- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:VSEC

Will VSE’s (VSEC) Operational Focus Unlock Sustainable Growth in the Aviation Aftermarket?

Reviewed by Sasha Jovanovic

- VSE Corporation recently announced that it will release its third quarter 2025 financial results after the market closed on October 28, 2025, with an investor conference call scheduled the following morning to discuss its performance and key developments.

- This update follows recent industry analysis highlighting VSE’s strong revenue growth, operational improvements, and efficiency gains, which have positioned the company as a growing player in the aviation aftermarket sector.

- With the upcoming financial release and management’s continued focus on operational strength, we'll explore how this scheduled update might influence VSE's current investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

VSE Investment Narrative Recap

To be confident as a VSE shareholder, you need to believe in the company's ongoing transformation as a focused aviation aftermarket provider and its ability to sustain growth through both organic improvements and acquisitions. The announcement of a third quarter earnings release and conference call is unlikely to materially change the short-term catalyst, which remains the successful execution and integration of recent acquisitions, nor does it alter the principal risk of increased exposure to aviation-sector cyclicality following the recent divestiture of its Fleet segment.

Among recent announcements, VSE’s addition to the S&P Aerospace & Defense Select Industry Index stands out as directly relevant. This inclusion aligns with VSE’s growth as a sector specialist and may help build institutional interest, potentially supporting liquidity around earnings events, the very catalyst currently driving attention to its progress and financial discipline.

In contrast, investors should also be mindful of growing revenue concentration from the aviation sector and what this could mean if air travel demand unexpectedly weakens...

Read the full narrative on VSE (it's free!)

VSE's outlook anticipates $1.8 billion in revenue and $142.7 million in earnings by 2028. This scenario assumes a 12.4% annual revenue growth rate and a $78.9 million increase in earnings from the current $63.8 million.

Uncover how VSE's forecasts yield a $183.12 fair value, a 15% upside to its current price.

Exploring Other Perspectives

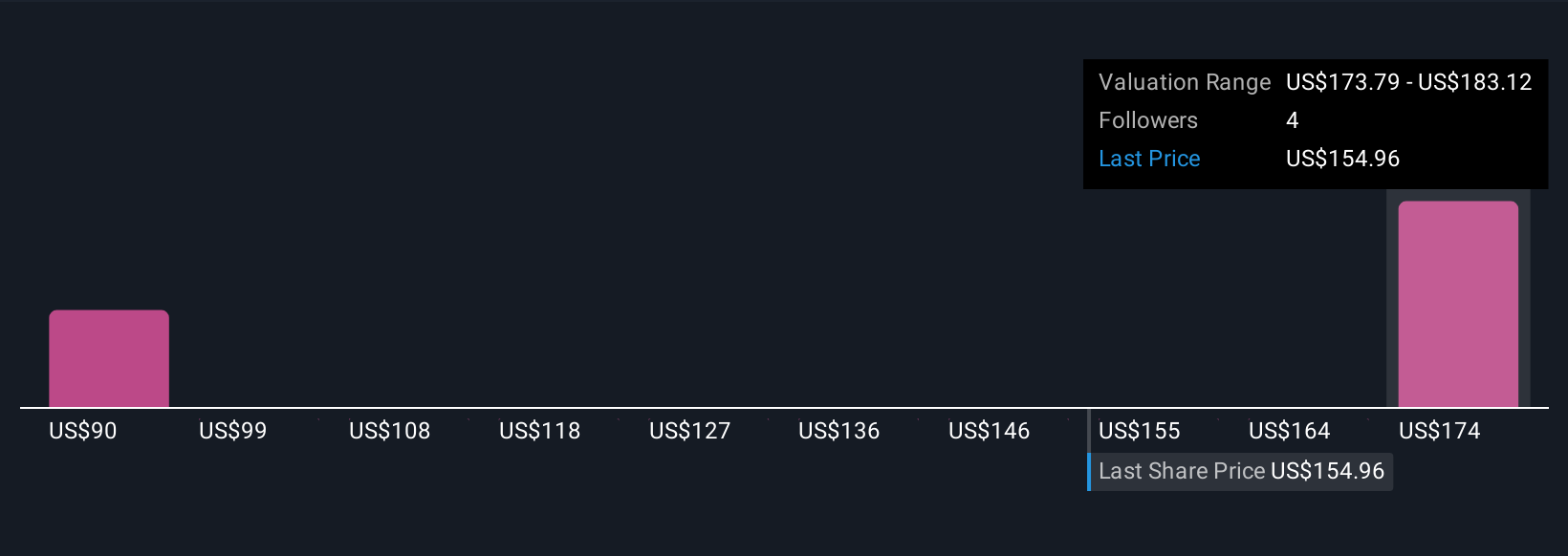

Two members of the Simply Wall St Community provided fair value estimates for VSE ranging from US$90.15 to US$183.12 per share. While outlooks vary widely, broad consensus highlights that recent growth via acquisitions remains central to the company’s perceived strengths and ongoing risks, see how your view fits into the debate.

Explore 2 other fair value estimates on VSE - why the stock might be worth 43% less than the current price!

Build Your Own VSE Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VSE research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free VSE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VSE's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VSEC

VSE

Provides aviation aftermarket parts distribution and maintenance, repair, and overhaul services for air transportation assets for commercial and government markets.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives