- United States

- /

- Construction

- /

- NYSE:ACM

AECOM (ACM) Declares Quarterly Cash Dividend of US$0.26 Per Share

Reviewed by Simply Wall St

AECOM (ACM) recently announced the affirmation of a $0.26 quarterly dividend, continuing its consistent dividend program, which complements a price move of 11% over the last quarter. This positive price action aligns with broader market trends marked by all-time highs in major indices like the S&P 500 and Nasdaq. AECOM's earnings report, which showcased annual net income growth despite a slight decline in quarterly figures, likely bolstered investor confidence. Furthermore, various high-value client partnerships, including those in the U.K. and Singapore, added positive momentum during a period of robust market performance.

Buy, Hold or Sell AECOM? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

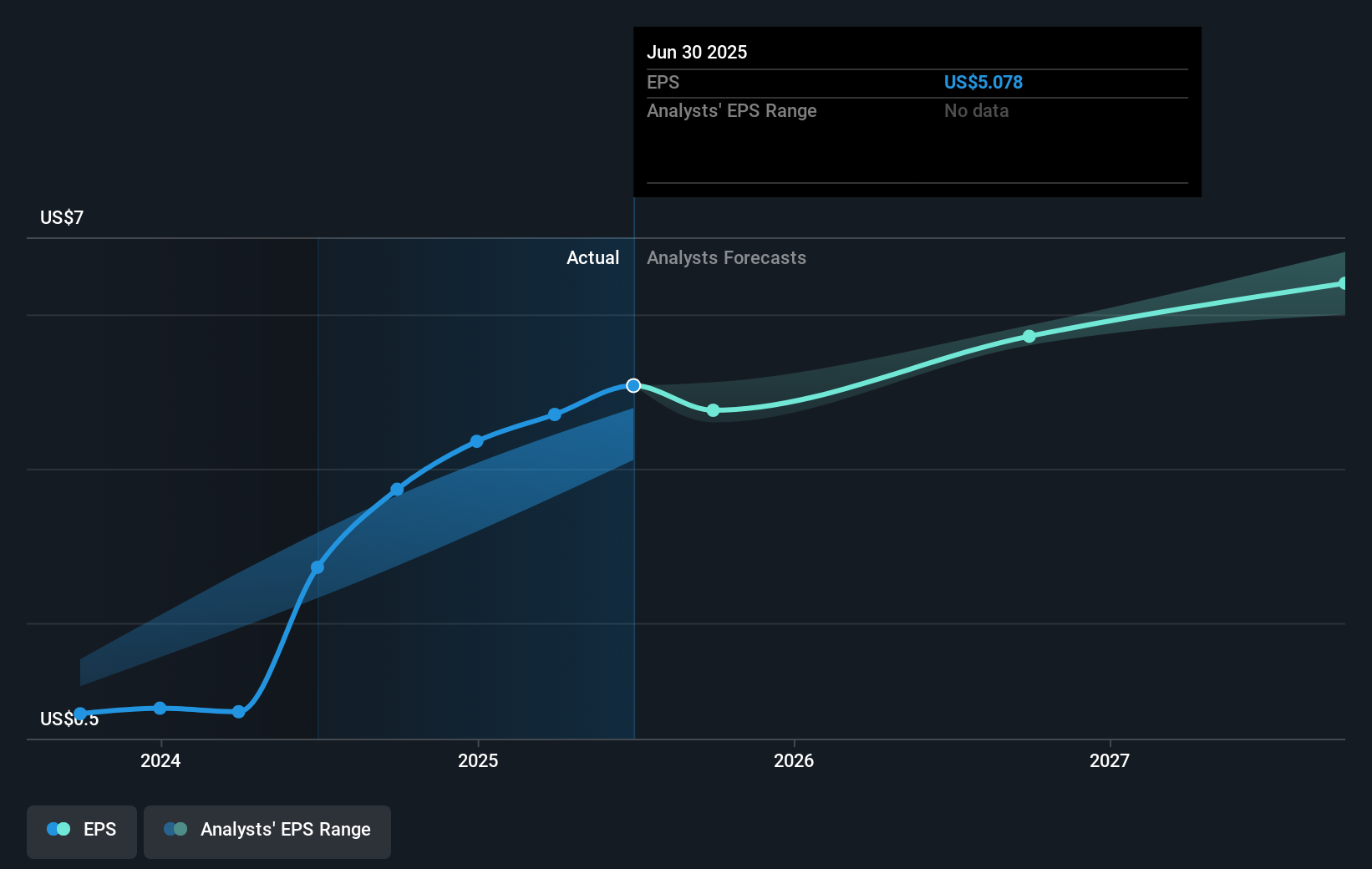

The affirmation of a $0.26 quarterly dividend by AECOM underscores a commitment to providing shareholder returns, coinciding with an 11% share price increase over the last quarter. This momentum is part of a broader narrative that includes substantial infrastructure and AI-driven investments, which may enhance revenue visibility and margin improvements. Notably, over a five-year period, AECOM has achieved a total return of 230.91%, highlighting robust longer-term growth. However, over the past year, AECOM's return underperformed the US Construction industry, which returned 59%.

The news aligns with anticipated revenue growth driven by government infrastructure spending and climate resilience projects. Analysts forecast revenue to grow at 5.4% annually over the next three years, aiming for earnings of $955.0 million by 2028. Potential impacts on earnings could stem from both rising client demand for high-margin advisory contracts and industry-wide technological advancements. Although AECOM's current share price of US$124.30 is close to the consensus price target of US$133.18, analysts' views on the stock remain varied, with targets ranging from US$109.0 to US$145.0. The close proximity of the current price to the target suggests that the market may perceive the stock as fairly valued at present, thereby aligning with the broader confidence in the company's strategic direction and earnings growth.

Review our growth performance report to gain insights into AECOM's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACM

AECOM

Provides professional infrastructure consulting services for governments, businesses, and organizations internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)