- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:RKLB

Rocket Lab USA, Inc.'s (NASDAQ:RKLB) Earnings Haven't Escaped The Attention Of Investors

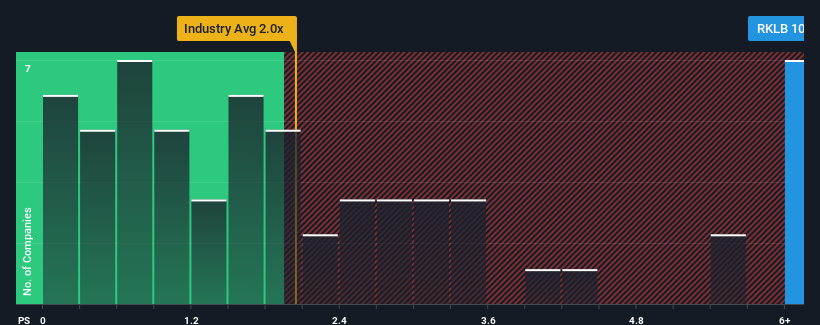

Rocket Lab USA, Inc.'s (NASDAQ:RKLB) price-to-sales (or "P/S") ratio of 10.6x may look like a poor investment opportunity when you consider close to half the companies in the Aerospace & Defense industry in the United States have P/S ratios below 2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Rocket Lab USA

What Does Rocket Lab USA's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Rocket Lab USA has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Rocket Lab USA will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Rocket Lab USA's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 27% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 55% per year over the next three years. With the industry only predicted to deliver 8.2% per annum, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Rocket Lab USA's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Rocket Lab USA shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 4 warning signs for Rocket Lab USA that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RKLB

Rocket Lab USA

A space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

Exceptional growth potential with adequate balance sheet.