- United States

- /

- Building

- /

- NasdaqGS:UFPI

UFP Industries (UFPI): Examining Valuation After Recent Share Price Weakness

Reviewed by Kshitija Bhandaru

UFP Industries (UFPI) shares have been steady lately, moving sideways after a tough stretch over the past month. While there is no dramatic headline driving recent activity, investors may be weighing the company's fundamentals against its price action.

See our latest analysis for UFP Industries.

UFPI has seen its share price struggle recently, losing almost 11% over the past month. With the year-to-date return now deep in the red, momentum has clearly faded compared to the strong total returns it delivered over the past five years. Shifting risk appetite in the market may be impacting sentiment, even as the company's longer-term track record remains solid.

If you’re curious about where else strong performance could be found, now is a great chance to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares down notably despite steady revenue and earnings growth, does UFP Industries now trade at a compelling value? Or is the market right to discount the stock’s future prospects accordingly?

Most Popular Narrative: 22.8% Undervalued

With the most followed analyst-driven narrative setting fair value at $118.40, UFP Industries trades well below that benchmark, closing last at $91.35. This gap has investors watching for catalysts that could unlock value as the market resets expectations.

The company's $60 million cost reduction program, restructuring activities (such as consolidating or closing underperforming facilities and exiting less profitable lines), and automation investments are projected to materially lower the cost structure by 2026, driving net margin expansion even if industry conditions remain mixed.

Curious what bold cost-cutting bets and future margin forecasts are baked into this bullish price target? The narrative draws its conclusions from aggressive efficiency improvements and some surprisingly optimistic growth levers. Find out which financial assumptions make up the core of this compelling fair value estimate!

Result: Fair Value of $118.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in U.S. housing or sharper price competition could present challenges for UFP Industries’ margin expansion and stall its planned earnings growth.

Find out about the key risks to this UFP Industries narrative.

Another View: What Does the SWS DCF Model Say?

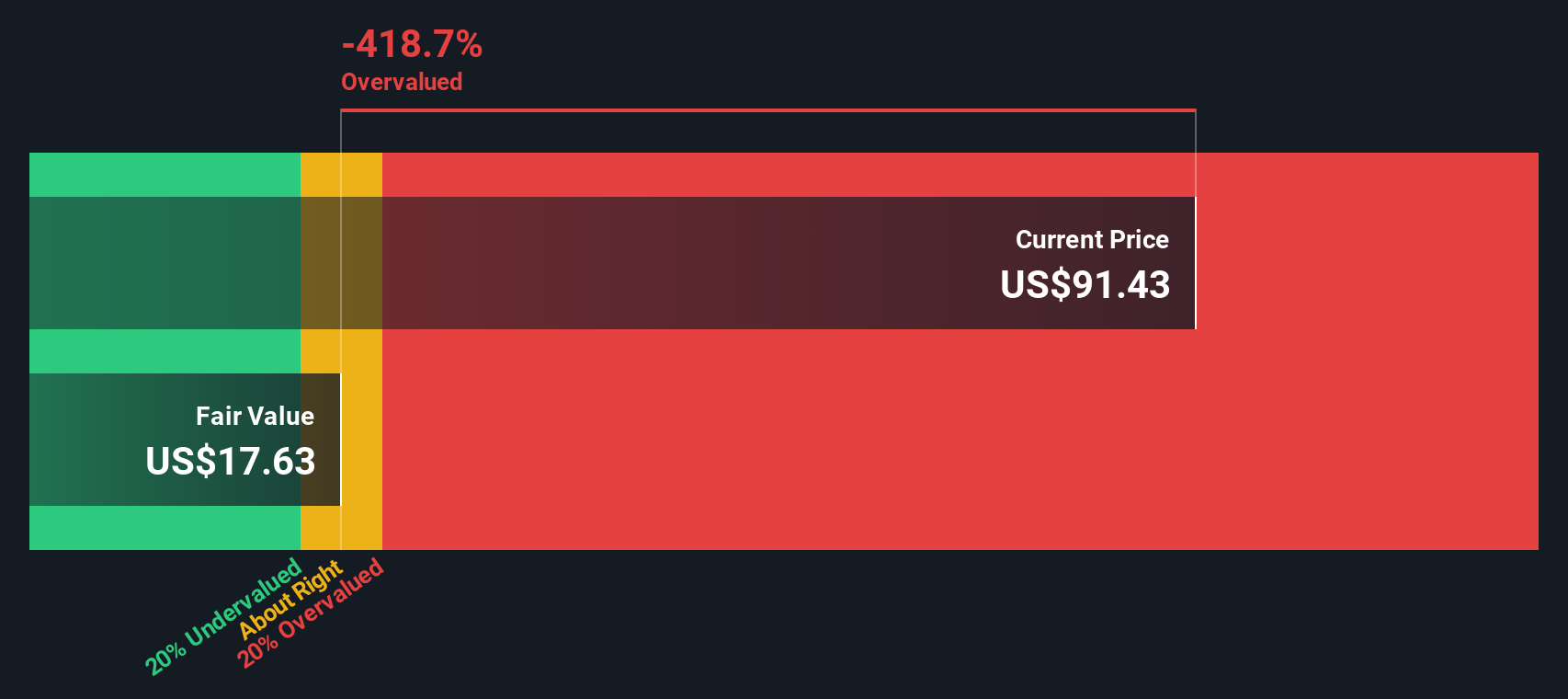

While analysts see UFP Industries as undervalued based on expected earnings growth and price targets, our DCF model suggests a very different story. Using conservative cash flow projections, the SWS DCF model estimates fair value at just $17.63 per share, which is far below current prices. This stark difference highlights how sensitive valuation can be to assumptions about future growth and required returns. Which approach holds up in reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out UFP Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own UFP Industries Narrative

If you have your own take on UFPI's story or want to analyze the numbers in a different way, you can craft a narrative of your own in just a few minutes, then Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding UFP Industries.

Looking for more investment ideas?

Set yourself up for smarter moves by tapping into fresh growth stories and hidden value. Don’t miss your chance to discover stocks you might wish you’d spotted sooner.

- Unlock growth potential and seize opportunities in tech by starting with these 25 AI penny stocks. These companies are transforming industries with innovation and competitive edge.

- Maximize your income with these 19 dividend stocks with yields > 3%, which offers yields above 3%, and put your portfolio on a firmer financial footing.

- Capitalize early on future market leaders by scanning these 3574 penny stocks with strong financials. These stocks feature strong financials and breakthrough potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UFPI

UFP Industries

Designs, manufactures, and supplies wood and non-wood composites, and other materials in the United States and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives