- United States

- /

- Construction

- /

- NasdaqCM:SGBX

It's Down 26% But Safe & Green Holdings Corp. (NASDAQ:SGBX) Could Be Riskier Than It Looks

To the annoyance of some shareholders, Safe & Green Holdings Corp. (NASDAQ:SGBX) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 73% loss during that time.

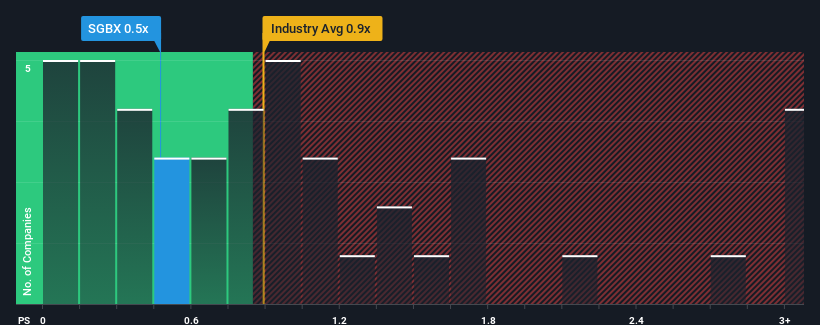

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Safe & Green Holdings' P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Construction industry in the United States is also close to 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Safe & Green Holdings

How Safe & Green Holdings Has Been Performing

For instance, Safe & Green Holdings' receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Safe & Green Holdings' earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Safe & Green Holdings?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Safe & Green Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 35% decrease to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

This is in contrast to the rest of the industry, which is expected to grow by 9.2% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Safe & Green Holdings' P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Safe & Green Holdings' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We didn't quite envision Safe & Green Holdings' P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Safe & Green Holdings (at least 3 which make us uncomfortable), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Safe & Green Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SGBX

Safe & Green Holdings

Provides prefabricated modular structures using wood or steel as the base material for residential and commercial use in the United States.

Medium-low and slightly overvalued.

Market Insights

Community Narratives