- United States

- /

- Machinery

- /

- NasdaqGS:NNBR

NN (NASDAQ:NNBR) shareholders are up 11% this past week, but still in the red over the last five years

NN, Inc. (NASDAQ:NNBR) shareholders should be happy to see the share price up 27% in the last month. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. In fact, the share price has declined rather badly, down some 62% in that time. Some might say the recent bounce is to be expected after such a bad drop. We'd err towards caution given the long term under-performance.

On a more encouraging note the company has added US$17m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

View our latest analysis for NN

Because NN made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over five years, NN grew its revenue at 1.2% per year. That's not a very high growth rate considering it doesn't make profits. It's likely this weak growth has contributed to an annualised return of 10% for the last five years. We'd want to see proof that future revenue growth is likely to be significantly stronger before getting too interested in NN. However, it's possible too many in the market will ignore it, and there may be an opportunity if it starts to recover down the track.

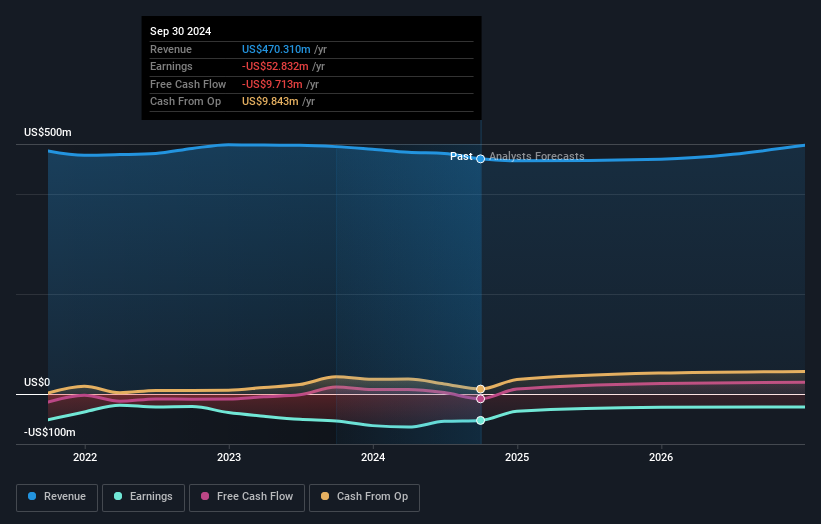

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling NN stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While the broader market gained around 24% in the last year, NN shareholders lost 32%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand NN better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with NN .

NN is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if NN might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:NNBR

NN

Designs, manufactures, and sells high-precision components and assemblies for various end markets in the United States and internationally.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives