- United States

- /

- Construction

- /

- NasdaqGS:STRL

Sterling Infrastructure (STRL): Is the Stock’s Rapid Growth Still Undervalued?

Reviewed by Kshitija Bhandaru

See our latest analysis for Sterling Infrastructure.

Sterling Infrastructure’s recent share price pullback has not slowed its spectacular momentum, with a 30-day share price return of 7.4% and a year-to-date gain of nearly 101%. Over the longer term, its 1-year total shareholder return stands at 114% while the 3- and 5-year figures remain off the charts, highlighting firm growth that continues to capture the market’s attention.

If Sterling’s performance is making you rethink your watchlist, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

After such a remarkable climb, many are asking whether Sterling Infrastructure’s current valuation understates its ongoing growth story or if the market has already factored in all the good news, leaving little room for a bargain.

Most Popular Narrative: 5% Undervalued

Sterling Infrastructure’s widely followed narrative pegs its fair value above the last close, signaling that upbeat assumptions are driving analyst models. With the current price trading below the consensus target, attention is shifting to what underpins these bullish forecasts.

Record-high and growing backlog, particularly in E-Infrastructure Solutions (up 44% year-over-year to $1.2 billion), coupled with a robust pipeline of future phase work approaching $2 billion, provides strong multi-year revenue visibility and stability, mitigating downside risk to revenues and supporting sustained earnings growth.

Curious what stands behind this optimistic price tag? The linchpin of the thesis is a powerful combination of outsized project momentum and ambitious profit expectations. What is the secret mix of earnings and revenue growth that sets this narrative apart? You’ll have to dig deeper to discover the bold financial forecasts and the eyebrow-raising multiple at play.

Result: Fair Value of $355 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, any slowdown in data center demand or delays in critical mega-projects could quickly challenge the high-growth story of Sterling Infrastructure.

Find out about the key risks to this Sterling Infrastructure narrative.

Another View: SWS DCF Model Suggests a Different Story

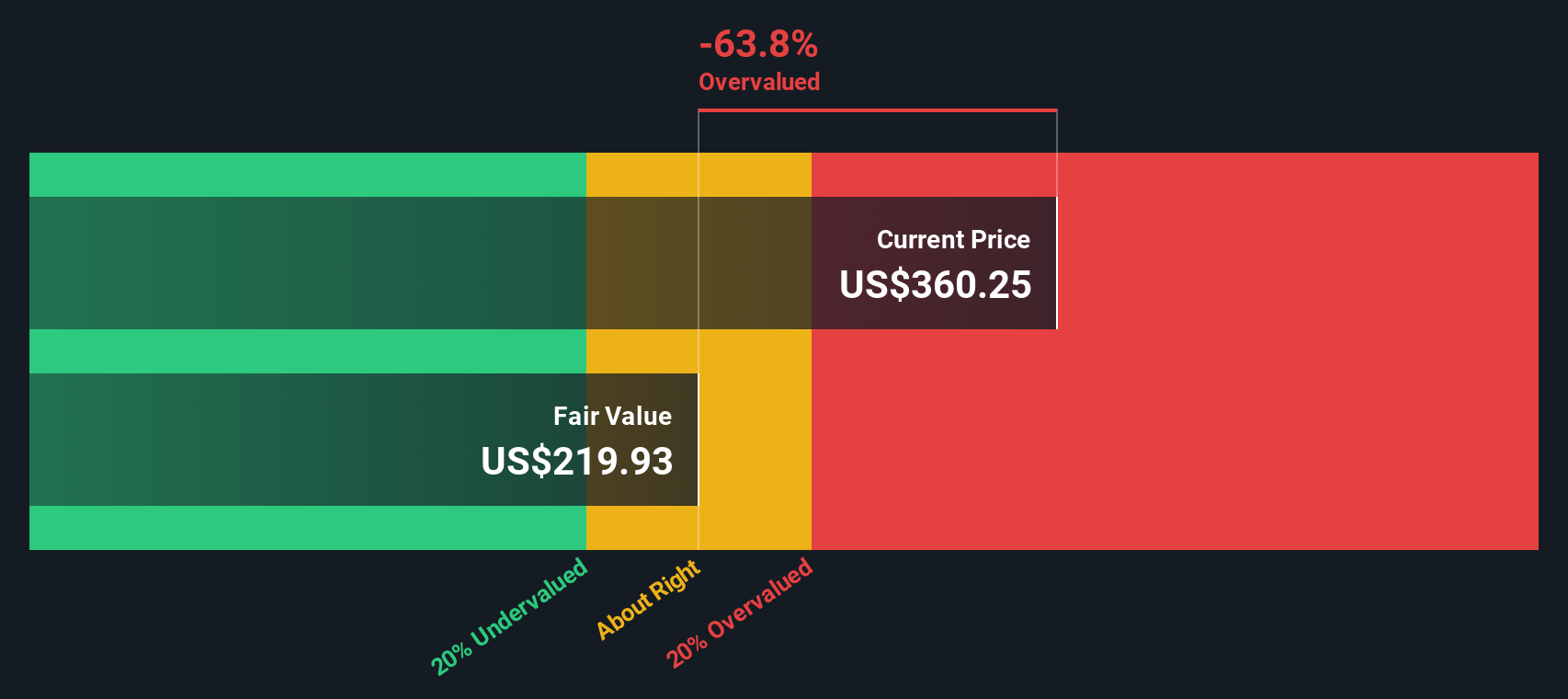

While analysts' targets point to undervaluation, our DCF model paints a less optimistic picture. According to the SWS DCF model, Sterling Infrastructure is actually trading above its estimate of fair value. This suggests the stock could be overvalued based on long-term cash flows. Does this mean the market is getting ahead of itself, or is there something the model is missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sterling Infrastructure for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sterling Infrastructure Narrative

If you have a different perspective or prefer hands-on analysis, you can dive into the numbers and craft your own take in just a few minutes, then Do it your way

A great starting point for your Sterling Infrastructure research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by. Level up your search with fresh stock picks tailored to fit today’s fast-moving markets. Here are three proven routes to uncovering your next big winner:

- Tap into high potential returns by starting with these 892 undervalued stocks based on cash flows for companies that trade below their intrinsic value and may offer room for growth.

- Capture the pulse of tomorrow’s technology by checking out these 24 AI penny stocks leading the charge in artificial intelligence innovation and rapid sector expansion.

- Lock in passive income potential when you scan these 19 dividend stocks with yields > 3% for established businesses consistently offering attractive dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STRL

Sterling Infrastructure

Engages in the provision of e-infrastructure, transportation, and building solutions in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives