- United States

- /

- Electrical

- /

- NasdaqGS:POWL

Bullish: Analysts Just Made An Incredible Upgrade To Their Powell Industries, Inc. (NASDAQ:POWL) Forecasts

Shareholders in Powell Industries, Inc. (NASDAQ:POWL) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with the analysts modelling a real improvement in business performance. Investors have been pretty optimistic on Powell Industries too, with the stock up 35% to US$81.97 over the past week. We'll be curious to see if these new estimates convince the market to lift the stock price higher still.

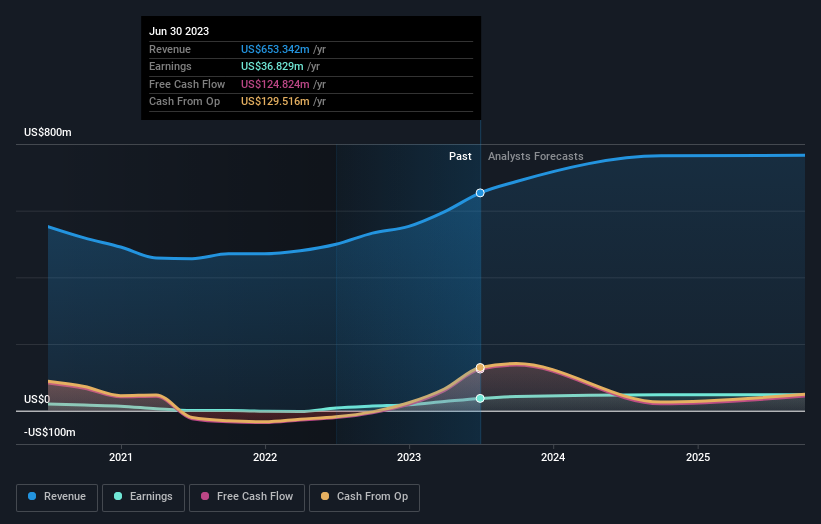

Following the upgrade, the current consensus from Powell Industries' dual analysts is for revenues of US$764m in 2024 which - if met - would reflect a solid 17% increase on its sales over the past 12 months. Statutory earnings per share are presumed to soar 26% to US$3.91. Previously, the analysts had been modelling revenues of US$679m and earnings per share (EPS) of US$2.60 in 2024. So we can see there's been a pretty clear increase in analyst sentiment in recent times, with both revenues and earnings per share receiving a decent lift in the latest estimates.

See our latest analysis for Powell Industries

It will come as no surprise to learn that the analysts have increased their price target for Powell Industries 51% to US$71.00 on the back of these upgrades.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's clear from the latest estimates that Powell Industries' rate of growth is expected to accelerate meaningfully, with the forecast 13% annualised revenue growth to the end of 2024 noticeably faster than its historical growth of 3.8% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 7.8% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Powell Industries is expected to grow much faster than its industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for next year. They also upgraded their revenue estimates for next year, and sales are expected to grow faster than the wider market. With a serious upgrade to expectations and a rising price target, it might be time to take another look at Powell Industries.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At least one analyst has provided forecasts out to 2025, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:POWL

Powell Industries

Designs, develops, manufactures, sells, and services custom-engineered equipment and systems.

Flawless balance sheet with solid track record.