- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:RKLB

Rocket Lab (RKLB): Evaluating Valuation After Record-Breaking Back-to-Back Launch Successes

Reviewed by Simply Wall St

Rocket Lab (RKLB) is turning heads after executing a pair of launches from different hemispheres within just 48 hours. This achievement breaks its own annual launch record and underscores the company’s operational agility in meeting customer demands.

See our latest analysis for Rocket Lab.

After a standout series of rapid-fire launches and a wave of government and commercial contracts, Rocket Lab’s momentum remains strong, but that hasn’t kept volatility at bay. The latest share price sits at $40.3 and the year-to-date share price return is an impressive 61.5%. Short-term fluctuations have been sharp with a recent 30-day share price return of -37.6%. Still, the bigger story is the company’s ability to deliver a massive 905% total shareholder return over three years, which speaks volumes about the longer-term potential investors have seen in its evolution.

If you’re tracking how industry innovations translate into major moves, now is the perfect time to explore other high-growth tech and space companies. See the full list for free with See the full list for free..

With shares still trading at a notable discount to analysts’ price targets and fresh operational milestones stacking up, investors have to ask: Is Rocket Lab undervalued, or is the market already factoring in all future growth?

Most Popular Narrative: 38.6% Undervalued

With analysts projecting a fair value well above Rocket Lab’s recent close of $40.3, the narrative suggests considerable upside if the bold forecasts play out. The valuation reflects high confidence in both near-term momentum and multi-year growth prospects, and signals that market participants are watching for execution on key milestones.

Rocket Lab's move toward end-to-end space solutions, including the acquisition of Geost and expanding vertically integrated payload, satellite, and launch service capabilities. This uniquely positions the company to capture larger national security and defense contracts such as the Golden Dome and SDA constellations, and supports significant top-line growth and enhanced gross margins in future quarters.

Want to see what’s behind this aggressive fair value? Analysts are betting on explosive revenue growth, margin expansion, and a future profit multiple that’s a rarity even in the hottest tech sectors. Curious about the ambitious numbers propping up this valuation? Only the full narrative reveals the assumptions driving this price target.

Result: Fair Value of $65.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing Neutron development costs or delays in landing key contracts could challenge Rocket Lab’s margin outlook and put near-term growth expectations at risk.

Find out about the key risks to this Rocket Lab narrative.

Another View: Multiple-Based Valuation Raises Questions

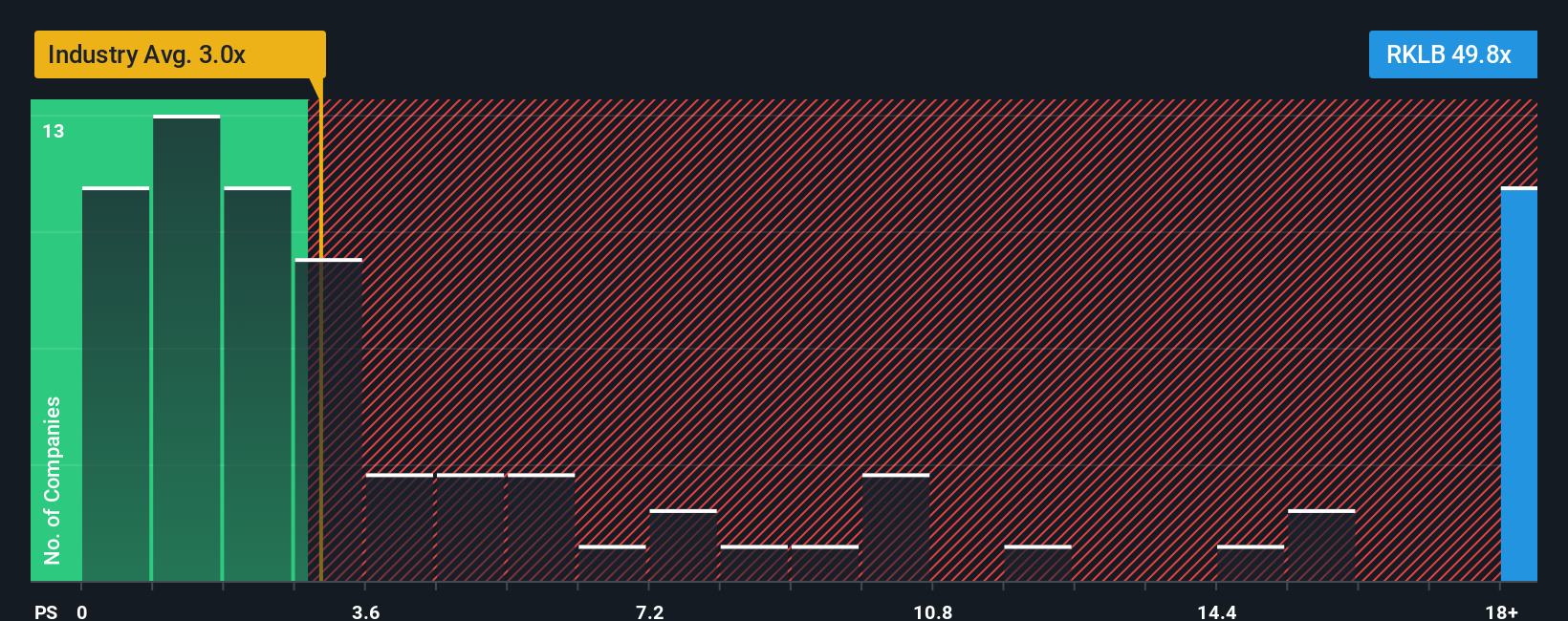

Looking through another lens, Rocket Lab’s price-to-sales ratio stands at 38.8x. This figure is far above its peers at 8.2x and much higher than the industry average of 2.9x. Even compared to a fair ratio of 7.3x, Rocket Lab appears particularly expensive. Does this disconnect signal higher valuation risk, or is the market already pricing in future gains?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rocket Lab Narrative

If you see the story differently or would like to investigate the numbers yourself, it’s easy to craft your own take in just minutes: Do it your way.

A great starting point for your Rocket Lab research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let the next big opportunity slip by. Broaden your horizons with tailored stock ideas chosen to help you move confidently toward your investing goals.

- Supercharge your growth strategy by tapping into these 921 undervalued stocks based on cash flows that the market has overlooked but show strong upside on fundamentals and cash flow.

- Maximize your income with these 15 dividend stocks with yields > 3% offering stable returns and yields above 3%, giving your portfolio a reliable boost.

- Ride the front edge of innovation and check out these 26 quantum computing stocks as quantum computing reshapes industries and redefines what is possible in tech.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RKLB

Rocket Lab

A space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026