- United States

- /

- Machinery

- /

- NasdaqGS:NNBR

NN, Inc. (NASDAQ:NNBR) Shares Fly 28% But Investors Aren't Buying For Growth

NN, Inc. (NASDAQ:NNBR) shares have continued their recent momentum with a 28% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 89%.

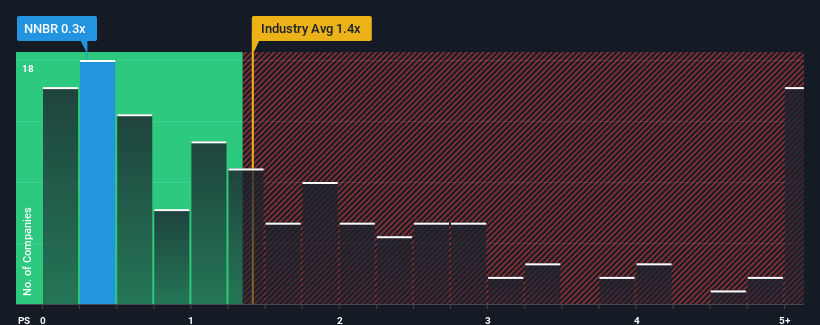

Although its price has surged higher, considering around half the companies operating in the United States' Machinery industry have price-to-sales ratios (or "P/S") above 1.4x, you may still consider NN as an solid investment opportunity with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for NN

What Does NN's Recent Performance Look Like?

Recent times haven't been great for NN as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think NN's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For NN?

NN's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period was better as it's delivered a decent 18% overall rise in revenue. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 0.1% over the next year. That's shaping up to be materially lower than the 2.3% growth forecast for the broader industry.

With this information, we can see why NN is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does NN's P/S Mean For Investors?

Despite NN's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that NN maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for NN you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if NN might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:NNBR

NN

Designs, manufactures, and sells high-precision components and assemblies for various end markets in the United States, China, Brazil, Mexico, Germany, Poland, and internationally.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives