- United States

- /

- Electrical

- /

- NasdaqCM:PLUG

There's Reason For Concern Over Plug Power Inc.'s (NASDAQ:PLUG) Massive 30% Price Jump

Plug Power Inc. (NASDAQ:PLUG) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 61% share price drop in the last twelve months.

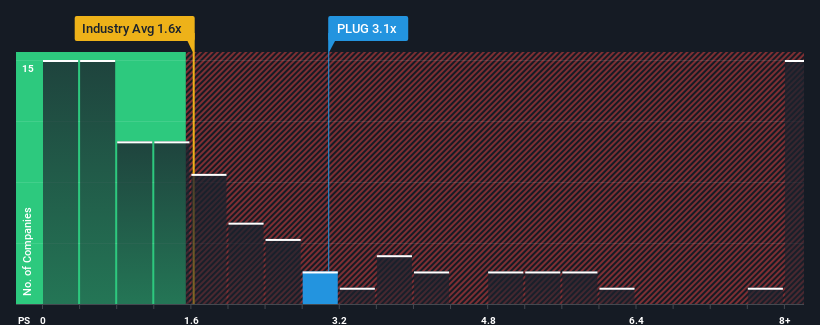

After such a large jump in price, you could be forgiven for thinking Plug Power is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.1x, considering almost half the companies in the United States' Electrical industry have P/S ratios below 1.6x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Plug Power

How Has Plug Power Performed Recently?

With revenue growth that's superior to most other companies of late, Plug Power has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Plug Power.Is There Enough Revenue Growth Forecasted For Plug Power?

In order to justify its P/S ratio, Plug Power would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 38% last year. The strong recent performance means it was also able to grow revenue by 190% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 53% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 68% per year, which is noticeably more attractive.

In light of this, it's alarming that Plug Power's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Plug Power's P/S?

Plug Power shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Plug Power, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 8 warning signs for Plug Power (4 make us uncomfortable!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PLUG

Plug Power

Develops hydrogen fuel cells product solutions in North America, Europe, Asia, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives