- United States

- /

- Electrical

- /

- NasdaqGS:POWL

Powell Industries (NasdaqGS:POWL) Declines 11% Despite Strong Earnings And Dividend Increase

Reviewed by Simply Wall St

Powell Industries (NasdaqGS:POWL) recently experienced a 10.68% decline in its share price over the past week. This drop came in the wake of the company's encouraging earnings announcement, which reported significant year-over-year growth in sales and net income for the first quarter of the fiscal year. Additionally, the board declared a dividend increase, reflecting confidence in its financial health. The concurrent amendments to the company's Certificate of Incorporation could also influence investor sentiment by signaling governance changes. These internal developments occurred amidst a mixed wider market influenced by macroeconomic factors, including concerns over U.S. tariffs on Mexico, Canada, and China, affecting overall investor sentiment. The broader U.S. stock market experienced volatility, with indexes having mixed results during the week, potentially exacerbating Powell's decline. This backdrop of both internal and external factors collectively appears to have contributed to the stock's performance, with Powell decoupling from broader market trends over the same period.

Unlock comprehensive insights into our analysis of Powell Industries stock here.

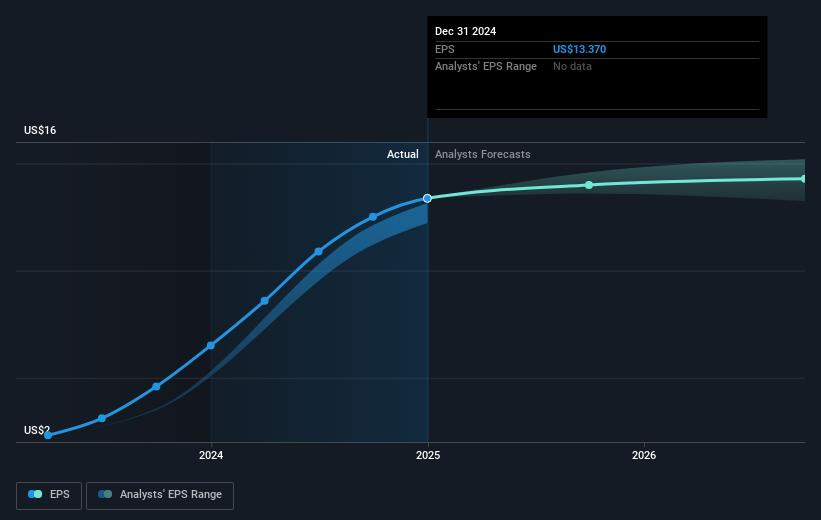

Over the past three years, Powell Industries has achieved a remarkable total shareholder return of very large 770.63%, including dividends. This exceptional performance stands out even more considering the company's recent underperformance compared to the broader market and its industry peers over the last year. The company's strong financial results have likely played a key role in the longer-term performance, with earnings growth outpacing the electrical industry markedly, increasing 107.3% over the past year alone.

Key financial events have undoubtedly influenced this impressive return. Notable earnings growth across multiple quarters, such as Q4 2024, where sales surged to US$275.06 million from the prior year's US$208.64 million, and a strong net income, are significant events. Additionally, regular dividend payouts reflect positively on investor returns. The significant rise in net profit margins, from 10.1% to 15.1% over the past year, further showcases Powell's improved profitability. These factors collectively contribute to the company’s substantial long-term gains.

- Unlock the insights behind Powell Industries' valuation and discover its true investment potential

- Assess the downside scenarios for Powell Industries with our risk evaluation.

- Hold shares in Powell Industries? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:POWL

Powell Industries

Designs, develops, manufactures, sells, and services custom-engineered equipment and systems.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives