- United States

- /

- Machinery

- /

- NasdaqGS:NDSN

Nordson (NDSN): Assessing Valuation After Earnings Growth and $500M Share Buyback Expansion

Reviewed by Simply Wall St

If you have been tracking Nordson (NDSN), this week’s headlines probably caught your eye. The company just posted higher third-quarter sales and net income compared to last year, providing solid evidence of operational momentum. On top of that, management has approved a $500 million boost to its share buyback program, bringing total authorization to $2 billion. For investors weighing their next move, these pieces of news together signal both business resilience and a clear vote of confidence from leadership.

These announcements come as Nordson’s stock has experienced a bit of a roller coaster over the past year, dropping about 13% even as its revenue and annual net income have increased. The buyback news and recent product innovations in semiconductor equipment have given shares a modest lift this month, but momentum over the year has lagged behind the broader capital goods sector. Still, longer-term holders have seen gains of 22% over five years, which underscores Nordson’s ability to deliver steady returns, though not at a rapid pace.

With the stock now trading at $219.93, the question is whether Nordson’s improved results and increased buyback are enough to justify a fresh look, or whether the market is already pricing in all the future growth potential.

Most Popular Narrative: 12.7% Undervalued

According to community narrative, Nordson is viewed as undervalued based on analysts’ growth projections and future profit expectations.

"Nordson's integration of the Atrion acquisition is expected to improve profitability as they implement NBS Next to enhance manufacturing efficiencies. This could positively impact net margins and earnings as Atrion performance exceeds initial targets."

If this price tag appears steep, the analysts supporting this target are anticipating significant improvements in both profit margins and overall earnings. Interested in learning the specific financial predictions, strategic upgrades, and growth targets that support the positive outlook for Nordson’s fair value? Explore what assumptions are behind this upward revision and understand why experts are increasing their expectations.

Result: Fair Value of $251.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, soft demand in key markets and ongoing currency volatility could pose challenges to Nordson’s growth outlook and impact its future earnings momentum.

Find out about the key risks to this Nordson narrative.Another View: Is the Market Pricing Right?

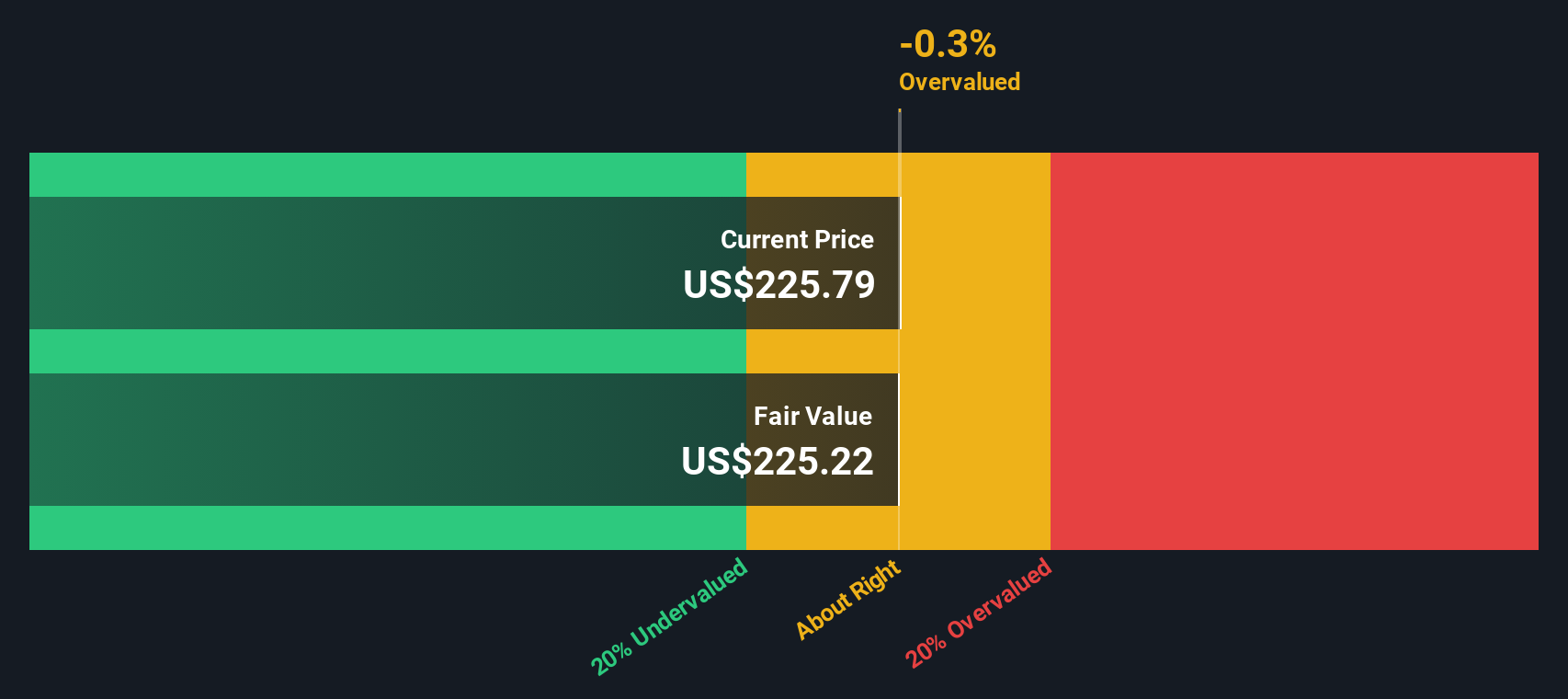

Looking from another angle, our DCF model suggests Nordson’s shares may not be as undervalued as the community narrative implies. This raises the question: which approach best captures the stock’s real potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Nordson Narrative

If you want a different perspective or would rather dive into the numbers yourself, you can easily craft your own analysis in just a few minutes, and do it your way.

A great starting point for your Nordson research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Staying ahead in today’s dynamic market means being open to unique opportunities. Make sure you do not miss out on tomorrow’s winners by branching out beyond just Nordson. Unlock powerful new investment angles with these handpicked stock themes. Your next smart move could be just a click away.

- Boost your portfolio with income potential as you tap into dividend stocks with yields > 3% offering reliable dividends and yields above 3% for steady returns.

- Seize the innovation wave by checking out healthcare AI stocks that are transforming healthcare with breakthrough artificial intelligence.

- Get ahead of tech trends and browse quantum computing stocks redefining what’s possible in the world of quantum computing and futuristic applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NDSN

Nordson

Nordson Corporation engineers, manufactures, and markets products and systems to dispense, apply, and control adhesives, coatings, polymers, sealants, biomaterials, and other fluids.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives