- United States

- /

- Electrical

- /

- NasdaqGS:VICR

Pipeline Shortfall and Margin Pressures Could Be a Game Changer for Vicor (VICR)

Reviewed by Sasha Jovanovic

- Recent updates indicate concerns for Vicor, as its sales pipeline points to potential shortfalls in future revenue growth along with a significant drop in operating margin and weakening returns on capital.

- This combination of declining profitability metrics and uncertainty around the company's ability to sustain expected growth levels has drawn increased attention from investors and market observers.

- We'll examine how news of Vicor's weakening sales pipeline and shrinking margins could impact its broader investment narrative and future outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Vicor Investment Narrative Recap

Owning Vicor stock has always hinged on confidence in its ability to capture sustained, high-margin growth from AI, data center, and automotive power markets. The latest news spotlights stress around its sales pipeline and margin contraction, directly affecting near-term optimism; while the main catalyst remains rollout of next-generation products and partnerships, any greater-than-expected slowdown in orders now stands as the primary risk. For shareholders, the clarity of upcoming product ramps and pipeline health takes on new significance.

Among recent announcements, Vicor's partnership with Spirit Electronics stands out, broadening its access to aerospace customers with specialized, radiation-tolerant power modules. Although promising as an incremental growth driver, this development may not offset immediate concerns around the broader sales pipeline, indicating why investors are closely monitoring near-term revenue signals and customer adoption rates before reassessing future prospects.

In contrast, investors should note the risk of order cancellations or further pipeline weakness that could...

Read the full narrative on Vicor (it's free!)

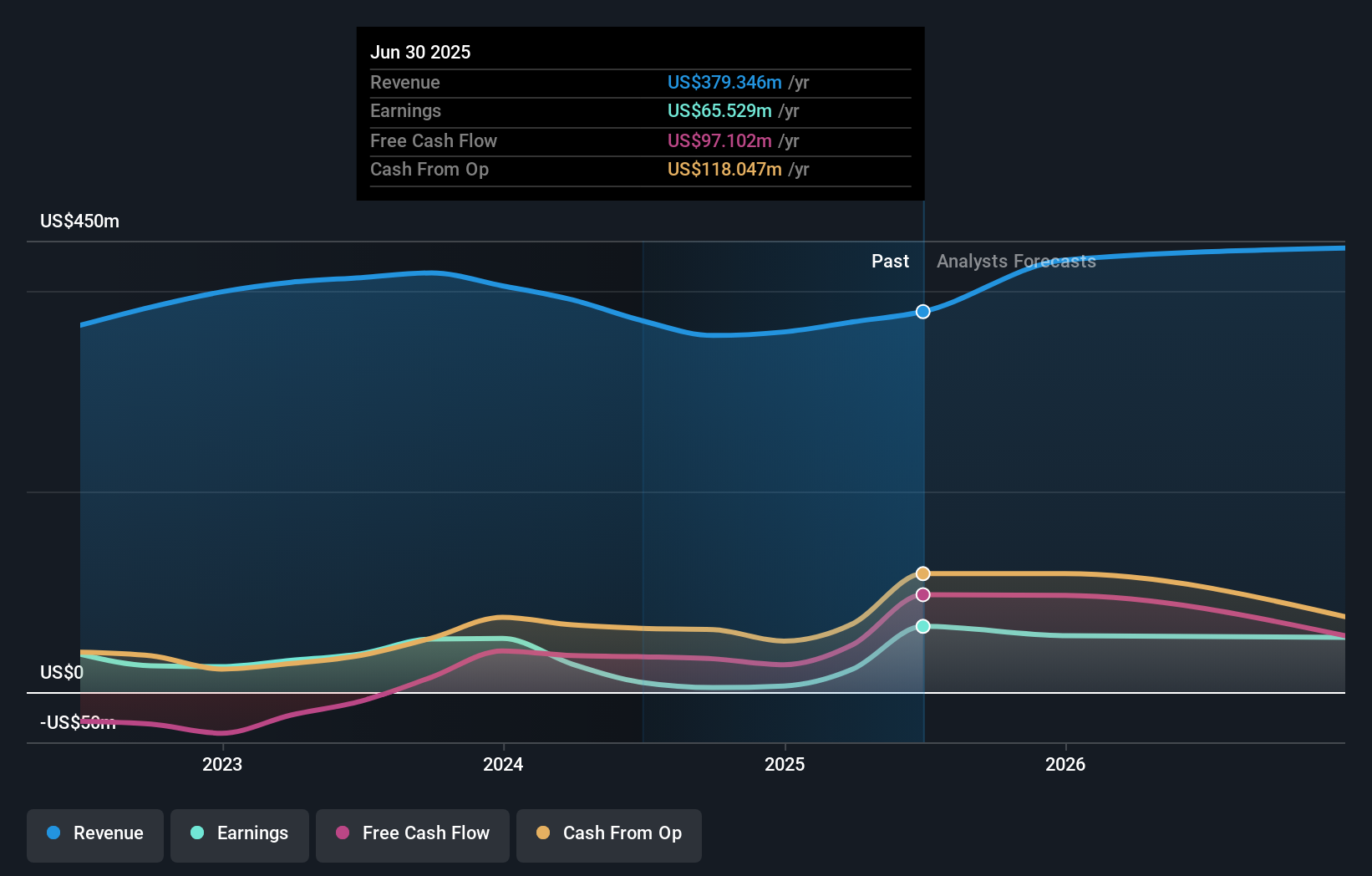

Vicor's outlook projects $523.8 million in revenue and $45.4 million in earnings by 2028. This is based on an expected 11.4% annual revenue growth and a $20.1 million decrease in earnings from the current $65.5 million.

Uncover how Vicor's forecasts yield a $52.50 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$12.18 up to US$52.50, based on just two individual perspectives. While some investors expect significant long-term growth, renewed pipeline uncertainty reminds you that future performance is still up for debate, explore more viewpoints to make an informed decision.

Explore 2 other fair value estimates on Vicor - why the stock might be worth as much as 8% more than the current price!

Build Your Own Vicor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vicor research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Vicor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vicor's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VICR

Vicor

Designs, develops, manufactures, and markets modular power components and power systems for converting electrical power for use in electrically-powered devices.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives