- United States

- /

- Electrical

- /

- NasdaqGS:PLPC

How Investors May Respond To Preformed Line Products (PLPC) Leadership Changes and Rising Institutional Interest

Reviewed by Sasha Jovanovic

- The Board of Directors of Preformed Line Products announced with sadness the unexpected passing of director Michael E. Gibbons on September 14, 2025, and detailed subsequent leadership changes to the Board and its committees.

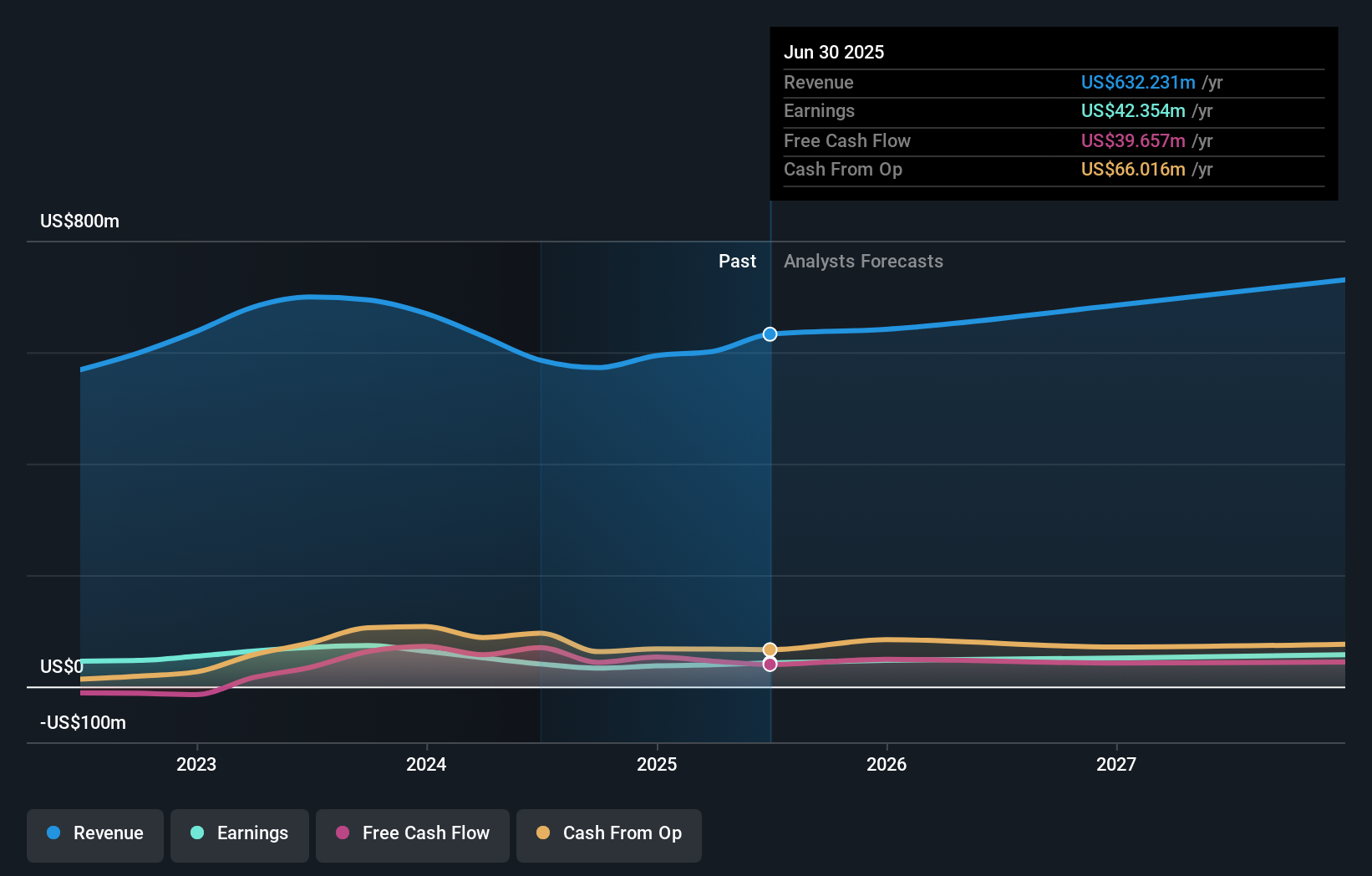

- Meanwhile, analyst upgrades and increased institutional investor holdings have drawn attention, reflecting a shift in investor sentiment toward the company.

- We’ll explore how increased institutional investment and recent leadership transitions could shape Preformed Line Products’ investment narrative going forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Preformed Line Products' Investment Narrative?

For someone considering Preformed Line Products, the investment story is built on dependable operational performance, financial discipline, and an experienced board, all underpinned by stable dividend returns and recent international expansion. The unexpected passing of a highly experienced director might prompt some to reassess board stability, but recent price gains and the market’s response suggest minimal immediate impact to major catalysts like ongoing buybacks, earnings momentum, and institutional interest. Near-term risks lie more with the company's modest revenue and profit growth expectations compared to the broader market, and questions around how a lack of fresh board perspectives or leadership transitions could shape longer-term strategy. Barring a material shift in governance effectiveness, these board changes appear more of a transition than a disruption, with the critical short-term drivers largely intact.

Yet, a lack of fresh board perspectives could limit future adaptability, an issue worth considering. Preformed Line Products' shares are on the way up, but they could be overextended by 10%. Uncover the fair value now.Exploring Other Perspectives

Explore 2 other fair value estimates on Preformed Line Products - why the stock might be worth 9% less than the current price!

Build Your Own Preformed Line Products Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Preformed Line Products research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Preformed Line Products research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Preformed Line Products' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLPC

Preformed Line Products

Designs and manufactures products and systems that are used in the construction and maintenance of overhead, ground-mounted, and underground networks for the energy, telecommunication, cable, data communication, and other industries.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives