- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:TATT

The Bull Case For TAT Technologies (TATT) Could Change Following Launch of FutureWorks Center and First Major Partnership

Reviewed by Simply Wall St

- Earlier this month, TAT Technologies announced the opening of FutureWorks, its new Center for Aerospace Innovation in Charlotte, North Carolina, focused on the research, testing, and development of next-generation thermal management solutions for both current and future aircraft platforms.

- This move comes as TAT secured its first customer partnership for its advanced thermal management systems, highlighting tangible industry demand for its lightweight, high-efficiency aerospace technologies and underscoring its commitment to sustainable aviation growth.

- We'll assess how the FutureWorks launch and its first partnership could reshape TAT Technologies' investment outlook and growth trajectory.

Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

TAT Technologies Investment Narrative Recap

Owning shares of TAT Technologies means believing in the accelerating need for cutting-edge, efficient aerospace solutions as the aviation industry shifts toward advanced and more sustainable platforms. The unveiling of FutureWorks and a new customer partnership bolster TAT’s first-mover advantage in next-gen thermal management, a possible near-term catalyst, yet the company’s ongoing reliance on discretionary MRO work leaves it exposed to fluctuations in airline maintenance demand, a risk that this news does not immediately mitigate.

Among TAT Technologies’ recent announcements, the five-year global fleet support agreement stands out, providing recurring revenue and underpinning short-term financial stability even as the company pushes into uncharted innovation space with FutureWorks. This balance between stable MRO contracts and future-focused development remains key in assessing near-term momentum versus longer-term uncertainties.

By contrast, it’s just as important for investors to be aware of how continuing exposure to airline maintenance cycles could...

Read the full narrative on TAT Technologies (it's free!)

TAT Technologies' outlook anticipates $270.2 million in revenue and $37.8 million in earnings by 2028. This projection requires 17.5% annual revenue growth and a $24.1 million increase in earnings from the current $13.7 million.

Uncover how TAT Technologies' forecasts yield a $37.75 fair value, a 6% upside to its current price.

Exploring Other Perspectives

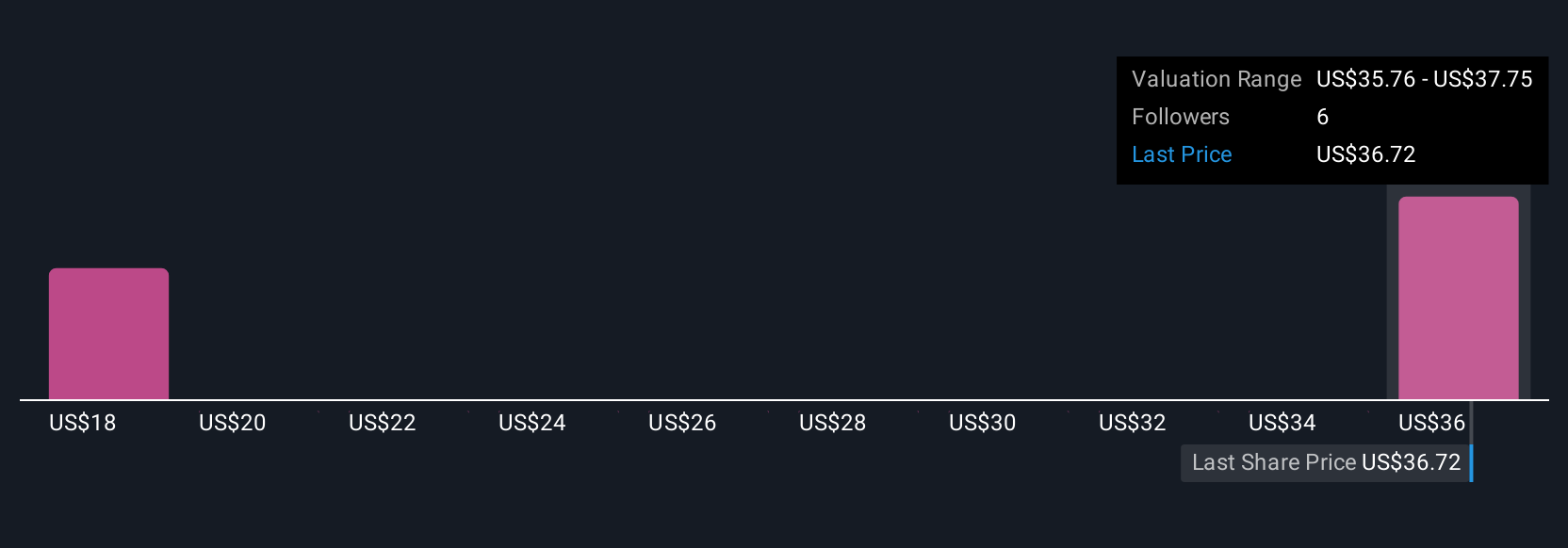

Three community-sourced fair value estimates for TAT Technologies span from US$17.86 to US$37.75, reflecting a range of retail perspectives on future growth. While these views differ widely, recurring revenue from major MRO contracts may help buffer risks from variability in global airline activity, prompting you to consider several interpretations of the company’s prospects.

Explore 3 other fair value estimates on TAT Technologies - why the stock might be worth as much as 6% more than the current price!

Build Your Own TAT Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TAT Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TAT Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TAT Technologies' overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TAT Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TATT

TAT Technologies

Provides solutions and services to the commercial and military aerospace and ground defense industries in the United States, Israel, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)