- United States

- /

- Construction

- /

- NYSE:ACM

How Investors May Respond To AECOM (ACM) Securing Major Asia-Pacific and US Contracts

Reviewed by Simply Wall St

- In the past week, AECOM announced a major joint venture consultancy agreement for the Hong Kong-Shenzhen Western Rail Link and secured three multi-year US Army Corps of Engineers contracts with a combined ceiling of over US$400 million across the Pacific region.

- These wins reflect AECOM's ongoing ability to obtain high-value, multiyear infrastructure projects that strengthen its presence in both the Asia-Pacific and US markets.

- We will now examine how these significant contract awards, particularly the multi-region wins, could influence AECOM's investment narrative going forward.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

AECOM Investment Narrative Recap

To be a shareholder in AECOM, you need to believe in the company's ability to secure and deliver large-scale infrastructure partnerships and manage contract backlogs while weathering macroeconomic uncertainties. The recent announcements of multi-year wins in both Asia-Pacific and the US highlight AECOM’s project acquisition strengths; however, these developments do not materially reduce near-term risks tied to macro volatility or project delays, particularly in international markets where uncertainty remains a key challenge for growth and margins.

The consultancy agreement for the Hong Kong-Shenzhen Western Rail Link stands out among recent news, aligning with the company’s strategy to deepen its role in transformative infrastructure across the Asia-Pacific region. This win reinforces AECOM’s presence in public sector projects and supports the underlying catalyst of a robust pipeline and backlog, which are central to prospects for margin expansion and higher future earnings, yet project-specific and macro delays remain relevant risks to monitor.

By contrast, even with these contract wins, investors should closely watch for signs of deferred project decisions in key markets that could...

Read the full narrative on AECOM (it's free!)

AECOM's narrative projects $18.6 billion in revenue and $922.6 million in earnings by 2028. This requires 5.0% yearly revenue growth and a $293.3 million earnings increase from $629.3 million today.

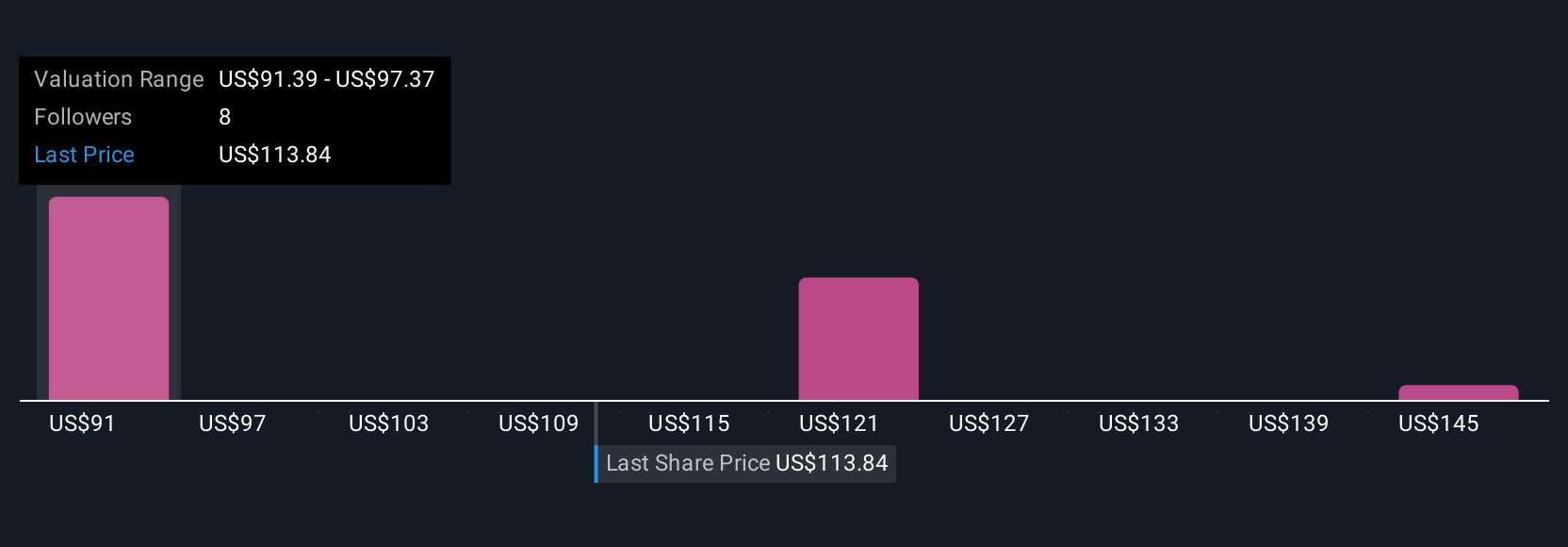

Uncover how AECOM's forecasts yield a $121.92 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set fair values for AECOM ranging from US$96.31 to US$169.53, across four independent estimates. While opinions vary widely, the company’s record-high backlog and visible project pipeline continue to be focal points for those assessing longer-term growth potential.

Build Your Own AECOM Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AECOM research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free AECOM research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AECOM's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACM

AECOM

Provides professional infrastructure consulting services for governments, businesses, and organizations worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives