- United States

- /

- Building

- /

- NasdaqGS:ROCK

Here's Why We Think Gibraltar Industries (NASDAQ:ROCK) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Gibraltar Industries (NASDAQ:ROCK). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Gibraltar Industries with the means to add long-term value to shareholders.

Check out our latest analysis for Gibraltar Industries

How Quickly Is Gibraltar Industries Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Gibraltar Industries managed to grow EPS by 13% per year, over three years. That's a good rate of growth, if it can be sustained.

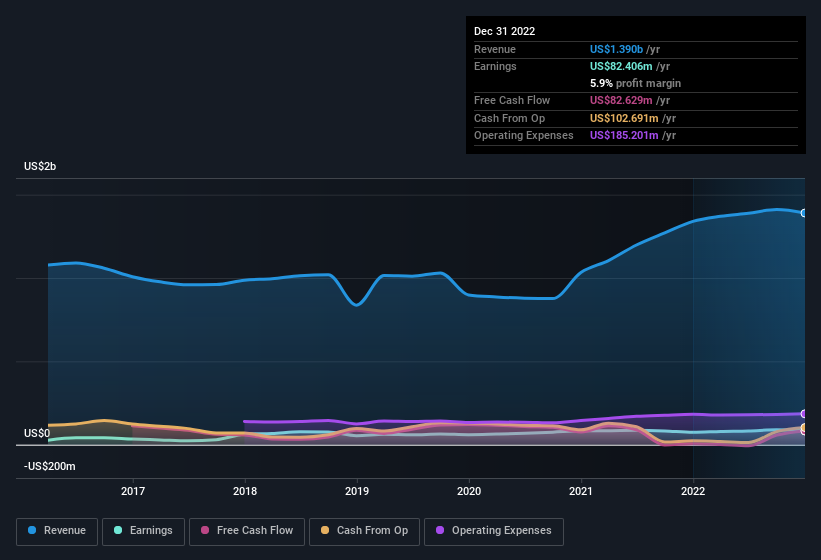

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Gibraltar Industries remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 3.7% to US$1.4b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Gibraltar Industries' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Gibraltar Industries Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Gibraltar Industries top brass are certainly in sync, not having sold any shares, over the last year. But the bigger deal is that the Independent Director, Linda Myers, paid US$61k to buy shares at an average price of US$38.16. Strong buying like that could be a sign of opportunity.

On top of the insider buying, it's good to see that Gibraltar Industries insiders have a valuable investment in the business. To be specific, they have US$17m worth of shares. This considerable investment should help drive long-term value in the business. Even though that's only about 1.1% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. The cherry on top is that the CEO, Bill Bosway is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Gibraltar Industries with market caps between US$1.0b and US$3.2b is about US$5.3m.

Gibraltar Industries offered total compensation worth US$4.0m to its CEO in the year to December 2021. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is Gibraltar Industries Worth Keeping An Eye On?

As previously touched on, Gibraltar Industries is a growing business, which is encouraging. On top of that, we've seen insiders buying shares even though they already own plenty. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of Gibraltar Industries.

The good news is that Gibraltar Industries is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ROCK

Gibraltar Industries

Manufactures and provides products and services for the residential, renewable energy, agtech, and infrastructure markets in the United States and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives