- United States

- /

- Electrical

- /

- NasdaqGM:SHLS

How Shoals Technologies Group's (SHLS) Raised 2025 Revenue Guidance and Energy Storage Push May Shift Investor Focus

Reviewed by Sasha Jovanovic

- Shoals Technologies Group announced it will release its third quarter 2025 financial results on November 4, 2025, before the market opens, with a conference call to follow at 8:00 a.m. Eastern Time and a webcast available on its Investor Relations website.

- Shoals has raised its 2025 revenue guidance to US$461.6 million, pointing to a robust backlog, expansion into fast-growing sectors like battery energy storage, and a competitive advantage due to its predominantly US-based supply chain amid industry tariffs.

- We will now explore how Shoals' higher revenue outlook and diversification into energy storage may reshape the company's investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Shoals Technologies Group Investment Narrative Recap

To have confidence as a Shoals Technologies Group shareholder, an investor needs to believe in the company’s ability to convert a strong industry tailwind, growing clean power demand and renewables infrastructure, into sustained, profitable growth. The recently raised 2025 revenue guidance reflects Shoals’ exposure to high-growth sectors like battery energy storage, which could support its short-term growth catalyst, but does not meaningfully offset the biggest current risk: margin pressure from competitive pricing and elevated legal and warranty costs.

One relevant announcement is Shoals’ expanded 2025 revenue outlook to US$461.6 million, citing a robust backlog and new market wins. This move reinforces management’s focus on order momentum and end-market diversification, which ties directly to growth catalysts but does not materially change ongoing concerns about profitability and cash flow in the face of legal challenges and lower-margin revenue mix.

However, investors should be aware that, despite strong top-line ambitions, cash flows may remain under pressure due to continued legal and warranty remediation expenses…

Read the full narrative on Shoals Technologies Group (it's free!)

Shoals Technologies Group's narrative projects $589.7 million in revenue and $80.2 million in earnings by 2028. This requires 13.8% yearly revenue growth and a $59.1 million increase in earnings from the current $21.1 million.

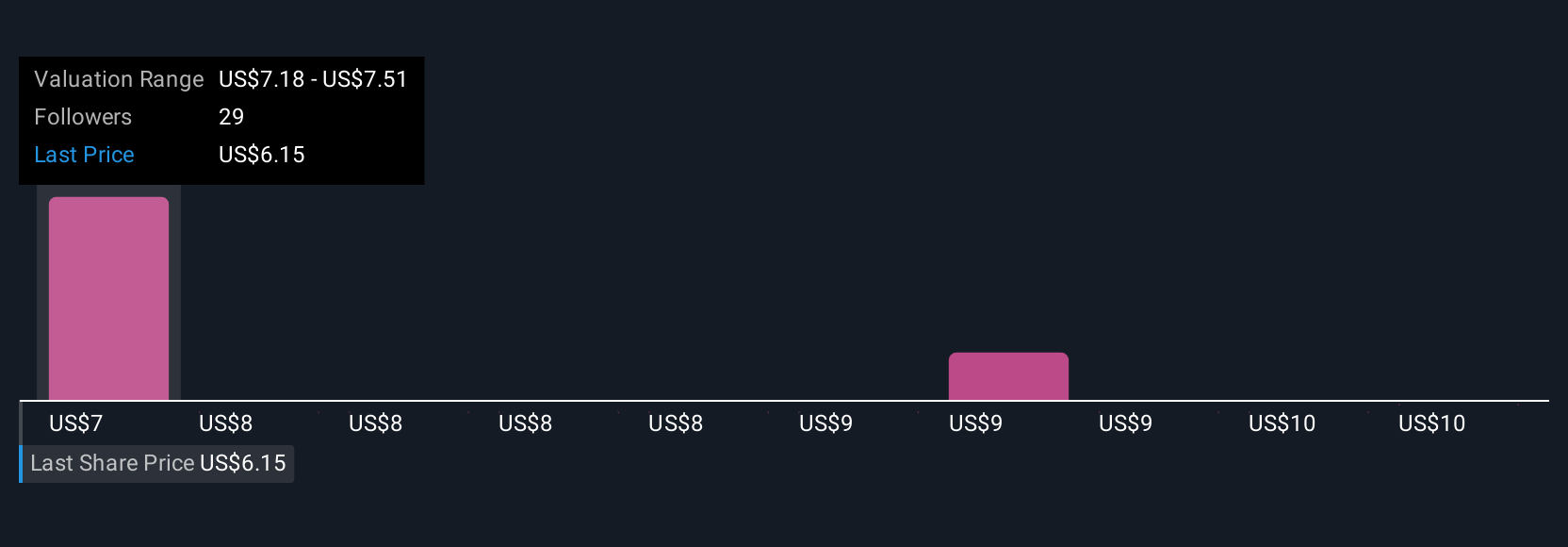

Uncover how Shoals Technologies Group's forecasts yield a $7.72 fair value, a 12% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Shoals’ fair value between US$7.72 and US$10.62 across three views, underscoring a wide spectrum of expectations. Ongoing industry pricing competition could influence whether the company’s profit margins and valuation meaningfully align, so consider these varied inputs as you weigh the outlook for Shoals.

Explore 3 other fair value estimates on Shoals Technologies Group - why the stock might be worth as much as 21% more than the current price!

Build Your Own Shoals Technologies Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shoals Technologies Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Shoals Technologies Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shoals Technologies Group's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SHLS

Shoals Technologies Group

Provides electrical balance of system (EBOS) solutions and components in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives