- United States

- /

- Electrical

- /

- NasdaqGS:PLPC

Shareholders May Not Be So Generous With Preformed Line Products Company's (NASDAQ:PLPC) CEO Compensation And Here's Why

CEO Rob Ruhlman has done a decent job of delivering relatively good performance at Preformed Line Products Company (NASDAQ:PLPC) recently. As shareholders go into the upcoming AGM on 04 May 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

View our latest analysis for Preformed Line Products

How Does Total Compensation For Rob Ruhlman Compare With Other Companies In The Industry?

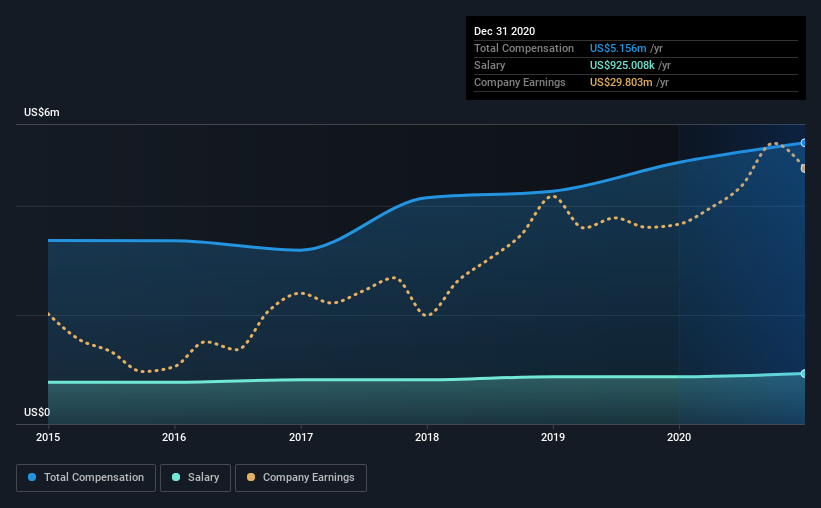

According to our data, Preformed Line Products Company has a market capitalization of US$334m, and paid its CEO total annual compensation worth US$5.2m over the year to December 2020. That's just a smallish increase of 7.5% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$925k.

For comparison, other companies in the same industry with market capitalizations ranging between US$200m and US$800m had a median total CEO compensation of US$2.2m. This suggests that Rob Ruhlman is paid more than the median for the industry. What's more, Rob Ruhlman holds US$15m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$925k | US$867k | 18% |

| Other | US$4.2m | US$3.9m | 82% |

| Total Compensation | US$5.2m | US$4.8m | 100% |

Speaking on an industry level, nearly 23% of total compensation represents salary, while the remainder of 77% is other remuneration. In Preformed Line Products' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Preformed Line Products Company's Growth

Over the past three years, Preformed Line Products Company has seen its earnings per share (EPS) grow by 35% per year. It achieved revenue growth of 4.8% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Preformed Line Products Company Been A Good Investment?

With a total shareholder return of 4.2% over three years, Preformed Line Products Company has done okay by shareholders, but there's always room for improvement. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling Preformed Line Products (free visualization of insider trades).

Important note: Preformed Line Products is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Preformed Line Products, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:PLPC

Preformed Line Products

Designs and manufactures products and systems that are used in the construction and maintenance of overhead, ground-mounted, and underground networks for the energy, telecommunication, cable, data communication, and other industries.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives