- United States

- /

- Electrical

- /

- NasdaqCM:PLUG

Plug Power Inc.'s (NASDAQ:PLUG) Popularity With Investors Under Threat As Stock Sinks 27%

The Plug Power Inc. (NASDAQ:PLUG) share price has fared very poorly over the last month, falling by a substantial 27%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 78% loss during that time.

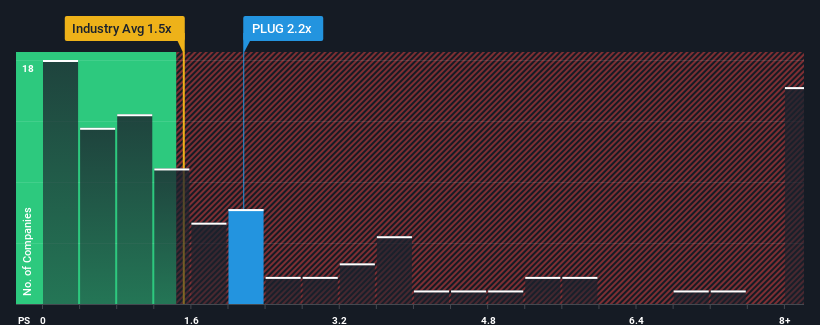

In spite of the heavy fall in price, you could still be forgiven for thinking Plug Power is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.2x, considering almost half the companies in the United States' Electrical industry have P/S ratios below 1.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Plug Power

What Does Plug Power's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Plug Power has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Plug Power.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Plug Power's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.9% last year. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 40% each year over the next three years. That's shaping up to be materially lower than the 47% per year growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Plug Power's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Plug Power's P/S?

Despite the recent share price weakness, Plug Power's P/S remains higher than most other companies in the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Plug Power, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Plug Power (1 can't be ignored!) that you should be aware of before investing here.

If you're unsure about the strength of Plug Power's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PLUG

Plug Power

Develops hydrogen fuel cells product solutions in North America, Europe, Asia, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success