- United States

- /

- Electrical

- /

- NasdaqGM:SHLS

Shoals Technologies Group (SHLS): Evaluating Valuation After Upward 2025 Guidance and Expansion Into New Markets

Reviewed by Kshitija Bhandaru

Shoals Technologies Group (SHLS) has made waves after raising its 2025 revenue guidance, thanks in part to steady growth across core business segments and a healthy pipeline of new contracts. In addition, the company is exploring expansion into the Battery Energy Storage Systems market and seeing potential opportunities in data center recombiners.

See our latest analysis for Shoals Technologies Group.

Shoals Technologies Group’s latest upward guidance and sector expansions have certainly helped momentum build. The company’s 35% one-month share price return stands out, and total shareholder return for the last year is up an impressive 75%. Still, the longer-term three-year total shareholder return remains deep in negative territory. This makes the recent excitement feel more like a turnaround story than a new trend.

If Shoals’ rapid rebound has you rethinking what’s possible in this part of the market, now could be an ideal moment to broaden your perspective and discover fast growing stocks with high insider ownership

With shares surging and new markets on the horizon, is Shoals Technologies Group now trading at an attractive discount, or has Wall Street already priced in every bit of future growth potential?

Most Popular Narrative: 16.6% Overvalued

The most widely followed narrative points to Shoals Technologies Group’s fair value estimate of $7.72 per share, which stands below the recent close at $9. The current price surpasses the fair value, highlighting debate over whether strong operational improvements are enough to justify the stock’s surge.

“Shoals is actively expanding its product suite into fast-growing adjacent markets, such as battery energy storage systems (BESS) and international solar projects. This positions the company to capture new revenue streams and reduce dependency on U.S. policy, which is expected to support top-line growth and diversification.”

Want to break down what’s fueling that price gap? This narrative claims Shoals is on the edge of a growth transformation, hinting at ambitious margin targets and future earnings jumps. Want to know why analysts believe a major sector shift could change the narrative for this stock? Click through to see if these bold forward-looking assumptions stack up against market realities.

Result: Fair Value of $7.72 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin compression and elevated legal costs could quickly erode Shoals’ profitability. This raises fresh doubts about the strength of its turnaround.

Find out about the key risks to this Shoals Technologies Group narrative.

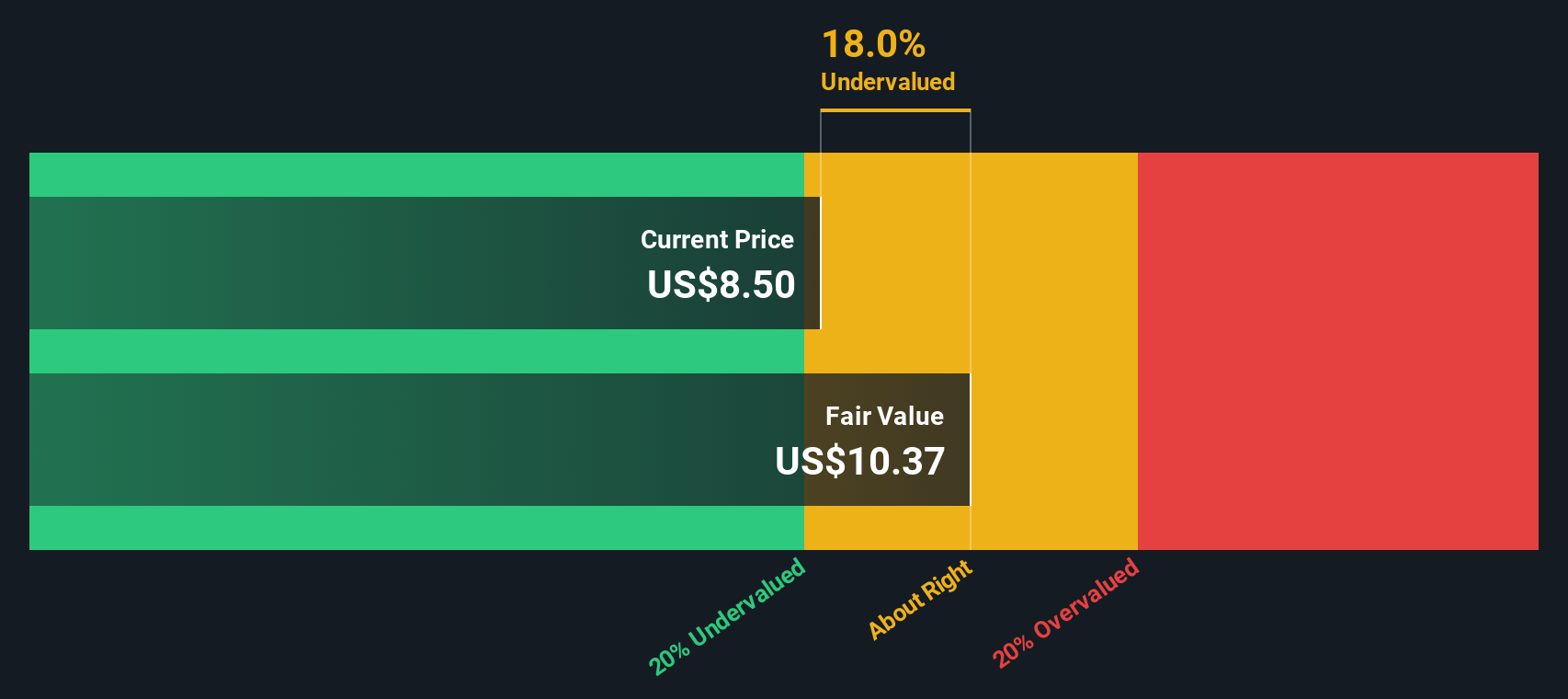

Another View: Discounted Cash Flow Suggests Undervalued

While the most popular narrative deems Shoals Technologies Group overvalued, our DCF model reaches a different conclusion. It estimates the shares are trading about 13% below their fair value. Could this mean the market is misjudging the company’s future cash flows, or is the discount justified?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Shoals Technologies Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Shoals Technologies Group Narrative

If you have a different perspective, or want to see how your own research stacks up, creating your own view is quick and straightforward in just a few minutes. So why not Do it your way?

A great starting point for your Shoals Technologies Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Every savvy investor knows success means keeping your options open. Give yourself a real edge by using expert tools that spotlight dynamic markets leading today's growth.

- Build consistent long-term income streams and tap into higher yields with these 18 dividend stocks with yields > 3% offering attractive payout potentials today.

- Ride the AI boom and uncover trailblazing businesses at the forefront by checking out these 25 AI penny stocks before the crowd spots them.

- Position yourself for growth by finding undervalued companies using these 897 undervalued stocks based on cash flows that may have been overlooked by the mainstream market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SHLS

Shoals Technologies Group

Provides electrical balance of system (EBOS) solutions and components in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives