- United States

- /

- Machinery

- /

- NasdaqGM:SYM

Evaluating Symbotic (SYM): Is Growth in Warehouse Automation Already Priced Into Its Valuation?

Reviewed by Simply Wall St

Symbotic (SYM) is generating buzz thanks to increased demand for warehouse automation as artificial intelligence makes these solutions more efficient. The company’s major backlog and recent deals, including agreements with Walmart, have driven fresh investor attention.

See our latest analysis for Symbotic.

Momentum remains strong for Symbotic, with a 182.8% year-to-date share price gain and three-year total shareholder returns over 436%. Recent enhancements to its robotics platform and ongoing Walmart agreements continue to fuel bullish sentiment, even as some insider selling has occurred.

If you’re interested in spotting other companies combining innovation and growth, the next logical step is to discover See the full list for free.

With shares soaring and optimism running high, the key question is whether Symbotic’s current valuation still leaves room for further upside, or if markets have already accounted for all that future growth potential.

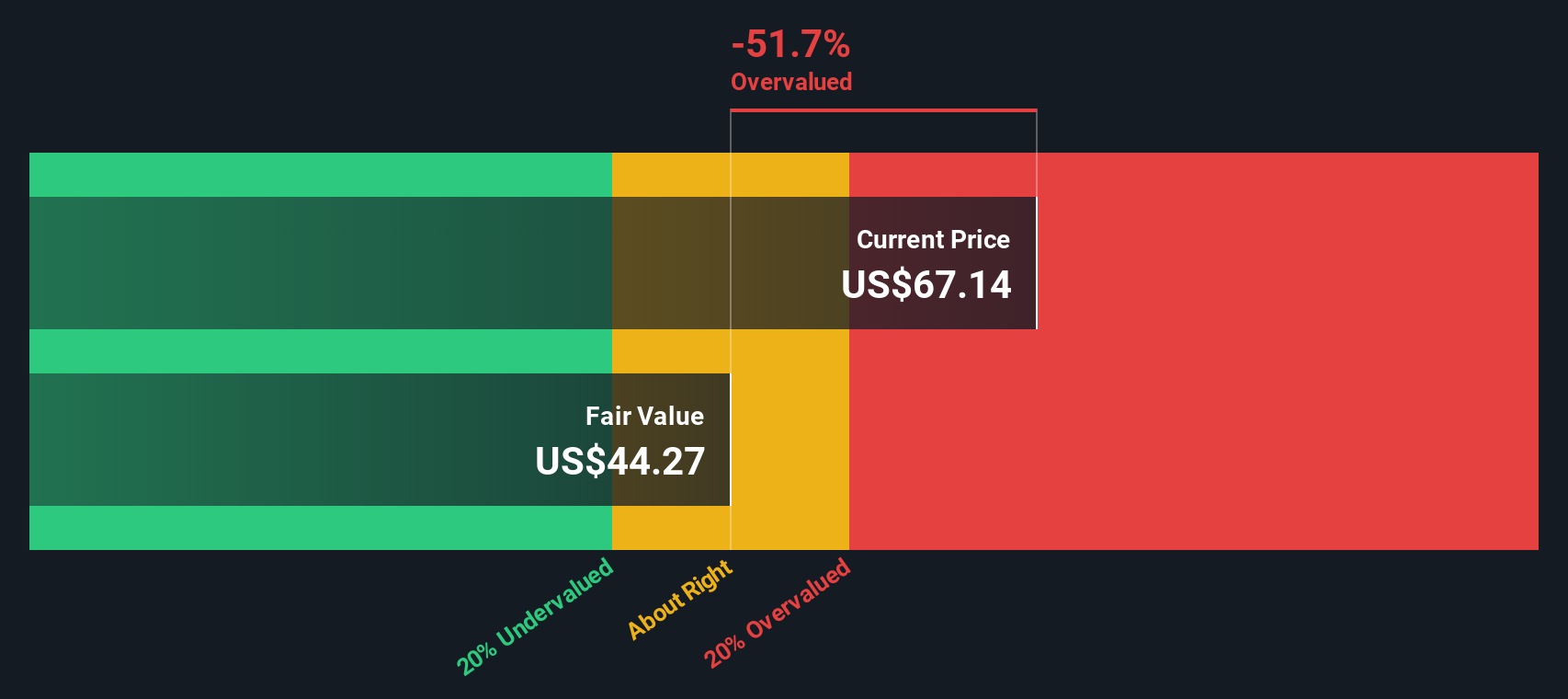

Most Popular Narrative: 37.5% Overvalued

Symbotic’s narrative fair value stands at $50.82 per share, while the last close was $69.89. This sharp difference highlights tension regarding future growth assumptions and sets up a crucial debate about the path ahead.

Continuous innovation in proprietary robotics and AI-powered automation, such as the new storage structure and increased bot capabilities, is enabling Symbotic to command premium pricing and realize higher gross and net margins as systems become faster to deploy and less costly to operate. Increasing software and service revenue, with software maintenance gross margins exceeding 70% and more than doubling year-over-year, demonstrates significant operating leverage and margin expansion. This positions Symbotic for greater profitability as its installed base scales.

Curious about the bold financial blueprint that justifies this valuation? The narrative’s future profit margins and ambitious growth projections may surprise you. Uncover which numbers drive this ambitious target and why analysts are so divided.

Result: Fair Value of $50.82 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in deployment growth or delayed customer projects could quickly shift sentiment and raise doubts about Symbotic’s ambitious valuation targets.

Find out about the key risks to this Symbotic narrative.

Another View: DCF Suggests Undervaluation

While the narrative-based fair value points to overvaluation, our DCF model paints a different picture. According to this cash flow analysis, Symbotic is actually trading slightly below its fair value. This indicates there could be some hidden upside the market is overlooking. Which side of the valuation debate holds up under scrutiny?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Symbotic for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Symbotic Narrative

If you have a different perspective or want to dig into the numbers yourself, you can build your own narrative in just a few minutes. Do it your way

A great starting point for your Symbotic research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why stop at Symbotic? Seize your edge with unique opportunities in the market. Acting now can position you ahead of others. Use these targeted ideas to inform your next smart move.

- Uncover new income streams by leveraging these 17 dividend stocks with yields > 3% to reveal companies offering eye-catching yields and robust payout histories.

- Capitalize on AI innovation by reviewing these 24 AI penny stocks focused on advances in automation, data analysis, and emerging technology.

- Benefit from deep value opportunities by tracking these 879 undervalued stocks based on cash flows with strong fundamentals that still trade below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SYM

Symbotic

An automation technology company, develops technologies to enhance operating efficiencies in modern warehouses.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)