- United States

- /

- Machinery

- /

- NasdaqCM:TAYD

Taylor Devices, Inc. (NASDAQ:TAYD) Stock Rockets 26% But Many Are Still Ignoring The Company

Taylor Devices, Inc. (NASDAQ:TAYD) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The last month tops off a massive increase of 155% in the last year.

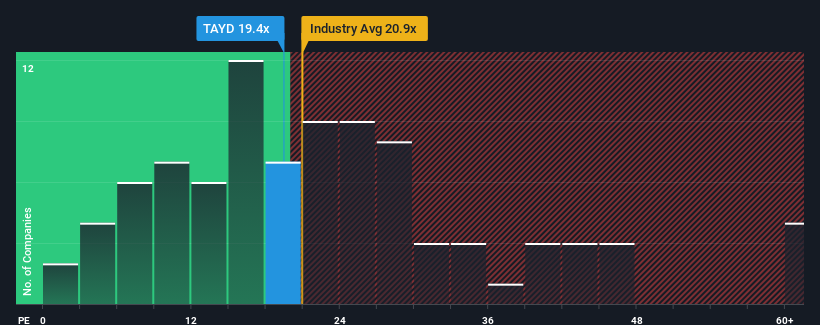

In spite of the firm bounce in price, it's still not a stretch to say that Taylor Devices' price-to-earnings (or "P/E") ratio of 19.4x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 18x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been quite advantageous for Taylor Devices as its earnings have been rising very briskly. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Taylor Devices

How Is Taylor Devices' Growth Trending?

In order to justify its P/E ratio, Taylor Devices would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 50%. Pleasingly, EPS has also lifted 848% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 15% shows it's noticeably more attractive on an annualised basis.

In light of this, it's curious that Taylor Devices' P/E sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Taylor Devices' P/E

Taylor Devices' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Taylor Devices currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Taylor Devices with six simple checks.

You might be able to find a better investment than Taylor Devices. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Taylor Devices might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:TAYD

Taylor Devices

Designs, develops, manufactures, and markets shock absorption, rate control, and energy storage devices for use in machinery, equipment, and structures in the United States, Asia, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives