- United States

- /

- Electrical

- /

- NasdaqGS:RUN

The three-year earnings decline has likely contributed toSunrun's (NASDAQ:RUN) shareholders losses of 70% over that period

As every investor would know, not every swing hits the sweet spot. But you have a problem if you face massive losses more than once in a while. So spare a thought for the long term shareholders of Sunrun Inc. (NASDAQ:RUN); the share price is down a whopping 70% in the last three years. That would be a disturbing experience. And more recent buyers are having a tough time too, with a drop of 46% in the last year. The falls have accelerated recently, with the share price down 48% in the last three months.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Sunrun

Because Sunrun made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, Sunrun grew revenue at 8.8% per year. That's a pretty good rate of top-line growth. So it seems unlikely the 19% share price drop (each year) is entirely about the revenue. More likely, the market was spooked by the cost of that revenue. If you buy into companies that lose money then you always risk losing money yourself. Just don't lose the lesson.

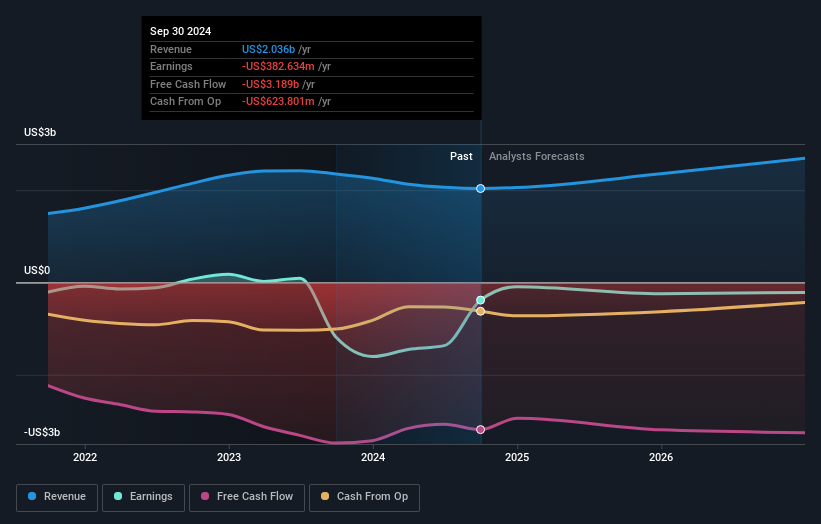

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Sunrun is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Sunrun stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

While the broader market gained around 30% in the last year, Sunrun shareholders lost 46%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Sunrun better, we need to consider many other factors. For instance, we've identified 5 warning signs for Sunrun (1 is concerning) that you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RUN

Sunrun

Designs, develops, installs, sells, owns, and maintains residential solar energy systems in the United States.

Moderate and slightly overvalued.