- United States

- /

- Construction

- /

- NasdaqGS:STRL

Sterling Infrastructure (STRL): Valuation Check After Analyst Support and Expanding Data Center Megaproject Pipeline

Reviewed by Simply Wall St

Sterling Infrastructure (STRL) is back on investors radar after multiple research firms reaffirmed their positive stance, pointing to its data center strength, steady revenue gains, and expanding backlog across several high demand infrastructure end markets.

See our latest analysis for Sterling Infrastructure.

Despite a sharp 1 day share price pullback of 7.45% to about $315, the year to date share price return of 87.89% and a 3 year total shareholder return above 900% suggest momentum is still very much intact as investors price in Sterling Infrastructure’s data center and megaproject pipeline story.

If Sterling’s surge has you thinking about what else might be riding similar long term trends, it could be worth scouting fast growing stocks with high insider ownership as potential next candidates for your watchlist.

With the stock already up sharply, yet still trading at a sizeable discount to analyst targets and supported by visible megaproject demand, is Sterling Infrastructure a fresh buying opportunity, or is the market already pricing in years of future growth?

Most Popular Narrative: 30.5% Undervalued

With Sterling Infrastructure last closing at $315.15 against a narrative fair value near $453, the gap implies investors are still heavily discounting its projected earning power despite robust execution so far.

The analysts have a consensus price target of $313.0 for Sterling Infrastructure based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $355.0, and the most bearish reporting a price target of $254.0.

Want to see why this fair value is so far ahead of today’s price? The narrative leans on resilient growth, firm margins, and a punchy future earnings multiple. Curious how those ingredients combine into that ambitious target? Dive in to unpack the full playbook behind this valuation.

Result: Fair Value of $453.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat scenario still faces pressure from potential data center capex slowdowns, as well as expiring infrastructure stimulus that could curb backlog growth and margins.

Find out about the key risks to this Sterling Infrastructure narrative.

Another Lens on Value

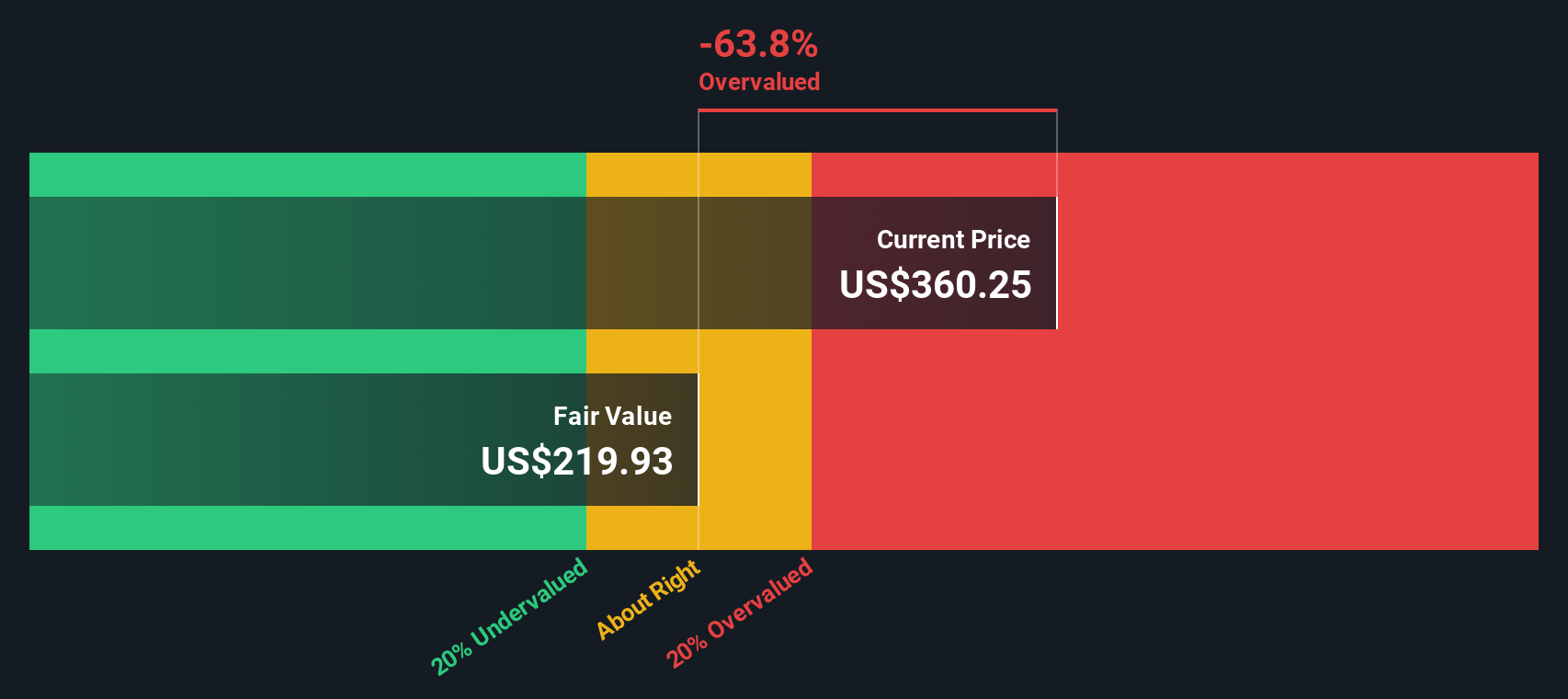

Our SWS DCF model paints a cooler picture than the upbeat narrative, suggesting Sterling is trading roughly in line with intrinsic value rather than at a deep discount. If cash flow assumptions are closer to reality than headline multiples, could upside from here be more limited than it looks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sterling Infrastructure for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sterling Infrastructure Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft a complete view in minutes, Do it your way.

A great starting point for your Sterling Infrastructure research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you may wish to use the Simply Wall Street Screener to identify focused opportunities that match your strategy today.

- Target companies with stronger cash generation by scanning these 13 dividend stocks with yields > 3% that can potentially support your portfolio’s income stream while still allowing for capital appreciation.

- Explore long term disruption by examining these 26 AI penny stocks that are involved in automation, data analytics, and intelligent software.

- Prepare for possible value rotations by filtering for these 908 undervalued stocks based on cash flows that the market may not have fully recognized.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STRL

Sterling Infrastructure

Engages in the provision of e-infrastructure, transportation, and building solutions in the United States.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)