- United States

- /

- Construction

- /

- NYSE:ACM

AECOM (ACM): Evaluating Valuation as Infrastructure Spending and Data Center Demand Drive New Investor Interest

Reviewed by Kshitija Bhandaru

AECOM (ACM) has been in the spotlight following its recent participation at the CSCMP EDGE 2025 Conference, where the company showcased its involvement in major infrastructure and supply chain projects worldwide. Investors are keenly watching how AECOM’s expanding backlog and demand in fast-growing sectors may drive the next stage of growth.

See our latest analysis for AECOM.

AECOM’s stock has been on a strong run, with a 24.7% year-to-date share price return that reflects mounting investor confidence in its global infrastructure expertise and a record project backlog. The company’s 1-year total shareholder return of nearly 26%, along with a 3-year total return topping 88%, show momentum is building as new contract wins and surging demand in sectors like AI data centers reinforce its growth thesis amid shifting market sentiment.

If you’re looking to expand your watchlist beyond the usual picks, now’s an ideal time to discover fast growing stocks with high insider ownership.

With AECOM’s shares surging and robust growth drivers in play, the question remains: is all this optimism already reflected in the price, or could this be a fresh opportunity for investors seeking more upside?

Most Popular Narrative: 3.1% Undervalued

With AECOM’s fair value narrative sitting just above its last close price, the gap is narrow but positive. This suggests the market might be slightly underrating the company’s near-term upside. The story hinges on factors beyond headline growth figures and highlights evolving margins and future project wins as pivotal swing points.

Accelerating global and U.S. government-backed infrastructure spending, especially in transportation, water, energy, and data centers, provides multi-year revenue visibility and a record backlog that should support top-line growth and backlog-driven earnings expansion.

Curious what this valuation is really built on? The narrative mixes high-margin optimism, revenue projections, and a future profit multiple that may surprise you. Dig deeper to discover the exact assumptions analysts are making about AECOM’s growth runway.

Result: Fair Value of $136.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, AECOM’s reliance on government contracts and the rapid evolution of digital technologies could present challenges to its margins and future project pipeline.

Find out about the key risks to this AECOM narrative.

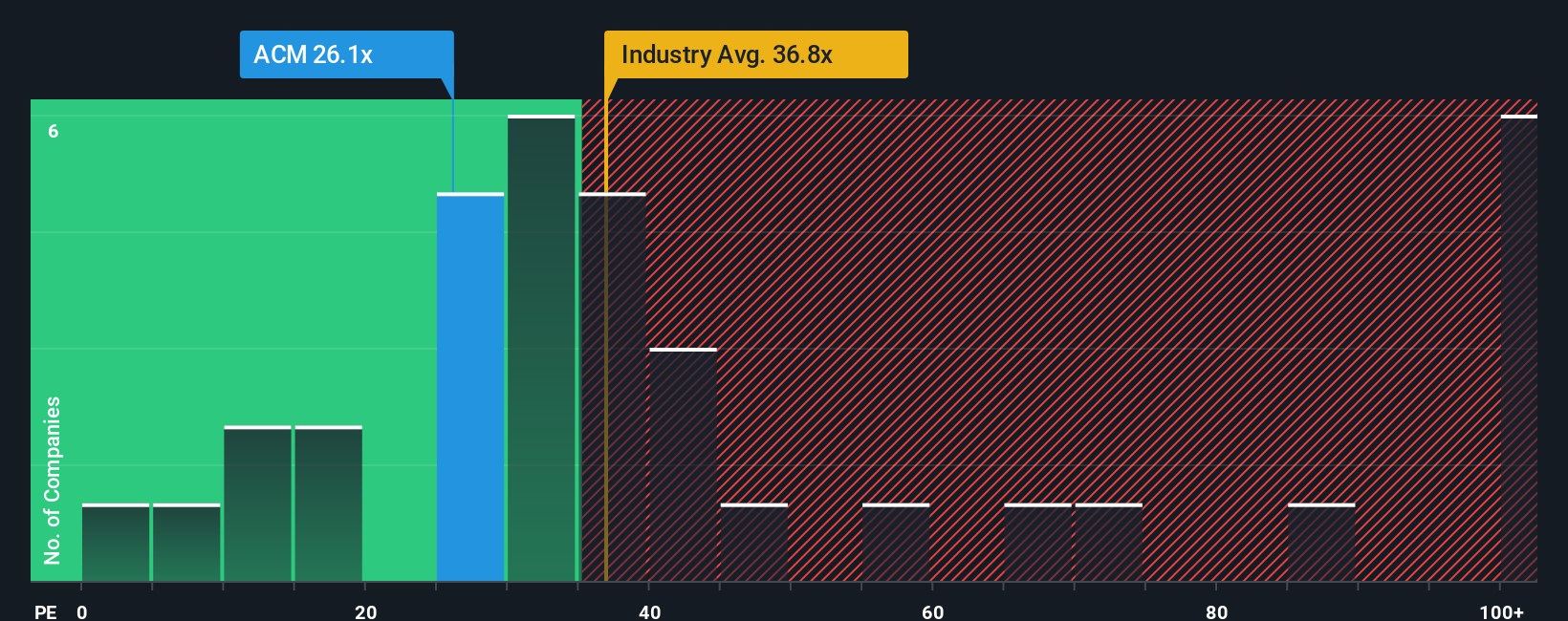

Another View: Testing The Valuation With Ratios

Looking beyond analyst forecasts, AECOM trades at a 26x price-to-earnings ratio, which is well below the US Construction industry average of 36.1x and a peer group average of 57x. However, its ratio is above the SWS fair ratio of 23.3x, meaning the market could shift closer to that lower fair value if sentiment changes.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AECOM for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AECOM Narrative

If you think the numbers tell a different story, or want to explore your own angle, it takes less than three minutes to craft a custom narrative yourself with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding AECOM.

Ready for Your Next Investment Move?

Smart investors never settle for yesterday’s winners alone. If you want to stay ahead, target stocks reshaping tomorrow’s market with these expertly curated ideas:

- Capture powerful income opportunities by tapping into these 18 dividend stocks with yields > 3%, which delivers yields above 3% that can boost your returns in any environment.

- Ride the momentum of digital innovation and level up your watchlist by unearthing high-potential companies among these 24 AI penny stocks, driving the future of artificial intelligence.

- Secure value right now with these 877 undervalued stocks based on cash flows, trading below their intrinsic cash flow estimates and poised for upside the market might be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACM

AECOM

Provides professional infrastructure consulting services for governments, businesses, and organizations worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives