- United States

- /

- Construction

- /

- NasdaqCM:WSC

Guidance Cut And Soft Volumes Could Be A Game Changer For WillScot Holdings (WSC)

Reviewed by Sasha Jovanovic

- WillScot Holdings recently cut its FY25 guidance to about US$2.26 billion in revenue and roughly US$970 million in adjusted EBITDA, underscoring continued weak core volume trends and limited visibility on a near-term demand recovery.

- While the company is pushing into enterprise accounts and non-construction areas like data centers, these newer verticals have yet to fully counterbalance softness in its core business volumes, reshaping how investors weigh its longer-term growth drivers against current operational headwinds.

- We’ll now examine how the recent guidance cut and still-soft core volumes affect WillScot’s previously more optimistic investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

WillScot Holdings Investment Narrative Recap

To own WillScot today, you need to believe its push into larger enterprise accounts and newer verticals can eventually offset weak core construction demand and flat units on rent. The FY25 guidance cut to about US$2.26 billion in revenue and roughly US$970 million in adjusted EBITDA reinforces that the near term picture remains cloudy, with the key catalyst now being any clear inflection in core volumes, and the biggest risk a prolonged slump in small and local project activity.

The company’s presentation at the Bank of America Leveraged Finance Conference gives management a timely platform to explain the guidance reset, soft volume trends, and progress in non construction verticals to a financially focused audience. For investors tracking catalysts, what management says about volume stabilization, capital spending, and enterprise pipeline at this event may matter more than headline guidance, since it can shape expectations for when units on rent might finally stop drifting lower.

Yet beneath the push into data centers and enterprise accounts, investors should be aware that prolonged weakness in small project demand could still...

Read the full narrative on WillScot Holdings (it's free!)

WillScot Holdings' narrative projects $2.5 billion revenue and $363.1 million earnings by 2028. This requires 2.5% yearly revenue growth and about a $253 million earnings increase from $109.7 million today.

Uncover how WillScot Holdings' forecasts yield a $24.75 fair value, a 18% upside to its current price.

Exploring Other Perspectives

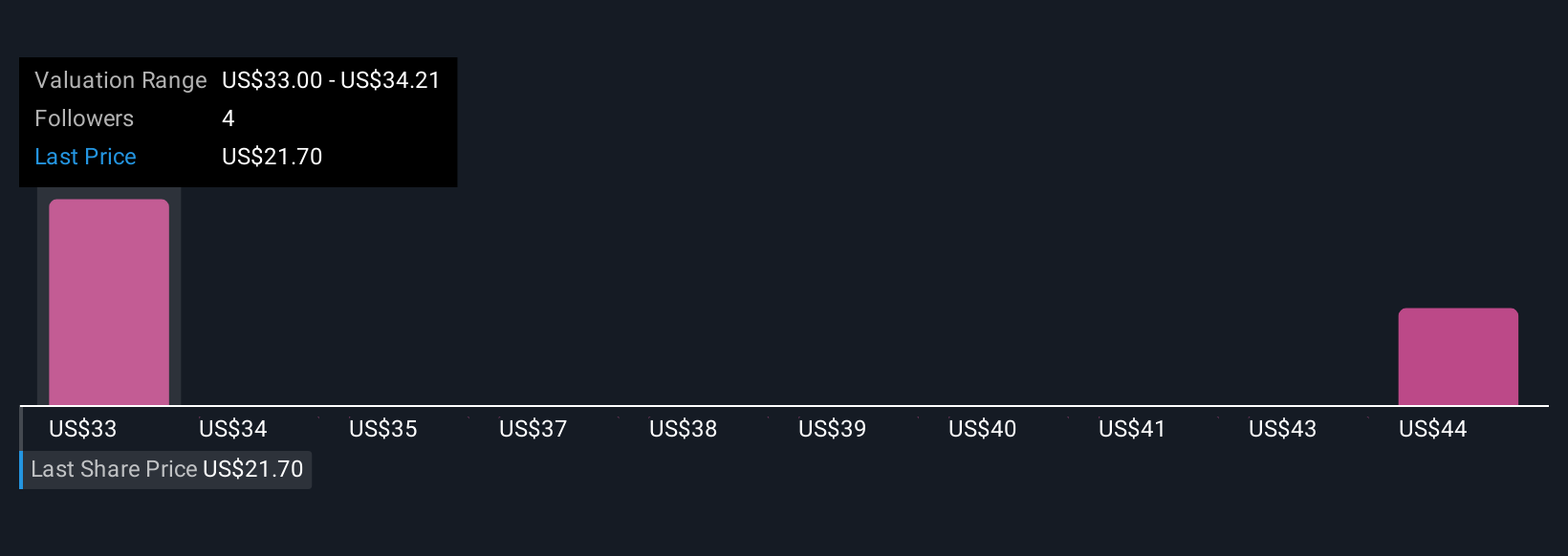

Two fair value estimates from the Simply Wall St Community span roughly US$24.75 to US$31.09 per share, underlining how far opinions can diverge. You should weigh those views against the risk that ongoing volume headwinds and muted small project demand could keep pressure on revenue recovery and overall performance, and explore several alternative viewpoints before deciding how that fits your own expectations.

Explore 2 other fair value estimates on WillScot Holdings - why the stock might be worth as much as 48% more than the current price!

Build Your Own WillScot Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WillScot Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free WillScot Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WillScot Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WillScot Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:WSC

WillScot Holdings

Provides turnkey temporary space solutions in the United States, Canada, and Mexico.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026