- United States

- /

- Electrical

- /

- NasdaqGS:PLPC

We Ran A Stock Scan For Earnings Growth And Preformed Line Products (NASDAQ:PLPC) Passed With Ease

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Preformed Line Products (NASDAQ:PLPC), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Preformed Line Products with the means to add long-term value to shareholders.

View our latest analysis for Preformed Line Products

How Fast Is Preformed Line Products Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Preformed Line Products' shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 37%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

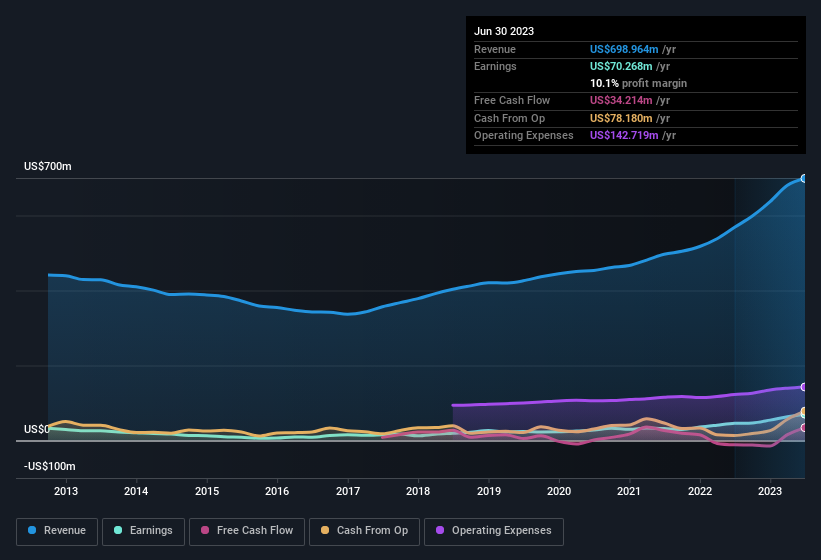

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Preformed Line Products shareholders can take confidence from the fact that EBIT margins are up from 9.0% to 15%, and revenue is growing. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Preformed Line Products' balance sheet strength, before getting too excited.

Are Preformed Line Products Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Preformed Line Products insiders have a significant amount of capital invested in the stock. Given insiders own a significant chunk of shares, currently valued at US$94m, they have plenty of motivation to push the business to succeed. Amounting to 12% of the outstanding shares, indicating that insiders are also significantly impacted by the decisions they make on the behalf of the business.

Should You Add Preformed Line Products To Your Watchlist?

Preformed Line Products' earnings per share have been soaring, with growth rates sky high. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So based on this quick analysis, we do think it's worth considering Preformed Line Products for a spot on your watchlist. Now, you could try to make up your mind on Preformed Line Products by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PLPC

Preformed Line Products

Designs and manufactures products and systems that are used in the construction and maintenance of overhead, ground-mounted, and underground networks for the energy, telecommunication, cable, data communication, and other industries.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026