Total Compensation | US$11m | US$9.5m | 100% |

On an industry level, around 22% of total compensation represents salary and 78% is other remuneration. AECOM pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

AECOM's Growth

Over the last three years, AECOM has shrunk its earnings per share by 14% per year. In the last year, its revenue is up 12%.

The decline in EPS is a bit concerning. There's no doubt that the silver lining is that revenue is up. But it isn't sufficiently fast growth to overlook the fact that EPS has gone backwards over three years. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has AECOM Been A Good Investment?

We think that the total shareholder return of 53%, over three years, would leave most AECOM shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us question whether these strong returns will continue. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 3 warning signs for AECOM that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ACM

AECOM

Provides professional infrastructure consulting services for governments, businesses, and organizations worldwide.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives