- United States

- /

- Electrical

- /

- NasdaqGS:VICR

Is It Too Late To Consider Vicor After Its 103% 2025 Surge?

Reviewed by Bailey Pemberton

- Wondering if Vicor is still worth chasing after its big run, or if the smart move now is to sit tight and wait for a better entry point? Let us unpack what the market might be pricing in.

- The stock has climbed 1.0% over the last week, 3.7% over the past month, and is up an eye catching 102.8% year to date, after gaining 79.3% over the past year and 83.1% over three years, even though the five year return is a more modest 7.2%.

- Behind these moves, investors have been reacting to Vicor’s positioning in high performance power modules for data centers and AI hardware, where demand expectations have been rising fast. The market has also been digesting updates about its role in next generation computing and infrastructure build outs, which can quickly change how much growth investors are willing to pay for.

- Despite all that excitement, Vicor currently scores just 0/6 on our valuation checks. This means it does not screen as undervalued on any of our standard metrics. Next we will walk through how different valuation approaches view the stock, and then finish with a more nuanced way to think about what “fair value” really means here.

Vicor scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Vicor Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and discounting them back to today, to see what those streams of cash are worth in present dollars.

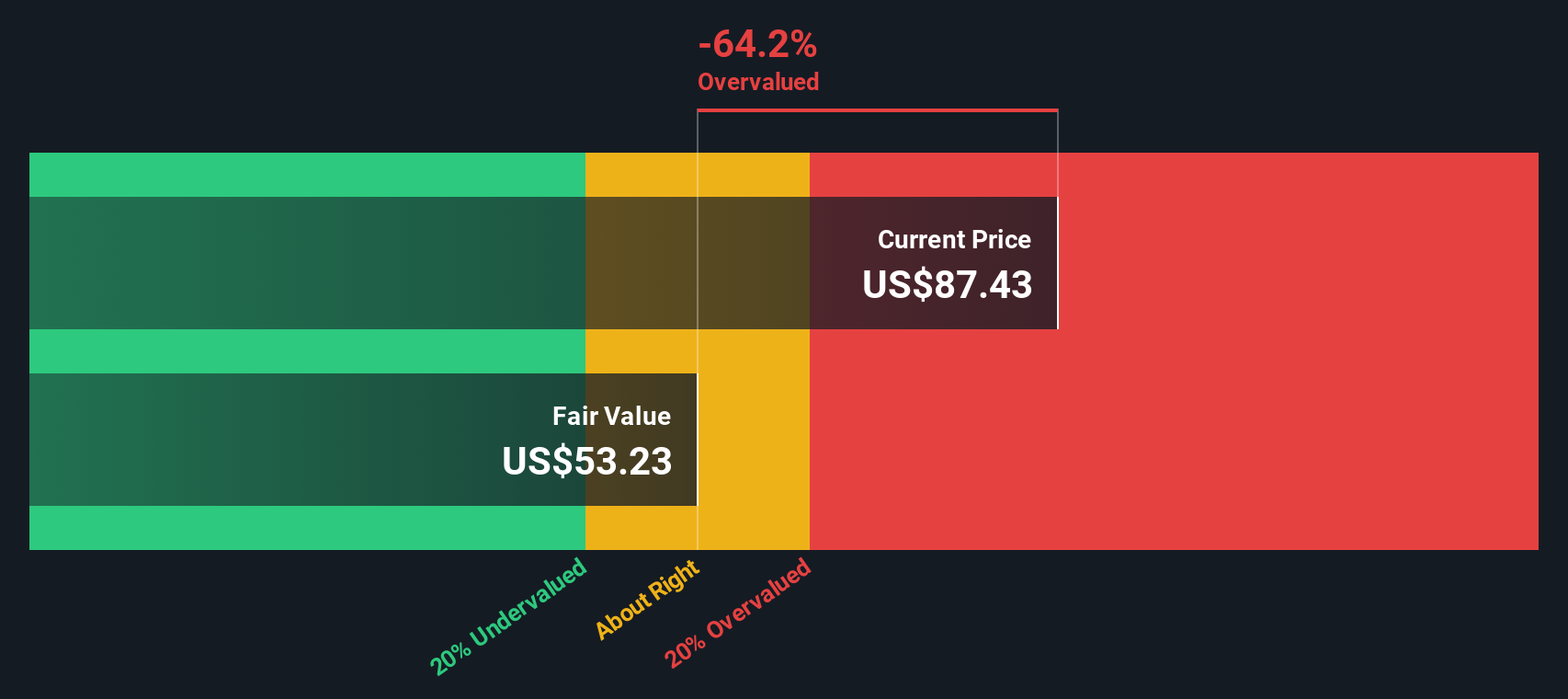

For Vicor, the latest twelve month Free Cash Flow is about $103.2 million, and analysts expect this to grow steadily, reaching around $129.6 million by 2027. Beyond that point, Simply Wall St extrapolates the trajectory out to 2035, with projected Free Cash Flow gradually rising into the $190 million range as growth rates ease over time.

Adding up all those discounted future cash flows produces an estimated intrinsic value of roughly $53.74 per share using this 2 Stage Free Cash Flow to Equity model. Compared with the current market price, the DCF implies the stock is about 82.0% overvalued. This suggests investors are paying far more than the cash flow outlook can justify right now.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Vicor may be overvalued by 82.0%. Discover 901 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Vicor Price vs Earnings

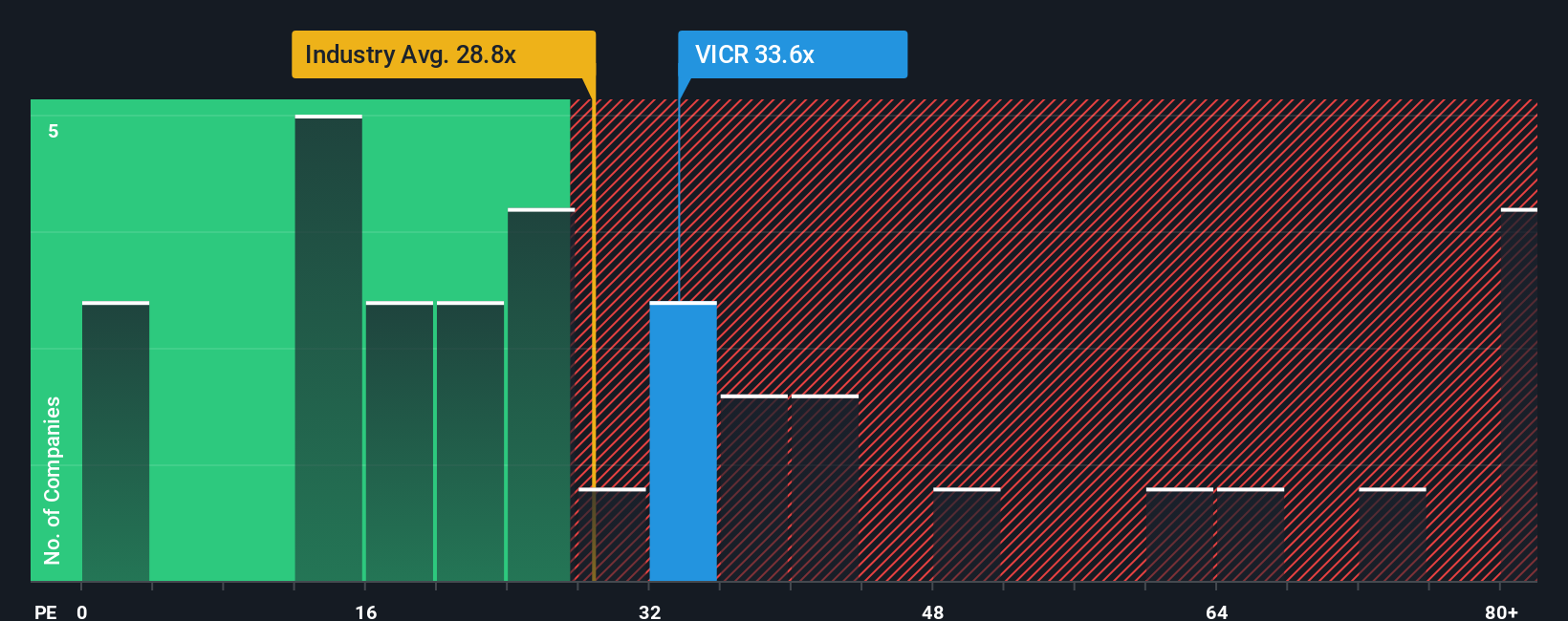

For a profitable business like Vicor, the Price to Earnings ratio is a useful yardstick because it links what investors are paying directly to the profits the company is generating today. In general, faster growing and lower risk companies tend to deserve higher PE ratios, while slower growing or riskier businesses usually trade on lower multiples.

Vicor currently trades on a PE of about 53.1x, which is well above both the Electrical industry average of roughly 31.6x and the broader peer average of around 26.9x. On the surface, that premium suggests investors are already factoring in strong growth and a robust competitive position.

Simply Wall St’s Fair Ratio takes this a step further. Instead of just lining Vicor up against peers, it estimates what a reasonable PE should be after adjusting for the company’s specific earnings growth profile, profit margins, industry, market cap and risk factors. For Vicor, that Fair Ratio is about 32.5x, noticeably below the current 53.1x. That gap indicates the market is likely paying more than the fundamentals justify on this metric alone.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vicor Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that lets you write the story behind your numbers by linking your view of a company’s future revenue, earnings and margins to a financial forecast, a fair value, and a clear buy or sell signal. That fair value is compared to today’s price and then updated dynamically whenever fresh news or earnings arrive. This means two Vicor investors can legitimately disagree, with one Narrative assuming more cautious growth and landing near a fair value around $52.50, while another assumes stronger adoption, resilient margins and a richer future multiple to support a higher fair value closer to $86.70. Yet both are still making disciplined, numbers backed decisions that fit their own expectations and risk tolerance.

Do you think there's more to the story for Vicor? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VICR

Vicor

Designs, develops, manufactures, and markets modular power components and power systems for converting electrical power for use in electrically-powered devices.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)