- United States

- /

- Construction

- /

- NYSE:ACA

Arcosa (ACA): Assessing Valuation as Net Income Grows and Infrastructure Tailwinds Build

Reviewed by Kshitija Bhandaru

Arcosa (ACA) is catching investor attention after recent coverage pointed to its strong net income growth and steady product backlog. This performance is supported by increased federal infrastructure spending and a healthy pipeline of construction projects.

See our latest analysis for Arcosa.

Even as Arcosa navigates industry headwinds like elevated costs and tariffs, the share price has slipped 6.4% over the past month. The company has achieved a total shareholder return of 52% over three years and nearly 89% over five years. While momentum has cooled recently, its long-term performance still impresses and suggests investors see ongoing value tied to infrastructure demand.

If you’re curious where else investor momentum is building in this space, this is a great moment to explore fast growing stocks with high insider ownership.

With Arcosa’s shares lagging lately, yet long-term prospects appearing strong, the key question becomes clear: Is this an attractive entry point for investors, or is all of that anticipated infrastructure growth already priced into the stock?

Most Popular Narrative: 23.1% Undervalued

Arcosa’s current share price of $89.15 stands well below the narrative’s fair value assessment of $116, signaling a substantial upside potential according to the dominant market storyline. The stage is set for a pivotal growth surge fueled by broad infrastructure trends and strategic expansion plans.

Accelerating investment in grid modernization, data center development, and renewable energy integration is boosting demand for utility and transmission structures. This is leading to a record backlog and prompting capacity expansions that are expected to support higher earnings growth and margin accretion.

What are the quantitative leaps behind this bullish projection? Competitive tailwinds and margin upgrades are at the core, but the story’s biggest surprises are hidden in the numbers that push this fair value far above the last close. Uncover the full financial blueprint driving this aggressive price target now.

Result: Fair Value of $116 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, long-term political budget cuts or difficulties in integrating new acquisitions could quickly challenge even the strongest bullish scenario for Arcosa.

Find out about the key risks to this Arcosa narrative.

Another View: The Multiples Perspective

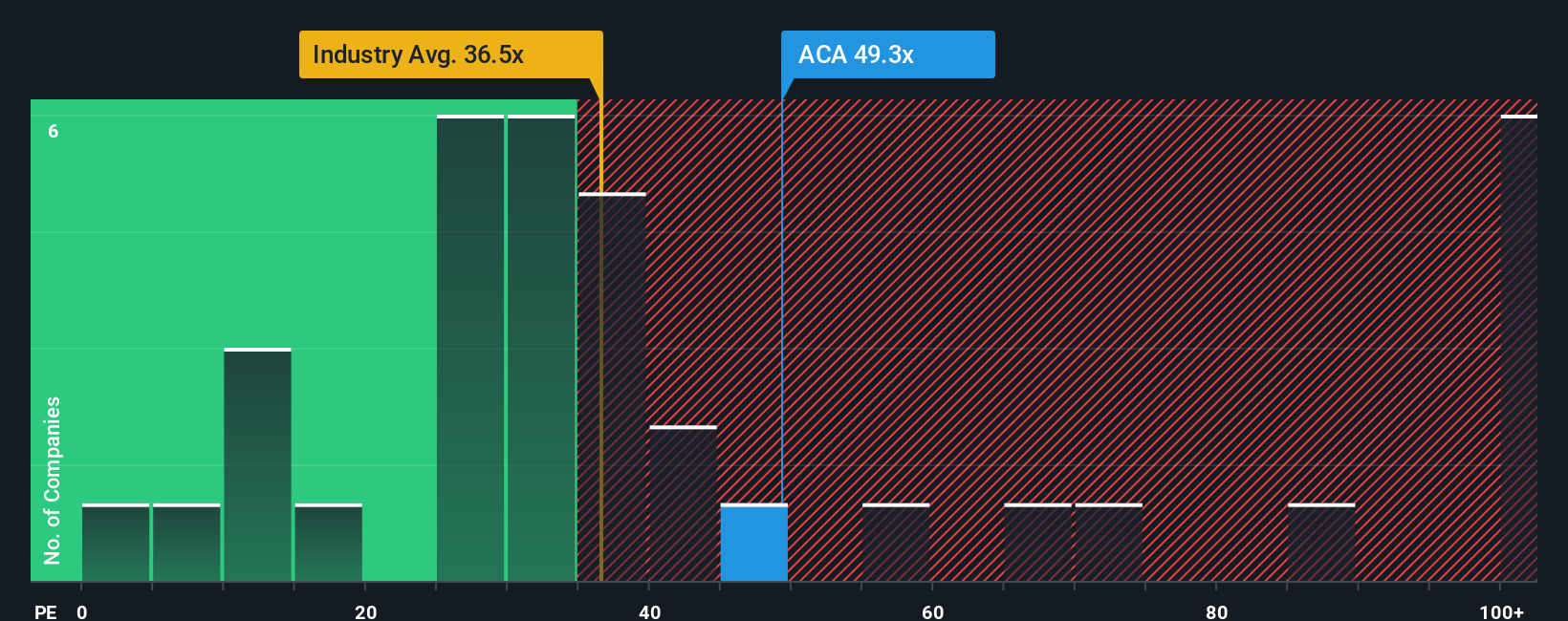

Taking a step back from the market narrative, Arcosa’s current valuation looks expensive when judged by its price-to-earnings ratio. At 47.5x, it sits well above both peer (32.6x) and industry (35.6x) averages, not to mention the fair ratio of 38.2x. This implies investors are paying a substantial premium for future growth. Does this set the stage for future disappointment if earnings don’t accelerate fast enough, or could market confidence be justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arcosa Narrative

For those who prefer to chart their own course or question the prevailing consensus, it’s easy to dig into the data and craft your own view in just a few minutes. Do it your way.

A great starting point for your Arcosa research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investing is all about finding opportunities that others may overlook. Make your next move count by checking out these unique stock picks before the market catches on.

- Scoop up income potential by checking out these 19 dividend stocks with yields > 3%, which consistently generate strong yields over 3% and prioritize shareholder returns.

- Ride the momentum of innovation by backing companies leading the charge in artificial intelligence through these 24 AI penny stocks, with real growth potential.

- Capitalize on future technologies by reviewing these 26 quantum computing stocks, featuring firms at the forefront of quantum computing advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACA

Arcosa

Provides infrastructure-related products and solutions for the construction, engineered structures, and transportation markets in the United States.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives