- United States

- /

- Machinery

- /

- NasdaqGM:OFLX

Declining Stock and Solid Fundamentals: Is The Market Wrong About Omega Flex, Inc. (NASDAQ:OFLX)?

It is hard to get excited after looking at Omega Flex's (NASDAQ:OFLX) recent performance, when its stock has declined 31% over the past three months. But if you pay close attention, you might gather that its strong financials could mean that the stock could potentially see an increase in value in the long-term, given how markets usually reward companies with good financial health. Particularly, we will be paying attention to Omega Flex's ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for Omega Flex

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Omega Flex is:

40% = US$25m ÷ US$63m (Based on the trailing twelve months to March 2022).

The 'return' refers to a company's earnings over the last year. So, this means that for every $1 of its shareholder's investments, the company generates a profit of $0.40.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Omega Flex's Earnings Growth And 40% ROE

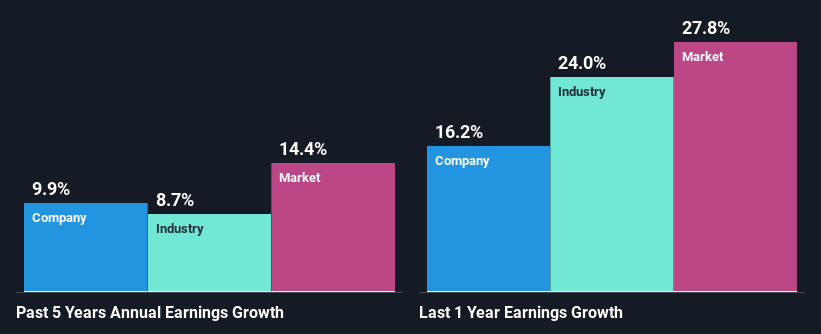

To begin with, Omega Flex has a pretty high ROE which is interesting. Secondly, even when compared to the industry average of 12% the company's ROE is quite impressive. Probably as a result of this, Omega Flex was able to see a decent net income growth of 9.9% over the last five years.

We then performed a comparison between Omega Flex's net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 8.7% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Omega Flex is trading on a high P/E or a low P/E, relative to its industry.

Is Omega Flex Making Efficient Use Of Its Profits?

Omega Flex has a significant three-year median payout ratio of 52%, meaning that it is left with only 48% to reinvest into its business. This implies that the company has been able to achieve decent earnings growth despite returning most of its profits to shareholders.

Besides, Omega Flex has been paying dividends over a period of eight years. This shows that the company is committed to sharing profits with its shareholders.

Conclusion

On the whole, we feel that Omega Flex's performance has been quite good. We are particularly impressed by the considerable earnings growth posted by the company, which was likely backed by its high ROE. While the company is paying out most of its earnings as dividends, it has been able to grow its earnings in spite of it, so that's probably a good sign. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. To gain further insights into Omega Flex's past profit growth, check out this visualization of past earnings, revenue and cash flows.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:OFLX

Omega Flex

Manufactures and sells flexible metal hoses, fittings, and accessories in the United States, Canada, and internationally.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026