- United States

- /

- Aerospace & Defense

- /

- NYSE:ACHR

Is Archer Aviation Set for Liftoff After United Airlines eVTOL Deal and 42% Monthly Surge?

Reviewed by Bailey Pemberton

Wondering what to do with Archer Aviation stock after its recent rollercoaster? You’re not alone. Plenty of investors are eyeing this ambitious eVTOL (electric vertical takeoff and landing) company, especially as its share price shows some serious lift. Just over the past week, shares are up 4.6%, and the one-month gain is an eye-popping 42.9%. If you’d gotten in a year ago, you’d be sitting on returns of 308.5%. It’s a pace that certainly grabs attention, and it’s been fueled mostly by excitement around progress in the urban air mobility space and optimism from fresh announcements about manufacturing readiness.

Of course, fast price gains often spark questions about value. Is Archer Aviation already flying too high, or is there still more runway ahead? According to our value score, where a company gets a plus-one for each of six major undervaluation signals, Archer scores a 3. In other words, it’s undervalued in half of our tested categories. That’s good company for investors who want potential upside coupled with some margin of safety.

You might be wondering which valuation checks are most telling or if there’s a smarter way to measure what Archer is really worth. Let’s break down the different valuation approaches next. Stick around, because later I’ll share an even more insightful angle on assessing Archer’s future value.

Approach 1: Archer Aviation Discounted Cash Flow (DCF) Analysis

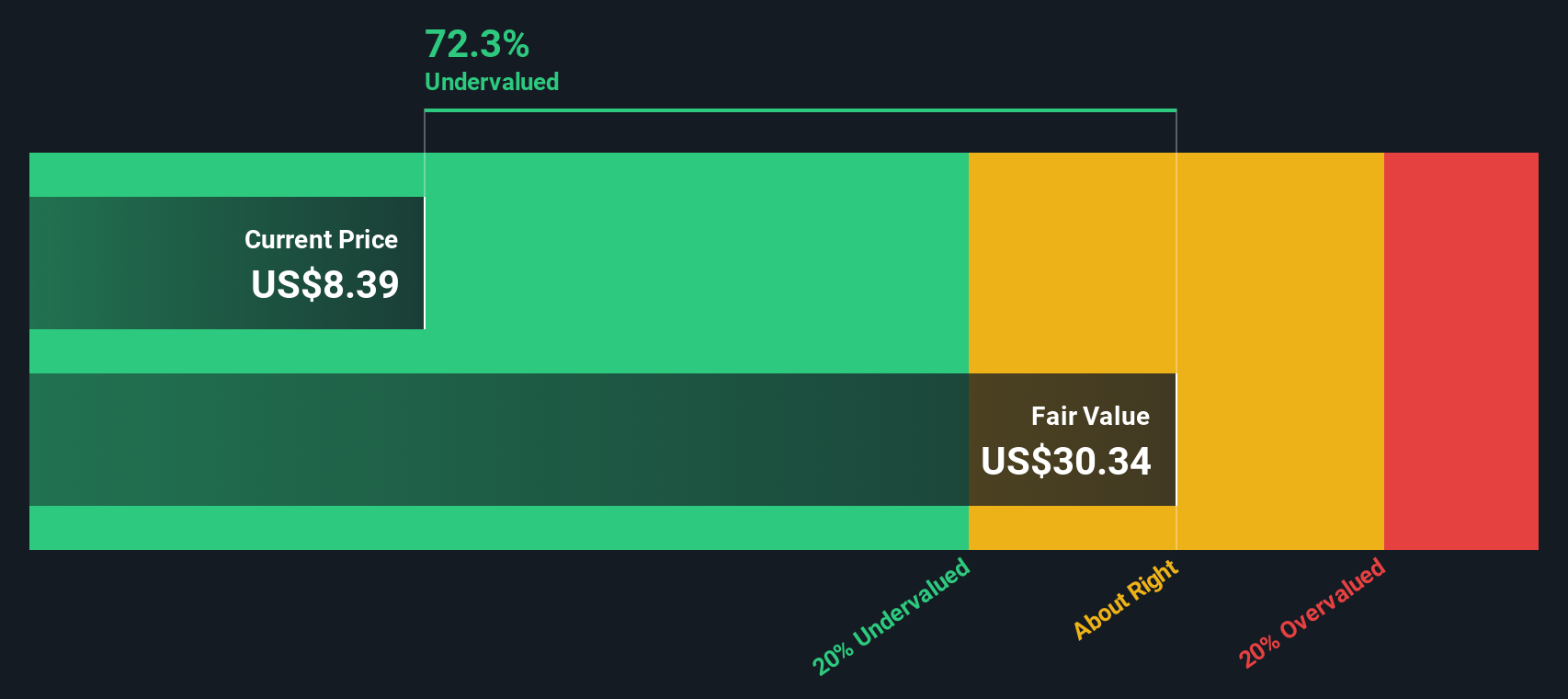

A Discounted Cash Flow (DCF) model estimates what a company is really worth by forecasting its future cash flows and then calculating what those are worth in today’s dollars. For Archer Aviation, analysts and our model project the company’s Free Cash Flow (FCF) over the next decade to chart a likely financial path.

Right now, Archer Aviation’s FCF is negative, at -$472 million. The forecasts indicate that free cash flow is expected to turn positive in 2028, reaching $27.5 million, and then rise sharply to $286 million by 2029. These projections are built from analyst estimates for the next five years. Later years use growth assumptions to extend the outlook through 2035.

Based on these projections, the DCF model calculates a fair value of $29.61 per share. Compared to Archer’s current share price, this suggests the stock is trading at about a 56.0% discount, indicating substantial undervaluation at present levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Archer Aviation is undervalued by 56.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

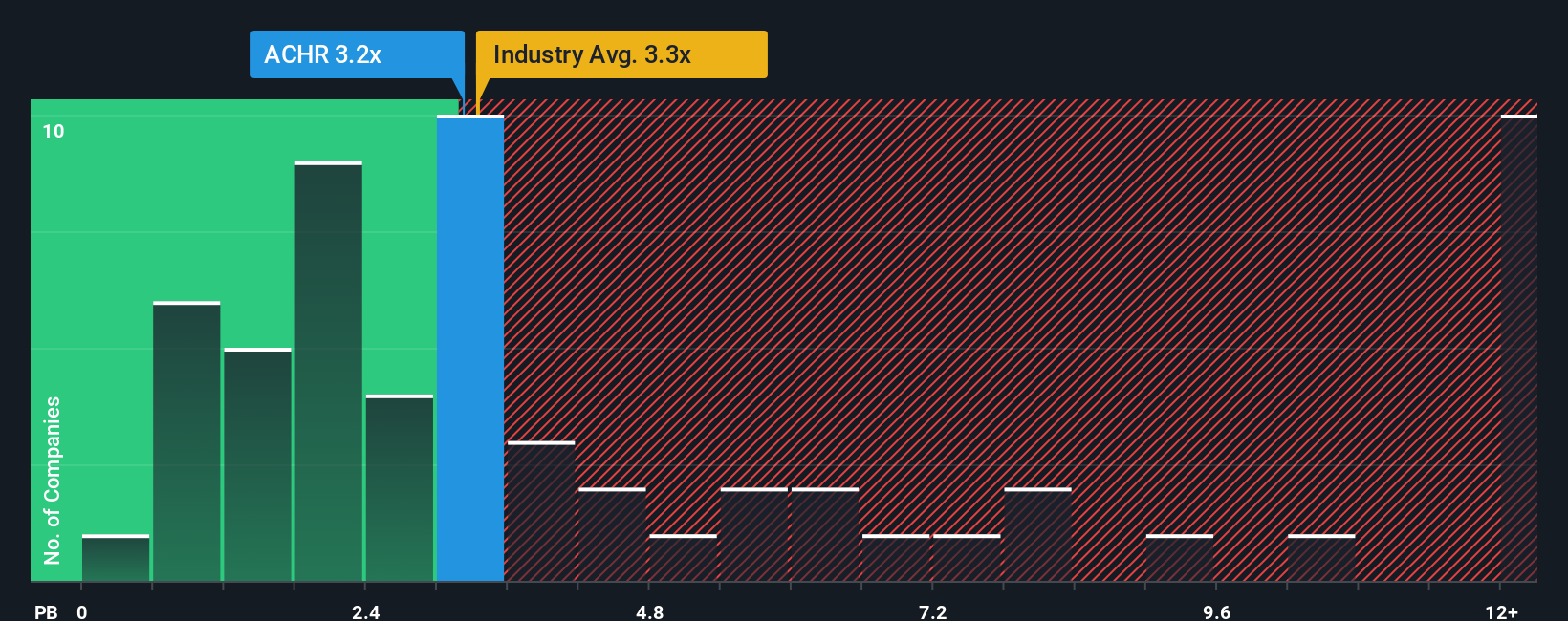

Approach 2: Archer Aviation Price vs Book

The Price-to-Book (P/B) ratio is a go-to valuation tool for companies with limited current earnings, like Archer Aviation, but meaningful balance sheet assets. It helps investors gauge if a stock’s market price is reasonable compared to what the company owns, making it particularly relevant for firms investing heavily in future growth.

Generally, higher growth and lower risk justify a higher P/B ratio. Conversely, companies with slow growth or elevated risks trade more cheaply on a book value basis. Archer Aviation currently trades at a P/B ratio of 5.0x. This stands above the aerospace and defense sector average of 3.69x, but below its peer group average at 10.42x.

To get a more tailored perspective, Simply Wall St’s proprietary “Fair Ratio” weighs factors like Archer’s expected earnings growth, risks, profit margins, and its size compared to industry peers. While industry or peer comparisons can offer a ballpark estimate, the Fair Ratio digs deeper by calibrating for company-specific strengths and challenges. This approach moves beyond surface-level comparisons and recognizes the nuances of each business’s outlook.

Comparing Archer’s actual P/B ratio to its calculated Fair Ratio, we see the difference is negligible, indicating the shares are valued about right given the current fundamentals and outlook.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Archer Aviation Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal story about a company, built around your own beliefs about its future and what you think it’s really worth. Rather than just crunching numbers, Narratives let you connect the dots between what you expect for revenue, earnings, and fair value, linking the company's journey to a customized financial outlook.

Accessible right on the Community page at Simply Wall St, Narratives make it easy for investors, whether new or experienced, to turn their outlook into a clear plan of action. Once you set your Narrative, you will see an up-to-date Fair Value compared to the market Price, helping you decide when it’s time to buy, sell, or wait. Better still, Narratives update automatically as new information, like earnings releases or news, surfaces.

For example, some Archer Aviation investors see massive upside and set a high Fair Value, while others are more cautious and assign a much lower target. These different perspectives are all tracked within Narratives, letting you quickly understand the range of views and make a smarter, more confident decision.

Do you think there's more to the story for Archer Aviation? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACHR

Archer Aviation

Designs and develops aircraft and related technologies and services in the United States and internationally.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives