- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:VSEC

How VSE’s (VSEC) Addition to the S&P Aerospace and Defense Index Has Changed Its Investment Story

Reviewed by Simply Wall St

- VSE Corporation (NasdaqGS:VSEC) was recently added to the S&P Aerospace & Defense Select Industry Index, highlighting its growing prominence in the aerospace and defense sector.

- This inclusion may enhance VSE's visibility among institutional investors and index-tracking funds, potentially influencing trading activity and long-term investor perception.

- We'll look at how VSE's addition to the S&P index could reinforce its position among institutional investors and broaden its shareholder base.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

VSE Investment Narrative Recap

To be a VSE shareholder, you need to believe that its transformation into a pure-play aviation aftermarket provider will win long-term industry tailwinds, especially as air travel and aging fleets drive recurring demand for parts and MRO services. While VSE's addition to the S&P Aerospace & Defense Select Industry Index boosts visibility and institutional reach, it does not fundamentally change the company's top catalyst: integrating acquisitions and growing aviation aftermarket share. The most immediate risk remains VSE's concentrated exposure to aviation cycles and its sizable acquisition-related debt, rather than short-term trading activity linked to the index addition.

One recent announcement closely connected to the index inclusion is VSE's reaffirmation of its 2025 revenue growth outlook of 35% to 40%, highlighting how acquisitions and operational expansion are already driving meaningful results. This outlook not only underpins current investor optimism but also connects with the exposure and validation brought by joining the S&P index, even as integration and execution risks must be watched.

On the other hand, investors should be particularly mindful of how VSE’s reliance on M&A to drive growth exposes the business to integration and interest expense risk...

Read the full narrative on VSE (it's free!)

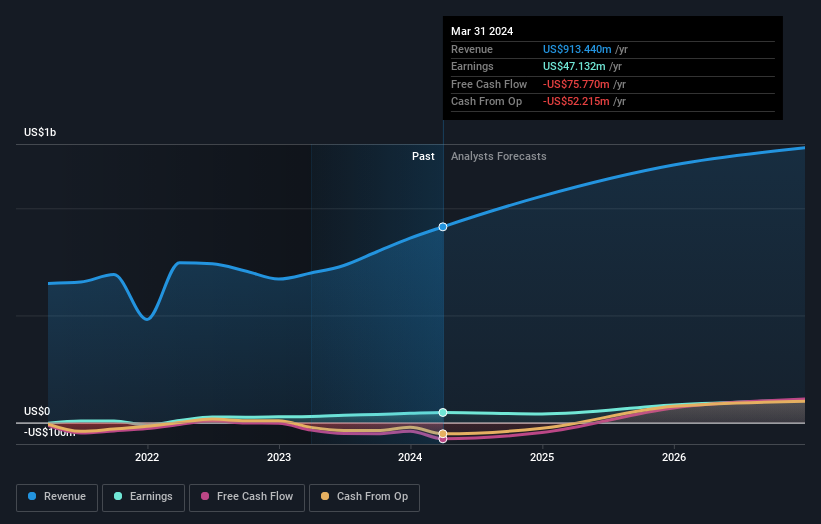

VSE's projections point to $1.8 billion in revenue and $142.7 million in earnings by 2028. This outlook requires 12.4% annual revenue growth and an increase of $78.9 million in earnings from the current $63.8 million.

Uncover how VSE's forecasts yield a $183.12 fair value, a 9% upside to its current price.

Exploring Other Perspectives

According to the Simply Wall St Community, two fair value estimates for VSE range from US$148.88 to US$183.12, showing meaningful variety in personal models. With VSE’s index addition reflecting stronger institutional interest, you can compare multiple views on what really drives the company’s performance here.

Explore 2 other fair value estimates on VSE - why the stock might be worth 11% less than the current price!

Build Your Own VSE Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VSE research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free VSE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VSE's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VSEC

VSE

Provides aviation aftermarket parts distribution and maintenance, repair, and overhaul services for air transportation assets for commercial and government markets.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives