- United States

- /

- Electrical

- /

- NasdaqCM:PLUG

Is Plug Power’s Recent 156% Surge Backed by Fundamentals?

Reviewed by Bailey Pemberton

With Plug Power’s stock closing recently at $3.90, it is no surprise if you are wondering whether the next move should be to buy, hold, or steer clear for now. The past month has been a rollercoaster; just look at that incredible 156.6% jump over the last 30 days, even though it pulled back a bit this past week with a 5.6% dip. Year to date, the stock is still up 67.4%, and over the past 12 months it has managed an 87.5% gain. However, long-term investors have had a bumpier ride, with returns over the last three and five years still sharply negative.

Much of this volatility can be traced back to big-picture shifts in the energy sector and increased speculation around hydrogen as a future fuel. Recent market attention has amplified both the optimism and caution in Plug Power’s share price, which can quickly swing as investor perceptions of risk and growth shift.

Now you may be asking, is Plug Power undervalued or overhyped at these levels? On a classic value investing scorecard, the company checks two out of six boxes as undervalued; its valuation score is just 2. There are different ways analysts measure valuation, and each can give us a slightly different perspective. Let’s walk through the most common approaches next, and then I’ll share what really matters for making sense of Plug Power’s true worth.

Plug Power scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Plug Power Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model assesses a company’s potential by projecting its future cash flows and discounting them back to today’s value. This method helps investors estimate a business’s intrinsic worth based on its likely long-term earnings rather than simply its current profits or market hype.

For Plug Power, the most recent Free Cash Flow (FCF) stands at a negative $1,026.91 Million. Looking ahead, analysts expect this to turn positive over time, with an estimated FCF reaching $306.5 Million by 2029. Projections for the next ten years, based on both analyst consensus and extrapolated trends, show steady improvement. By 2035, estimates put annual FCF at over $1 Billion, signaling expectations of robust growth as the company matures and scales its operations.

This DCF framework values Plug Power at an intrinsic fair value of $7.15 per share. With the stock currently trading at $3.90, the implied discount is 45.5 percent, suggesting Plug Power may be significantly undervalued according to this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Plug Power is undervalued by 45.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Plug Power Price vs Sales

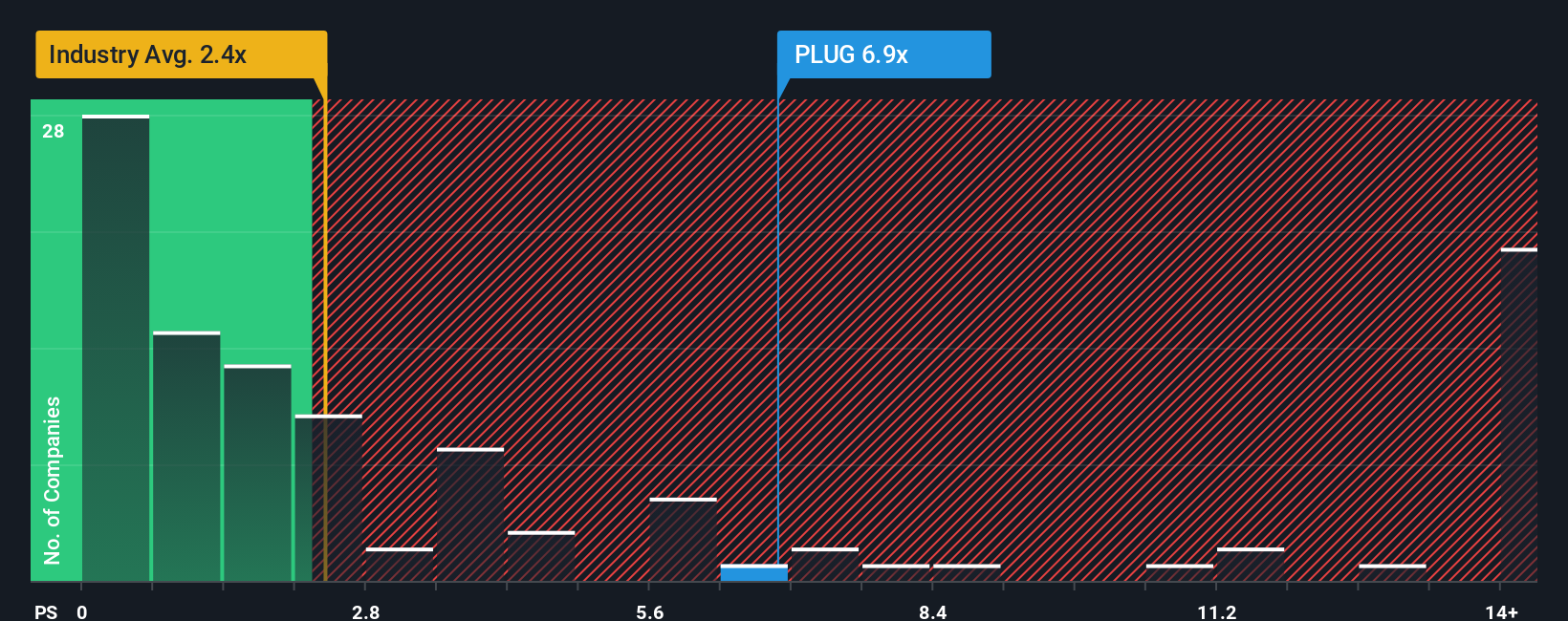

The Price-to-Sales (P/S) ratio is a particularly helpful metric for valuing companies like Plug Power that are not yet profitable but show meaningful revenue growth. Unlike earnings-based multiples, which are less useful for businesses with negative net income, the P/S ratio allows investors to assess value relative to top-line performance. This makes it ideal for companies in a growth phase or undergoing heavy reinvestment.

What counts as a “normal” or “fair” P/S multiple depends on factors like how quickly the company is expected to grow sales, how scalable its business model is, and its overall risk profile. Faster-growing or more stable businesses typically command higher ratios. Companies with greater risks or slower projected growth should trade at lower multiples.

Plug Power’s current P/S ratio is 6.86x, which is considerably higher than both the electrical industry average of 2.38x and the peer group average of 2.70x. This suggests the market is expecting much more future revenue growth from Plug Power relative to typical industry players. However, Simply Wall St’s proprietary "Fair Ratio" for Plug Power is 0.19x. The Fair Ratio is a more comprehensive measure because it incorporates growth outlook, profitability, industry dynamics, market cap, and company-specific risks. This delivers a more tailored benchmark than a simple industry or peer comparison.

Given that Plug Power’s actual P/S multiple of 6.86x is well above the Fair Ratio of 0.19x, current share pricing appears to be overvalued based on this metric.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Plug Power Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your investment story. It connects your view of Plug Power’s future and the assumptions you make about its revenue, earnings, and margins directly to a financial forecast and a fair value. This puts the “why” behind the numbers, tying together Plug Power’s big-picture potential with clear valuation outcomes.

Narratives are easy and accessible on Simply Wall St’s Community page, used by millions of investors. They let you test your thesis, compare your fair value with the latest market price, and decide if now’s the moment to buy or sell. When important news or earnings updates come in, Narratives update automatically, so you always see your story reflected with the latest data.

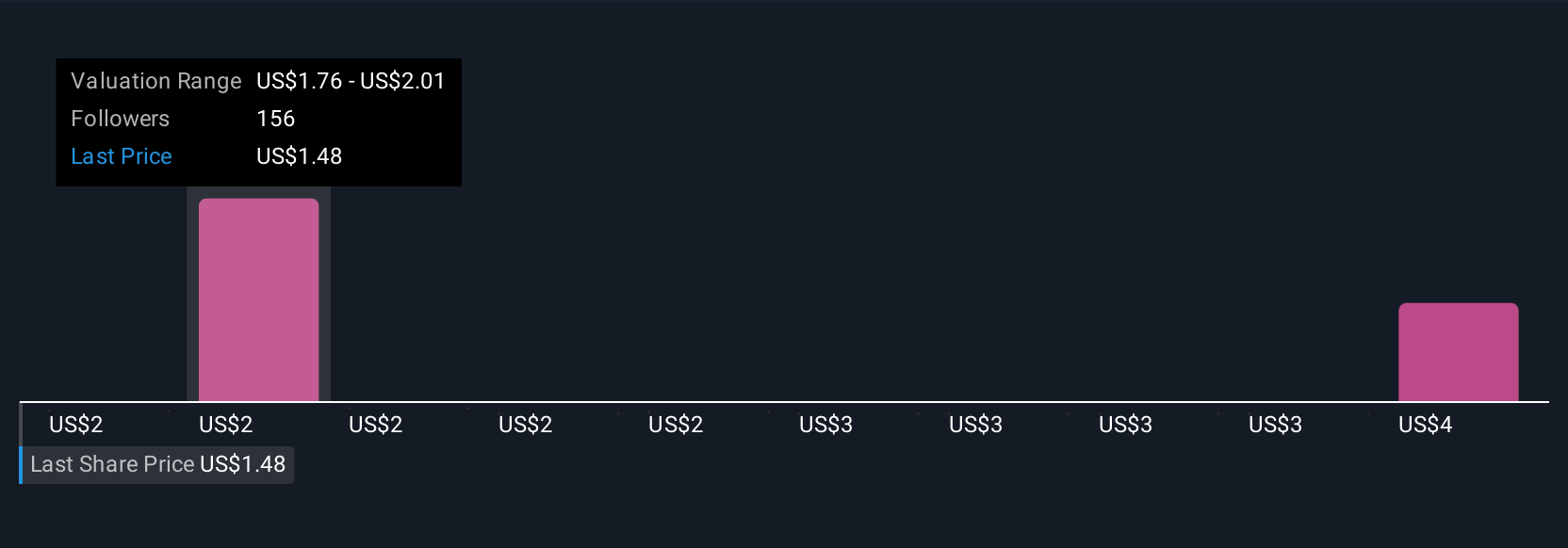

For example, one investor might build a Narrative that expects government incentives and scale to take Plug Power’s fair value above $5. Another investor, weighing competitive risks and liquidity concerns, might see fair value as low as $0.55. Narratives help you turn your understanding of Plug Power’s story into confident, actionable investment decisions, all grounded in your own logic and real numbers.

Do you think there's more to the story for Plug Power? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PLUG

Plug Power

Develops hydrogen fuel cells product solutions in North America, Europe, Asia, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives