- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:VSEC

Assessing VSE (VSEC) Valuation After a Strong Multi‑Year Run and Recent Share Price Pullback

Reviewed by Simply Wall St

VSE (VSEC) has quietly put together a strong multi year run, and its recent pullback after a steep year to date climb is catching investor attention. Let us unpack what the numbers suggest.

See our latest analysis for VSE.

At around $168.39 per share, VSE has cooled slightly after a big year to date climb, but with a powerful three year total shareholder return of 276.91 percent, the recent pause still looks more like consolidation than fatigue.

If VSE's run has you thinking about what else could be compounding quietly in the background, this is a good moment to explore fast growing stocks with high insider ownership.

With VSE still trading below analyst targets despite strong multi year returns and double digit growth, investors face a key question: is this consolidation phase a fresh buying opportunity, or has the market already priced in the next leg of growth?

Most Popular Narrative: 18.9% Undervalued

With VSE closing at $168.39 versus a narrative fair value near $207.51, the spread reflects ambitious expectations for growth and margin expansion.

The consolidation and integration of acquired businesses is already delivering cost synergies ahead of schedule, enabling margin expansion and increased operational efficiencies, improving adjusted EBITDA margins and enhancing long term earnings stability.

Curious what kind of revenue climb, margin lift, and future earnings power are baked into that upside case? The narrative reveals a surprisingly aggressive profitability roadmap.

Result: Fair Value of $207.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story hinges on smooth deal integration and aviation demand staying robust; any M&A stumble or sector slowdown could quickly challenge that upside case.

Find out about the key risks to this VSE narrative.

Another Lens on Value

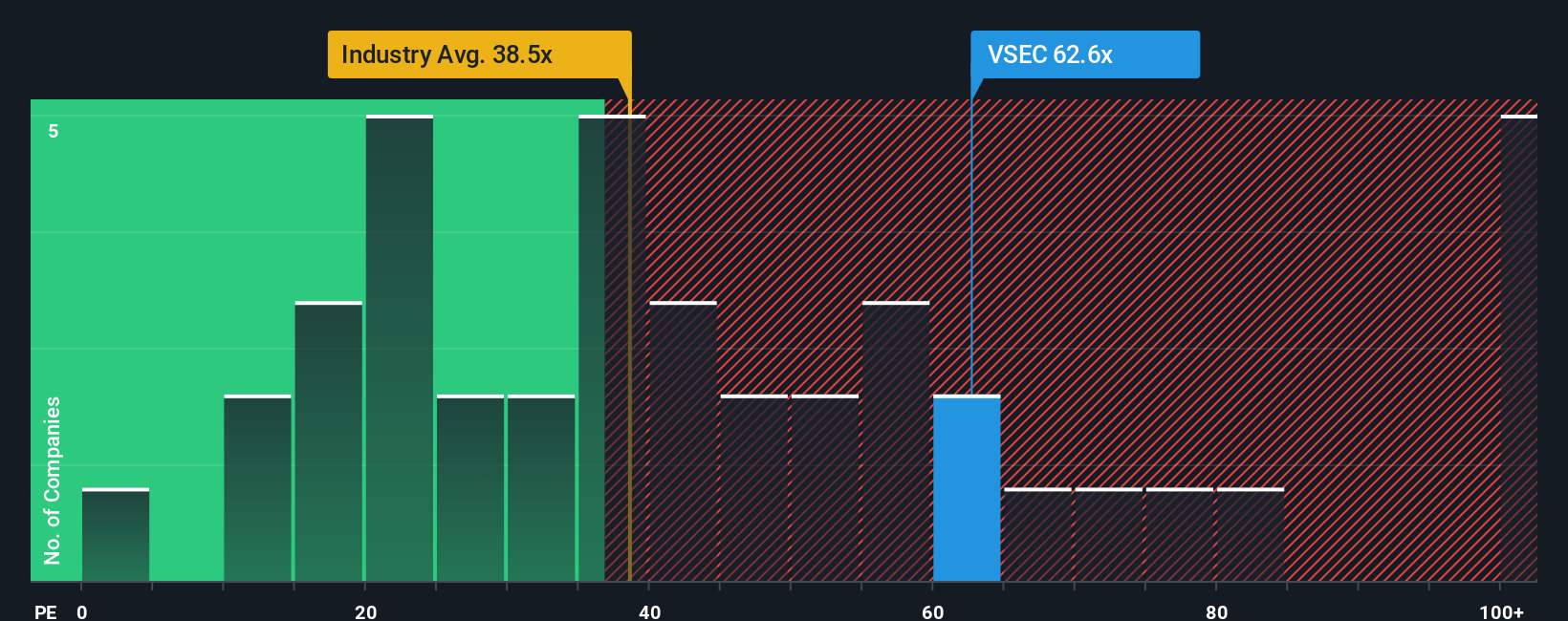

Step away from the optimistic narrative of fair value and VSE suddenly looks stretched. On a price to earnings of about 67 times, it trades well above the US aerospace and defense average near 37.5 times and even above a fair ratio of 40 times, raising clear valuation risk if expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own VSE Narrative

If you see the story differently or simply want to stress test the assumptions yourself, you can build a fresh view in under three minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding VSE.

Ready for more investing opportunities?

Do not stop with a single compelling story. Use the Simply Wall Street Screener to uncover fresh ideas that could reshape your portfolio before others catch on.

- Capitalize on mispriced quality by targeting companies trading below intrinsic value with these 909 undervalued stocks based on cash flows that still show healthy cash flow potential.

- Ride the next wave of innovation by focusing on smaller, fast moving names through these 25 AI penny stocks that could benefit most from accelerating AI adoption.

- Lock in potential income streams by zeroing in on reliable payers using these 13 dividend stocks with yields > 3% and avoid missing mature businesses quietly compounding returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VSEC

VSE

Provides aviation aftermarket parts distribution and maintenance, repair, and overhaul services for air transportation assets for commercial and government markets.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)